Bitcoin Purchase Contract Template

10 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

Buying and selling cryptocurrencies has become an important part of today’s economy. From their status as a shady method of transaction almost exclusively utilized by those engaged in money laundering, to today’s perception of these as an alternative asset ideal for transaction, investment, and trading—cryptocurrencies such as Bitcoin have surely come a long way. They go toe-to-toe against major currencies such as the USD, for example, in many domains (such as remittances with a lower fee).

Plus, they have the tendency to go up and down in value a lot more than stocks, forex, or derivatives. This makes them a speculative asset where digital assets such as BTC have become a point of interest for many due to their ever-increasing (over the long run) market price.

Purchasing BTC is a function of the rising price of Bitcoin and that is where a purchase agreement comes into the picture. Sure, technically, all you need is a wallet address and a bank account to deposit the liquidated BTC or ETH, but there is more to the picture than meets the eye—such as escrow, futures trading (especially when Ethereum and Bitcoin futures contracts have become as popular as those based on fiat currency), liquidity concerns under the laws of the state, the governing law for taxes, the public nature of the blockchain, and so on.

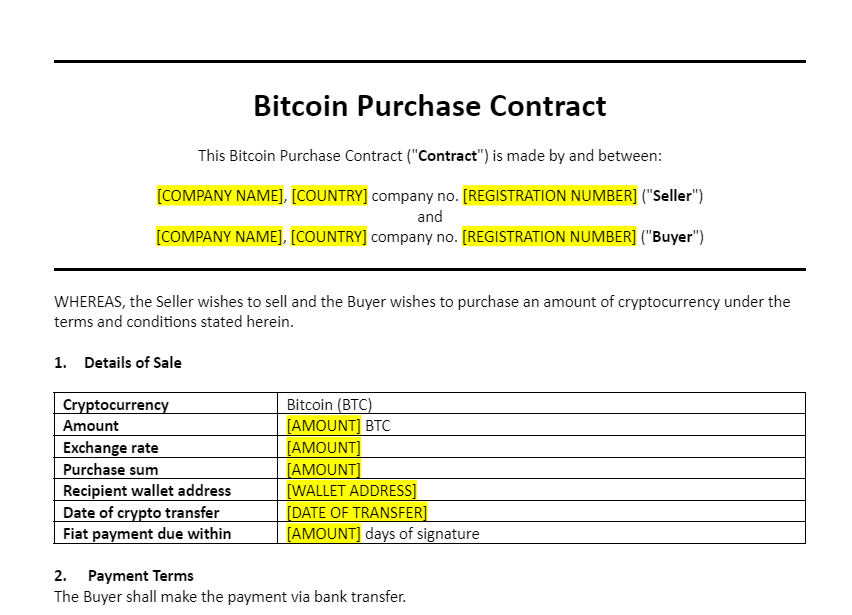

A purchase agreement for Bitcoin outlines the terms and conditions under which the BTC is being bought and sold. This document protects both the buyer and the seller by clearly defining the rights, obligations, warranties, waivers, and procedures involved in the transaction of digital currency across changing market conditions such as price fluctuations or abrupt dips (sudden negative price movements).

More specifically, this agreement covers the quantity of cryptocurrency to be purchased, the price at which it is to be sold, the method of payment, and the timing of the transaction. Such agreements are used in a variety of contexts, from individual investors buying cryptocurrency for personal portfolios to businesses integrating digital assets into their financial strategies.

So, today, let’s take a closer look at a Bitcoin Purchase Contract—its importance and key components—before diving into the risks of relying on an inadequate template and introducing you to our novel solution: the Bitcoin Purchase Contract Template from FreshDox.com. Without further ado, let’s dive right into it!

Why Use a Bitcoin Purchase Contract?

A legitimate question. All you need, after all, is a platform that has an escrow system! Just send your Bitcoin address and have them send you U.S. Dollars (or another currency). Once received, release the escrow and voila—you are done.

Well, as it turns out, it is not as simple as the rudimentary days of cryptocurrencies and blockchains. BTC is used for trading, investing, and transacting. Furthermore, it is used by individuals, companies, and even governments today. All this complicates stuff.

For example, if a company wishes to enter the BTC futures market, how do they ensure risk management associated with the inherent volatility of crypto futures? If it is a big sum, then an individual in New York receiving the amount from someone in Hong Kong needs some protection for tax purposes. Or, if you are selling to someone using a generic process where you first deposit fiat in a centralized exchange and then move the funds through a trading platform to the buyer, how do you ensure the legality of the transaction?

Essentially, for security and legal purposes, you need a Bitcoin Purchase Contract today.

The world of cryptocurrencies is volatile and rapidly evolving. This document ensures that transactions are conducted securely and transparently, regardless of how transparent blockchains are by design. The document also serves as a legal safeguard—providing clarity and confidence to both parties involved in the transaction. As such, the BTC Purchase Contract helps mitigate disputes by detailing the terms of the transaction while also providing a framework for legal recourse in case the terms are violated by either party.

Today, a lot of regions in the world also have to tread carefully because of different levels of regulations on cryptocurrencies. In that context, the Bitcoin Purchase Contract can ensure compliance with these regulatory requirements, which often vary significantly across jurisdictions. This makes such a contract an essential tool for participants in the global crypto market.

All in all, it suffices to say that a Bitcoin Purchase Contract is an essential tool in the modern world. Anyone who is purchasing or selling BTC needs to take a serious look at the implications of not using such a contract to underline their transactions—especially if the volumes are massive.

Bitcoin Purchase Contract: Key Components

Your contract should be robust for regulatory compliance, legal soundness, and enforceability. As such, it needs to have certain essential components. The exact contents will differ from situation to situation, but these categories are often a core part of any strong Bitcoin Purchase Contract. Let’s take a look:

- Identification of Parties: Just like any other legal contract or agreement, a Bitcoin Purchase Contract will also begin with the proper identification of all parties involved in the transaction—often the buyer and the seller—whether they are an individual or a limited liability company, for example. Make sure that this section includes the clear identification of the buyer and seller involved in the transaction with their contact details.

- Description of the Asset: Next, the contract should ideally offer a detailed description of the cryptocurrency being purchased (Bitcoin in this case—but can be denoted in its denominations, such as mBTC or sats). The type and quantity are very important to discuss. Also, for reference purposes, you should note the current USD-equivalent value of the quantity of BTC with a timestamp of the contract’s drafting.

- Transaction Terms: The price of the BTC, the currency of payment, and any conditions affecting the price or payment should be included in this section. Typically, transaction terms are quite limited in BTC transactions but if there is any specific clauses you have regarding the payment, it should ideally go here.

- Payment Method: After all that is clear, now it is time to provide detailed instructions for the payment method and any conditions related to the transfer of funds. Depending on what payment method is being used (from the fiat side), the exact contents of this section will differ. Some additional authentication might be required to confirm that the payment is indeed originating from the party mentioned in the first section.

- Transfer of Ownership: Both in legal and technical terms, what is actually happening during the purchase of Bitcoin is the transfer of an asset. Just like how a transfer of ownership has to be established and clarified for pretty much anything—a parcel of land or a motor vehicle, for example—a BTC transaction also carries the same requirements. On the blockchain, actual assets move when you execute a transaction. It is not a simple change in digits reflected on both sides while nothing moves (which is the case in normal fiat/banking transactions). The transfer of ownership clause is all the more important as such. Additionally, clarify the procedures and timelines for the transfer of the cryptocurrency from the seller to the buyer.

- Representations and Warranties: Next, you should include all statements by both parties regarding the authority to enter the transaction and the legality of the assets involved. Often, you might not be giving any warranty at all. But in case there is anything even remotely resembling a warranty or representation, make sure to add it here.

- Compliance and Regulatory Considerations: This is a simple section. Offer proper acknowledgements of and adherence to applicable laws and regulations governing the transaction. This will depend on your jurisdiction and how it regulates cryptocurrency purchases, specifically the class it is in (alternative, capital, etc.) and what tax bracket applies to it.

- Dispute Resolution: Lastly, this legal document will include information on the methods for resolving disputes that may arise from the agreement—including the jurisdiction where these disputes will be handled and the process or legal recourse that will be taken.

The Risks of Not Having a Good BTC Purchase Contract

Without a comprehensive Bitcoin Purchase Contract, all parties are exposed to significant risks. What happens is that without a formal agreement, misunderstandings regarding transaction details such as price, timing, and payment methods can arise all too easily. This, in turn, leads to disputes and potential financial loss.

What’s more, the absence of a legally binding agreement often results in non-compliance with regulatory standards, which can attract legal penalties.

So, if you are relying on a free, generic template that you found online to draft something as sensitive as a Bitcoin Purchase Contract—think again! This can be just as hazardous as not having a contract at all. Such contracts may not address specific needs or adhere to the latest legal and regulatory standards, ultimately leaving transactions insecure and parties vulnerable.

What do you do? Well, you choose a reliable, rock-solid, and premium template as your starting point for your Bitcoin purchase or sale contracts!

Safer Transactions with FreshDox.com’s Premium Bitcoin Purchase Contract Template

Cryptocurrencies are dynamic and ever-changing. BTC’s value, though on a generally upward trajectory since its creation and, later, popularity, it does experience its fair share of dips. Anything less than a robust, legally sound, and comprehensive contract is simply not acceptable in this case.

That is why you need a meticulously crafted Bitcoin Purchase Contract Template to meet the needs of both buyers and sellers in this digital landscape. Our template is created by legal experts who are familiar with the nuances of cryptocurrency transactions. It is designed to ensure utmost clarity, security, and compliance.

Anyone who subscribes to FreshDox.com unlocks access to our premium Bitcoin Purchase Contract Template—available in both PDF and Word formats for easy customization—alongside a wide array of other legal, financial, and business-related documents, all created professionally and with legal soundness.

Suiting your individual transactional requirements, it is very easy to customize our template. And the best part? You have a risk-free way to try our platform! FreshDox.com’s 14-day trial period allows users to join the platform and explore the benefits of the Basic and Premium Plans. Basic Members are entitled to download up to three document templates per month whereas Premium Members benefit from unlimited downloads (ideal for legal professionals or businesses engaged in frequent crypto transactions).

Choosing FreshDox.com’s Bitcoin Purchase Contract Template means that you are choosing a path of security and compliance for your cryptocurrency transactions. Our template not only facilitates smooth and clear transactions but also protects against the uncertainties and complexities of the crypto market. Register now and say yes to security and efficacy when it comes to BTC transactions with a FreshDox.com account!

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews