Asset Purchase Agreement Template

8 Downloads

Commercial, Money and Finances

December 8, 2024

Sayantani Dutta

The Asset Purchase Agreement (APA) is a fundamental document used during business acquisitions and mergers. Its purpose is to facilitate the smooth transfer of various assets from a seller to a buyer. Unlike stock purchases that involve buying the company as a whole, asset purchases allow buyers to selectively acquire business components. Typically, these components include equipment, inventory, liabilities, and intellectual property.

Today, we are going to talk about an Asset Purchase Agreement in more detail. More specifically, we will cover its critical components and the benefits of using a professionally tailored template from FreshDox.com for a comprehensive, legally sound agreement.

What is an Asset Purchase Agreement?

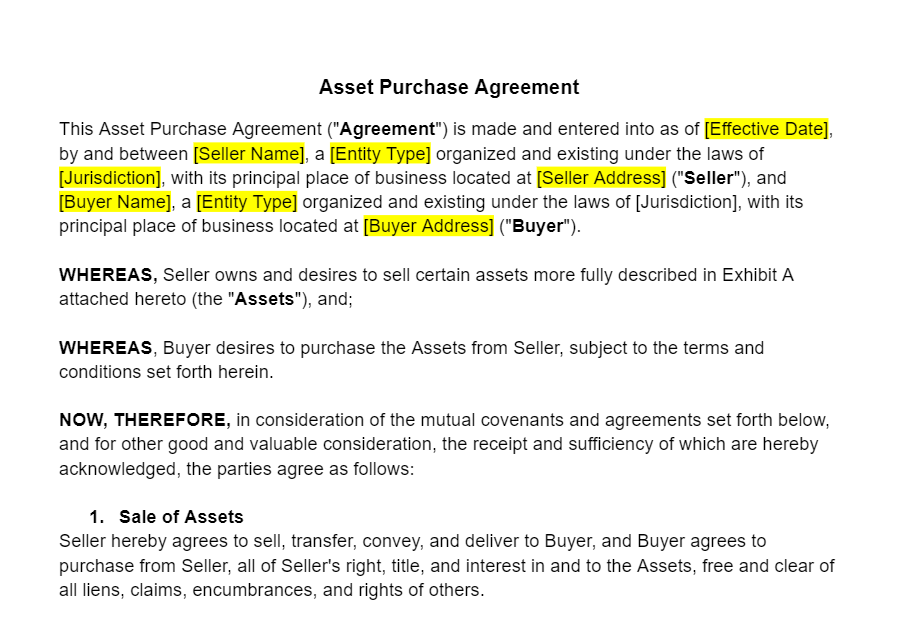

An APA is a legal contract between a buyer and a seller (often both parties being businesses). It outlines all the terms and conditions in detail under which the assets of a business are being sold from one party to another. This agreement specifies the assets that are being sold/purchased, the purchase price, the method of payment, the timeline for the payments, any warranties made by both parties, indemnification clauses, and so on.

APAs are common business transactions where the buyer is interested in specific assets rather than taking on the liabilities associated with the company’s stock. Often, the entire agreement is about buying a component from a business as is.

The enforceability of an asset purchase agreement under the governing law varies from state to state. Businesses get into an arrangement like this in good faith under the laws of the state. The objective is to purchase some inventory, equipment, or IP from another business where both parties win. Often, the agreement will include additional payment details as well, such as the accounts receivable or payable, a bill of sale, and any associated encumbrances.

Why is It Important?

An Asset Purchase Agreement is important because it clearly defines the scope of the transaction so that there is no ambiguity or misunderstanding down the line. A business transaction can be complex—so, often, it is required that both parties have a mutual understanding of what is being sold, purchased, and excluded from the deal.

For the selling party, the APA offers an opportunity to sell off parts of the business without liquidating the entire company. It could be something that the business does not need immediately. Such sales often improve the cash flow and help the business focus on other priorities.

For the buying business, there is an inherent flexibility to only acquire those assets that are or could be valuable to their own operations, all the while minimizing exposure to liabilities. Often, when you buy an entire business, things can be a little complex. Every provision of this agreement is meant to simplify the process and manage expectations—including any security interest, severability, payment schedules, and so on.

Assets can range from equipment and real estate to IP, inventory, tangible assets, and even the personal property of the shareholders if they are not protected by a waiver. This subject matter, as a result, can get very complex depending on what assets are involved. Also, the allocation of the assets across the current shareholders and board of directors affects the complexity of the transaction. A lot of assessments are required before an APA can be formulated under the applicable law.

But once it is prepared, you have a powerful, legally binding instrument that can facilitate the transfer of ownership from one part to another, adhering to the conditions precedent.

Consequences of Not Having a Good Asset Purchase Agreement

If you try to attempt the consummation of the transactions and the transfer of ownership without a good asset purchase agreement, you are opening the transaction up to litigation and disputes down the line. It is required by law to have an agreement in place—but there is no single metric to judge the comprehensiveness of such a contract.

As such, a lot of documents that are poorly written can ignore half of the headings or sections required in this contract, could introduce exploitable or vague narratives on behalf of the seller that are open to interpretation, or hurt the arbitration process.

Ultimately, any court of competent jurisdiction will find such a document inadequate, which can lead to a problem during the execution of this agreement. For example, if escrow terms are not established clearly, payments can be made without acquiring the assets. These legal loopholes are not rare—and that is why it is important to cover all bases ranging from the fair market value of the assets, a detailed overview of the financial statements from the seller, and a trail following assets to their original source.

Basically, you are supposed to do your due diligence following conditions of indemnity whether you are buying tangible or intangible assets. The conditions of the agreement will ensure that your transaction is protected and no disputes can arise down the line.

On the other hand, if there is no such detailed and well-structured Asset Purchase Agreement in place, then the parties risk misunderstandings and litigation post-transaction (or even during the transaction). An inadequate agreement often fails to accurately describe the assets, material respects, material adverse changes, any associated insurance policy, and the liabilities involved. This can lead to significant expenses through legal challenges over what was intended to be included in the sale.

Furthermore, insufficient due diligence and unclear terms can expose the buyer to unforeseen liabilities and the seller to potential breaches of warranties or any indemnification claims. Overall, the conditions of this agreement need to be so airtight that neither party suffers in an unwanted way—which can only be ensured if you have a solid agreement to begin with that covers all bases.

What to Include in an Asset Purchase Agreement?

The perfect APA will include a number of important details. However, the list of things that should be included is not fixed or exhaustive. In other words, the particular transaction and the nature of the businesses will determine what actually goes into the APA. That being said, here is a starting point—consider these to be the most common components of an Asset Purchase Agreement. If applicable, you should have them all in your agreement.

The identification of parties and the description of assets are the most integral parts of the asset purchase agreement, of course. You need to clearly state the names and details of the buyer and seller involved in the transaction. If it is about the sale of assets or real property, then you need to provide as much detail as possible about both. The description of assets should ideally extend to offering a comprehensive list of the assets being purchased, including physical assets, intellectual property, and any intangible assets. Use both, trade names and internal names.

Next, you should also clarify the excluded assets and liabilities. Sometimes, assets are interdependent on other resources or assets. It is always a good idea to tell what is not included before the transaction happens.

The agreement also includes details about the purchase price, payment terms, and payment schedule. For example, how many installments will be paid, what is the total valuation of the assets, how will the tax returns be handled, and so on. The terms of this agreement should clarify how the price was determined and if there are any warranties of seller that must be enforced or completed before the transaction can be finalized.

Representations and warranties are also required before the agreement can come into full force. Include statements by both parties regarding the condition of the assets and any material facts related to the business. Some items might be tied to trade secrets, in which case confidentiality is required, and as such, such terms must be included in the APA.

Sometimes, the agreement also needs to clearly state any precedent conditions. These are conditions that must be met before the transaction can be finalized—such as regulatory approvals or consent from third parties or an independent contractor. Such party can always raise a dispute if not considered during the planning phase itself and might require a copy of such consent from these third parties before you can move ahead with the transaction.

The APA should also outline any actions the parties agree to undertake before and after the transaction. These are different from precedent conditions and are called covenants.

Any reasonable attorney will tell you that when you try to buy or sell assets using such notice, you also need to protect yourself. This means indemnification. Describe the indemnification rights for both parties to protect against losses arising from breaches of the agreement. An agreement without an indemnification clause can be exploited by either party and cause a world of trouble.

Lastly, the Asset Purchase Agreement finishes while indicating the legal jurisdiction that governs the agreement (governing law clause) and the signatures of the authorized representatives of both parties to validate the agreement.

Asset Purchase Agreement Template by FreshDox.com

We understand the complexities involved in asset transactions. There is a strict need for a detailed, legally binding agreement and FreshDox.com offers an expertly developed Asset Purchase Agreement Template to simplify the task. Crafted by legal professionals well-versed in business law, our template addresses all essential aspects of an asset purchase. It will ensure clarity, compliance, and the necessary protections for all parties involved in the transaction.

You can subscribe to FreshDox.com and gain access to our extensive collection of legal document templates! We have a special 14-day trial period for you that will help you look at the various benefits of our Basic and Premium Plans. As per the Basic Membership, you will be able to download up to 3 templates a month. The Premium Plan has no limit and you can download as many customizable templates as you want every month!

We cater to a wide array of needs of all types of professionals—businesses, legal practitioners, and individual entrepreneurs. So, what are you waiting for?! Secure your business transactions and protect your interests with FreshDox.com’s Asset Purchase Agreement Template today! Sign up and access a plethora of professional, legally vetted templates to ensure your asset purchases are conducted smoothly and effectively.

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews