Articles of Incorporation Template

7 Downloads

Commercial

February 17, 2025

Sayantani Dutta

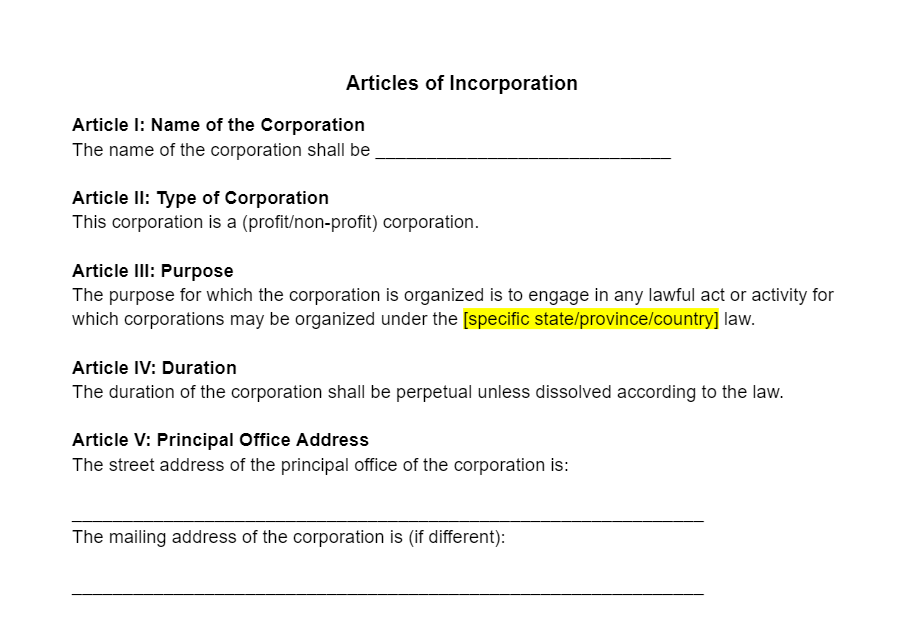

The Articles of Incorporation, also known as charter documents, are formal documents written and signed by business owners when forming a nonprofit organization, an S-Corp, or an LLC in the United States. After the business owners, directors, or members successfully file the Articles with the Secretary of State, they will receive a Certificate of Incorporation. This gives them the right to start operating as a separate legal entity.

As the name suggests, this document includes several articles. We will quickly summarize all the articles held within this document:

- Article I: Registers your company name with the state. The name must comply with the state’s naming requirements for companies.

- Article II: This Article states the LLC’s nature of business and whether the company serves a specific or lawful purpose.

- Article III: Notes the registered agent responsible for handling legal communications.

- Article IV: Notes on whether the company is member- or manager-managed.

- Article V: This Article states the operating duration and whether the LLC will operate for a limited time or perpetually.

- Article VI: Lists the names of the members or managers, their full names, and physical addresses.

- Article VII: Special rules and additional provisions regarding indemnification clauses or transfer of membership interest.

- Article VIII: The amendments to the Articles of Incorporation.

Together, these provisions also include information about the capital contributions the members make to the company. You will also ideally include a “dissolution clause.” As you would expect, this is the clause which specifies how, why, and when the business entity can be dissolved, the procedures of doing so, and how the winding up of the company will be carried out. The document will also need to specify the tax treatment and classification—and whether it is taxed as a corporation or a partnership.

Before we move on, we need to make an important distinction at this point. The Articles of Incorporation are different from the Corporate Bylaws. The bylaws identify the roles and number of members, formalize the board membership, and note when shareholder meetings are conducted. The Articles of Incorporation might have some overlap with all that, but they are quite separate legal documents. All LLCs are required to have them to operate legally in the United States.

What Information Do Companies Include in Articles of Incorporation?

The information required in the Articles differs by state, and there may be some constraints depending on the state in which you file. But generally speaking, here are the common ingredients you will find in a typical Articles of Incorporation document for an organization or company:

- Name: You must include the company name, and the name of the corporation must comply with the naming guidelines for new companies. It must also be available for registration. Search the Secretary of State’s website and see if the name you want is available. You can reserve the name for a nominal fee. The company name must end with an identifier abbreviation like Inc., Co., or Ltd.

- Street Address: The physical address for the company’s registered office or headquarters. You may not use a P.O. box number or mailing address.

- Corporate Structure: Note if the organization is a for-profit business or a nonprofit corporation.

- Purpose of the Corporation: A broad statement referring to the company’s purpose.

- Registered Agent: The initial registered agent handles official communications and legal documents between the state and your principal office. The Articles of Incorporation identify the name, phone number, and address of the registered agent.

- Stock: The total number of shares and the class of shares issued in the company.

- Incorporator: The names and addresses of the incorporators. The incorporator can be the member or members forming the entity or a professional or incorporation service retained to help the members get the company up and running as a going concern.

- Effective Date: If you plan on launching your business in the future, mention the effective date you intend to start operations. If you do not include an effective date in the Articles, the state will select the default option to affect the company immediately upon filing the Articles.

- Duration: Typically, companies do not list a duration. They operate perpetually. Businesses like pop-up stores that are testing a concept may mention limited operating durations in this section. Still, something to keep in mind.

- Directors: The names and addresses of the board of directors.

In the end, the incorporators of the LLC affect the Articles of Incorporation by signing the document.

Understanding the Incorporator’s Role

The Articles must include the names and addresses of the incorporator or incorporators of your business corporation. The incorporator is also referred to as the “promoter” in some states. So, who is the incorporator? This is a question that plagues many, so here is a clear answer.

The incorporator is the person who comes up with the business idea and gathers the shareholders to invest in the startup venture. There must be at least one incorporator named in the Articles of Incorporation. It is fine (and quite common) if you want to add more, but there must be at least one.

The incorporator not only forms the business idea and model and attracts investment from shareholders, but they also form the board.

Now, this begs the question—when should you use a professional incorporator?

The incorporator’s role in forming the company fades away after filing the Articles with the state and naming the board of directors of the corporation. Since it’s a temporary position, some companies choose to hire a professional to handle the tasks associated with the incorporator.

You can find individual professionals and companies to facilitate the incorporator’s activities for startups. These act as professional fiduciaries. You will sign a services agreement with the incorporator, and they agree, in writing, to resign from the role after the company files the Articles and appoints the board.

Filing the Articles of Incorporation

So, now that you have finished preparing the paperwork, and are ready to file your Articles of Incorporation with the Secretary of State, it is time to go over some initial expectations.

Here is what you can expect from the filing and approval process:

First of all, you should thoroughly review the Articles and File with the Secretary of State. You will need to file the Articles with the Secretary of State in the state in which you intend to operate. If you are operating nationally or internationally, you will incorporate the business in the state hosting your corporate headquarters.

Next, you will need to pay the filing fee. This is important to cover the admin work involved in processing your Articles. The fees vary from state to state, and you can expect to pay around $200 in the majority of cases.

Then, you wait to receive the approval. Often, it can take up to a few months for the Department of State to get around to filing your Articles of Incorporation. If you include the relevant information the Secretary of State’s office needs to file your Articles, the Secretary of State will send you your incorporation certificate. If there is information missing, you will need to amend your application and reapply it with a new filing fee. So, do your due diligence and avoid re-filing!

Assuming all goes well, it is now time to maintain compliance. Keep the Certificate of Incorporation on file at your company offices to maintain compliance. You will need to file annual reports with the state and the IRS to keep your company active and registered and on the right side of the tax laws.

You might also need to amend the Articles of Incorporation. If there are any changes, then these need to be reported to the state. Complete the state-specific form available from the Secretary of State’s official website and complete the changes. Some states allow you to file a corporate resolution to note the changes. Some examples of these changes include a change in the registered agent or the business address.

Also, keep in mind that corporate directors and officers may have a time constraint on how long they have to file these changes in the Articles. Check the rules in your state!

Should You Use a Professional Template or the State-Provided Forms?

You will find the forms for the Articles of Incorporation on the Secretary of State’s official website. These forms feature the minimum requirements for you to register your company with the state. The issue is that these forms might not request all the information required to file your Articles. It might save a few dollars, but the potential hassle that comes with using these forms does not make it worthwhile at all.

That is why drafting a custom Articles of Incorporation is the better move. If you go down this route, you can customize the Articles to your organization or company’s specific needs. You can choose to issue preferred or common stock to shareholders, for example, or deduct the fees paid to prepare your articles as a business expense.

And this is where the golden advice comes into the picture—do not rely on a cookie-cutter template! Choose a customizable Articles of Incorporation template from FreshDox. We will help you get your company incorporated so you can start serving the American economy.

You can download an Articles of Incorporation Template with a free trial of FreshDox.com today! All you need to do is sign up for an account. Basic Members are allowed up to three downloads a month and Premium Members have unlimited access to all of our professionally crafted, legally vetted, and fully customizable document templates available in PDF and Word formats!

So, what are you waiting for? Customize and download the FreshDox.com Articles of Incorporation Template to get your new business off the ground. Our professional templates are completely customizable to your company and its business model. Most importantly, they are accepted by the Secretary of State’s office. Sign up for a free trial of a Premium or Basic account and get access to this template and thousands of other professional, legal, and financial documents.

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews