Deed of Trust Template

7 Downloads

Tax

February 17, 2025

Sayantani Dutta

A Deed of Trust is a type of loan agreement governed by state law. In this agreement, the value of the property, usually their primary residence, acts as collateral to secure the loan for the borrower without rescinding ownership. During the loan term, a third party takes custody of the real estate offered as security to the lender. The third party, known as the “Trustee,” holds the tile in escrow during the loan term.

One of the unique advantages of homeowners who use this financial security instrument to loan money is that they can still live in their homes. They have full use of the property while they pay off their indebtedness to the lender. The parties to the Deed of Trust are the Beneficiary (lender and property owner), the Trustor (borrower), and the Trustee.

Unlike a mortgage, loan agreement, or promissory note, the Deed of Trust requires the signatures of all three parties—the beneficiary, the lender, and the trustee—for it to be legally binding. After signing and notarizing the document with a notary public, it is filed with the County Clerk’s Office and becomes part of the public record in the county where the property is located.

Financial & Legal Mechanics of the Deed of Trust

The Deed of Trust is a legal document covering the terms of a loan. 30 states recognize the Deed of Trust as a legal lending arrangement in real estate transactions. It is actually a quite popular alternative financial instrument to the conventional mortgage.

Private lenders prefer it to a mortgage because it has a non-judicial foreclosure process. It is easier to sell the property at a public auction and recover the loan amount if the buyer defaults. Needless to say, this is significantly easier than going through the foreclosure process associated with a mortgage. That stuff can take ages.

The Deed of Trust, on the other hand, also allows the borrower to live on the property while they are paying off the loan. They retain ownership rights to the property unless they default on the loan obligations. In many ways, it is a win-win situation.

In most Deed of Trust transactions, the Trustee is a title company or the closing attorney. That being said, even a group, individual, or company can serve in this capacity. In cases where there is an individual trustee, the lender and borrower may nominate a successor trustee as a backup to the deal if the Trustee cannot fulfill their obligations.

Alright, now let’s talk about what happens if the loan is not repaid in full (or if the repayments do not follow the stipulated terms and conditions of the agreement). So, if the borrower defaults on the terms of the loan provisions in the Deed of Trust, the Trustee has full right to start the foreclosure process to make the lender whole. The Deed of Trust itself empowers them to do so.

And if the borrower does pay off the loan as per the terms, schedule, and any other conditions, they have the right to acquire the legal title from the Trustee and close the loan or deed entirely.

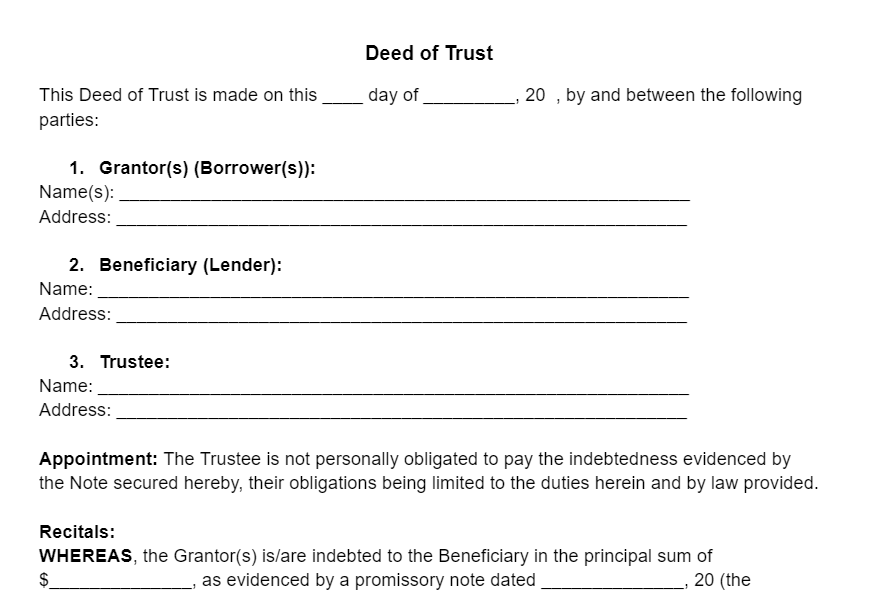

What Information is Included in a Deed of Trust?

The Deed of Trust must contain accurate details to be legally binding. It must contain the principal amount, repayment schedule, and the interest rate. The lender’s interest rate must not be predatory, or the agreement would not stand up in court.

The Deed of Trust must feature the full names of the borrower, lender, and Trustee, as well as the property address and a legal description of the property to be filed with the county recorder’s office. These are the essentials that the Deed of Trust begins with to set up the foundation for further terms and conditions.

The borrower is responsible for maintaining payment of the property insurance premiums during the loan term and the upkeep of all insurance policies related to the property. The Deed of Trust also includes the inception date of the loan and the maturity date, which is the due date when the borrower is expected to pay the loan.

Furthermore, this legal document also identifies the part of the property or refers to the official name of its subdivision, block number, or lot number, if applicable. There will also be provisions, obligations, requirements, and terms of the loan agreed on by the parties beforehand so that they can be enforced.

This includes provisions for terms regarding late payments, late fees on such amounts, and when the lender considers the payment to be late, legally speaking. The contract must also include a waiver discussing the conditions where the lender relieves the borrower of their responsibility to repay the loan.

In the event of default by the borrower, the Trustee will arrange the sale of the property to repay the lender via the “power of sale clause.” This provision allows the Trustee and lender to sell the property with written notice to the borrower. The borrower may be also liable for prepayment penalties and reasonable attorneys’ fees or other riders. In the event of default by the borrower, the alienation or acceleration clauses allow the lender to demand immediate payment.

How is the Title Different from the Deed of Trust?

The title assigns ownership of the property and facilitates transfers of ownership in real estate transactions. Don’t confuse the Deed of Trust with the basic Deed! These are separate contracts with different purposes in the real estate sector.

The Deed transfers the title from one person to another. The steps involved in writing a legally binding Deed of Trust vary between states, depending on governing law, which is why it is often a good idea to get legal advice on applicable law when structuring the loan terms and provisions.

What Happens When the Loan is Fully Paid?

So, what happens if the loan is paid in full, following all the terms and conditions mentioned in the Deed?

Well, when the borrower pays off the loan, the lender issues the Deed of Reconveyance. This document states that the borrower has fulfilled all of their loan warranty obligations. The Trustee releases the legal title of the property to the borrower who becomes the owner of the title to the property.

The public record files the Deed of Reconveyance, using it to cancel the Deed of Trust. As a result, all future property searches on the title holders will see the borrower mentioned as the title holder of the property.

In other words, things go back to the time before the Deed was signed.

Where Do You Register a Deed of Trust?

You will file the Deed of Trust with the County Recorder at the County Clerk’s office. They have standardized Deed of Trust forms available at the office and on the official website for your assessment. The County Recorder and Clerk’s offices usually provide copies of the document for a nominal fee.

But here is the thing—why take the risk of using generic documents when you can customize a legally sound Deed of Trust Template to meet your needs? A customizable template offers a much more well-rounded document and the ability to edit it to suit the exact terms and conditions of the deal!

That is where FreshDox.com comes into the picture. With us, you have access to a wide range of professionally drafted legal document templates that you can customize as per your needs. It is easy to add, remove, and edit sections; download the files as PDF or Word; adhere to your state’s laws; or enter any unique clauses or terms you need in your document! Yep, it is that easy.

All you need to do is sign up for a FreshDox.com account. And to make your barrier to entry even lower (or nonexistent, more like), we offer a risk-free 14-day trial period. Using this trial, you can experience the many benefits of both of our plans—Basic and Premium. Basic Members can download up to three customizable templates, including the Deed of Trust Template, every month. Premium Members have access to unlimited downloads.

Our templates are well-known to meet all legal and professional standards, and you can edit them to your specific loan requirements. Check out our library of legal, professional, financial, and educational documents with your free trial of our platform today!

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews