Articles of Association Template

10 Downloads

Commercial

January 11, 2025

Sayantani Dutta

The Articles of Association discuss the internal policies surrounding the new company’s day-to-day operations and bylaws. Authorities use the articles to assess the company and grant it a separate legal identity from stakeholders, thereby offering them indemnity from company liability.

The articles detail the company’s legal name and the type of entity it operates under. They also mention the capital structure, and bylaws surrounding corporate governance and the administration of records.

Depending on the jurisdiction, the authorities may refer to the articles as a “Memorandum of Association,” “Articles of Organization,” or “Memorandum of Incorporation”. The standard default articles include different models for private companies limited by shares, those limited by guarantee, and public companies.

Who Drafts the Articles of Association?

The company’s founders typically discuss and formalize the Articles of Association and the company secretary drafts the final document for approval by the board and stakeholders.

Since the articles surround the company’s finances and management policies, the members or stakeholders will consult with an attorney for legal advice on compliance and bylaws when drafting the document.

Corporations will need to pay the following additional fees alongside the filing fee when submitting documents.

- Franchise tax for doing business in that state.

- Government filing fees are based on the type of business and its state of operations.

- Legal fees.

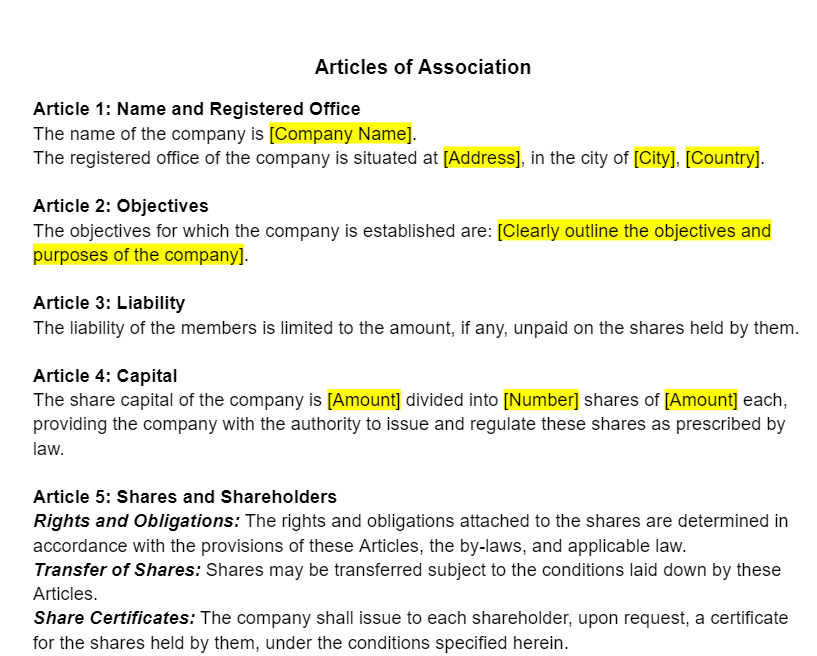

What the Articles of Association Include

The format for the articles of association differs between companies and the provisions found in the document. Regardless of the company’s structure and nature of business, the articles should include the following provisions.

Legal Entity and Requirements

Understanding industry regulations and local laws helps the founding members avoid making mistakes when forming the articles, keeping the organization compliant and its operations above board.

Organizational Purpose and Management Structure

What is the company’s purpose? Are you selling products and services? Some states allow the members to use a broad statement such as “commerce” or “management,” and others require the business to be more in-depth, such as “the operation of an e-commerce business selling children’s toys.”

The more loose you can be with this statement, the better. Taking this approach makes it easy to pivot the company’s nature of business without the need to amend the articles to maintain compliance with state laws and regulations.

The same applies to the organization’s management structure. The articles must clearly outline the management structure of the company and the details of the decision-making process. Once again, it’s a good idea to remain as broad in your definitions as possible to give the company room to maneuver and make changes quickly, without amending the articles.

Company Name and Registered Offices

This section includes the name of the company and its registered office address. Make a shortlist of company names and run through them using the search function on the Sectretary of States official website.

When you find a name that’s available for use, pay the fee to reserve it so you can carry on drafting the articles. The company name must also feature an identifier like “Inc.,” or “LLC.”

List the address of the company’s headquarters for the delivery of legal communications, documents, and notices. The address also explains the state where the company is legally incorporated, clarifying the regulations that apply to it.

Shareholder Rights and Share Capital

The members or shareholders own shares in the company. This section of the articles defines the shareholders’ agreement and the company’s financial structure.

The share capital refers to the number of shares, the holders of shares within the company, and the amount of capital the company can raise through issuing share certificates.

The shareholders’ rights explain the privileges and decision-making powers of the shareholders, specifically covering voting rights, preemptive rights, dividend entitlements, and the process for the transfer of shares. The guidelines should also discuss the procedure involved in transferring shares from a shareholder to the transferee.

Board of Director Powers and Duties

This section of the articles names the board members and identifies when a directors’ meeting or shareholder meeting takes place, and at what location. It covers the board’s responsibilities and overall authoritative decision-making powers of the board in dictating the company strategy.

This section also discusses parameters limiting director power to improve accountability and transparency with the shareholders. It notes how directors should engage with other members to fulfill their board roles reasonably and fairly. It mentions how a director might have a conflict of interest and the resolution process involved.

Shareholder Meetings and Voting Rights

This section details operational procedures for “Extraordinary General Meetings” (EGMs) and “Annual General Meetings” (AGMs). Shareholders must agree on the following.

- The notice period for convening a shareholder meeting

- The board members needed on-site to hold a shareholder meeting.

- Voting rights and procedures.

- The steps involved in passing resolutions.

- Shareholder meeting adjournment procedures.

Guidelines for Altering the Articles of Association

While loosely defining your company’s purpose offers advantages to prevent unnecessary altering of the articles, there are times when the owners will need to make changes to the document to reflect changes in the business. The articles of association must provide a process to alter the document in the future.

Making changes to the articles requires approval of a special resolution at the annual shareholders meeting, usually the AGM, but may require an EGM to make these changes in the case of a company emergency, such as the passing of a director.

Special resolutions require higher thresholds of votes for it to be an official change, ensuring these changes have broad support from the shareholders.

Steps for Liquidation

This section discusses the liquidation process for dissolving the company. These provisions detail the steps for distributing the company’s remaining assets between the shareholders after settling the company’s liabilities and debts.

The members must appoint a liquidator and outline the process involved with valuing assets and selling them off under shareholder rights. Since this process brings clarity and fairness to the liquidation process it protects the stakeholder’s interests.

It’s a good idea for members to consult with several law firms and gather legal advice when compiling this section of the articles to comply with any statutory requirements.

Who is Bound by the Company’s Articles of Association?

The shareholders and directors are bound under the AoA. Under the law, LLCs and other legal entities like S-Corps must have at least one director listed in the AoA. Public companies are required to name at least two directors.

Most Articles of Association permit a sole director to govern the decision-making process, but it’s a good idea to include more than one to make the decision-making process more transparent.

Board meetings are generally held every quarter, and directors can nominate other directors to join the board at this time. The quorum is the minimum number of company directors required to be present at board meetings to validate these decisions.

Articles of Association: Key Takeaways

- We can consider the Articles of Association (AoA) as a company’s “constitution.”

- The AoA must comply with the regulations and rules governing the business structure within its jurisdiction.

- The articles note the company’s purpose and strategies for accomplishing short-term and long-term goals.

- Typically, the provisions in the AoA detail the company’s legal status as a trading entity in its state of operations, its purpose, governance, capital structure, records, and other important items relating to the company’s operations.

- The company Secretary files the Articles of Association with the Secretary of State and all amendments to the document must meet the requirements originally laid out in the AoA and agreed on by the stakeholders in the business.

Download a Free Articles of Association Template with a Free Trial of FreshDox

Customize and download FreshDox Articles of Association templates to get your new business off the ground. Our professional templates are completely customizable to your company and its business model and accepted by the Secretary of State’s office.

Don’t waste time trying to build an AoA template on Google Docs. Sign up for a free 7-day trial of a Premium or Basic account and get access to this template and thousands of other professional business documents.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews