Bitcoin Sales Agreement Template

11 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

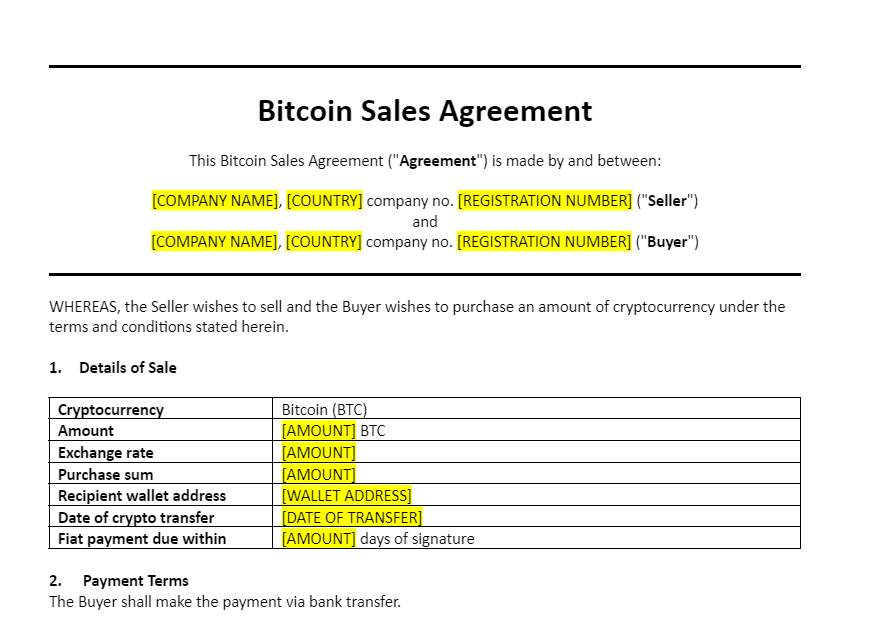

The Bitcoin Sales Agreement is a vital legal document that outlines the terms and conditions under which cryptocurrencies (BTC in this case) are bought and sold. Selling Bitcoin used to be a straightforward process—but that is not the case anymore, especially if organizations, companies, or massive sums are involved. For example, taxation and regulation vary from jurisdiction to jurisdiction, and you need stronger legal and technical protections to make sure the sale of your Bitcoin is executed securely and transparently.

The Bitcoin Sales Agreement or contract specifies the terms, conditions, and clauses that apply to the transaction. Often, these transactions can be complex and can include a lot of other factors and variables—such as market price considerations, liquidation control, terms for the payment method or schedule, any waivers or warranties, etc.

To that end, this agreement is designed to protect both the buyer and the seller by clearly defining the rights, obligations, interests, and procedures involved in the transaction of a digital asset—BTC. It further specifies the quantity of cryptocurrency to be purchased, the price at which it is to be sold, the method of payment, and the timing of the transaction.

Such an agreement is used in a variety of contexts—such as an organization in the process of liquidation (converting BTC in their wallet to a fiat like USD in their bank account). From individual investors buying cryptocurrency for personal portfolios to businesses integrating digital assets into their financial strategies, there is a huge demand for Bitcoin in today’s market. This agreement holds all the covenants, disclaimers, and rules under which the sale will happen.

So, today, let’s take a look at a Bitcoin Sales Agreement—and what makes a good one. We will also cover the risks of relying on generic, free templates; the importance of this agreement; and FreshDox.com’s very own Bitcoin Sales Agreement Template, which is the best starting point to draft your own agreement, whether you are running a business in New York or an investor from Delaware! The best part? Our BTC agreement template can be easily customized for any other major cryptocurrency, such as Ethereum.

Cryptocurrency Purchase Agreement: Importance & Benefits

It will not be an understatement to say that the world of cryptocurrencies is volatile and rapidly evolving. New regulations are being made fast, and new tokens launching even faster. To put an end to all ambiguities and any scope for confusion, you need a Bitcoin Sales Agreement underpinning any transaction, especially if it’s business-oriented or sensitive.

This agreement makes sure that transactions are conducted securely and transparently. Additionally, it also serves as a legal safeguard—providing clarity and confidence to both parties involved in the transaction.

A robust, well-drafted, and comprehensive Bitcoin Sales Agreement will also help you mitigate any disputes as it often details the transaction terms, while also providing a framework for legal recourse if the terms are breached.

Now, you would think that the job of an agreement is limited to all that. After all, even if BTC transactions require legal enforceability or clear terms in case of more complex, business-related transactions, what else can an agreement cover besides the conditions of the transaction, legal guardrails, and dispute and risk mitigation clauses?

Well, as it turns out, there is another key benefit of having a Bitcoin sales agreement to support your transactions. This has become all the more important today when legislation surrounding Bitcoin and other major cryptocurrencies is being drafted all around the world.

As such, it is critical for your transactions to adhere to regulations. The Bitcoin Sales Agreement can ensure that for you. The entire agreement is drafted under the governing law for digital currency and its uses. So, even though it has clear guidelines for the technical aspect—such as how the escrow will work—it also protects you regulatorily—by offering indemnity under the laws of the state.

For example, let’s say you are a limited liability company willing to sell your Bitcoin to a party all the way over in Hong Kong. As per the state regulations, you might need to have certain clauses in the sale agreement or some provision of this agreement to ensure that you avoid getting flagged for money laundering practices.

This is what the Bitcoin Sales Agreement brings to the table—it can help you convert your held BTC into U.S. Dollars (or another fiat currency) while protecting the functionality or technical side of the transaction as well.

As regulatory requirements vary remarkably across jurisdictions, you need a solid Bitcoin Sales Agreement to ensure compliance with these bodies. This is an essential tool, particularly for those who are a part of the global crypto market or engage in buying and selling Bitcoin overseas.

What If You Don’t Have a Good Bitcoin Sales Agreement?

A good Bitcoin Sales Agreement is an important tool for everything from ensuring clarity on the blockchain side of things to having proper dispute resolution safeguards. Every term of this agreement is aimed at protecting the seller and the buyer under the applicable law. As such, operating without a comprehensive, legally sound Bitcoin Sales Agreement can be a grave mistake and you could be opening yourself up to significant risks.

Without a formal agreement that underpins your Bitcoin sale transaction, there is a good possibility of misunderstandings regarding transaction details such as the price, timing, and payment methods. These problems often arise even on smaller transactions—not necessarily massive volumes transacted by businesses.

Ultimately, such misunderstandings, confusion, or ambiguities can lead to disputes, disagreements, and worst of all, financial loss.

Also, let’s not forget that without a legally binding agreement, you are risking it in terms of regulatory compliance as well. The absence of a legally binding agreement often results in non-compliance with regulatory standards, attracting legal penalties.

This is also why we recommend you never rely on free, generic templates found online. These can be just as harmful for your transaction as not having a Bitcoin sales agreement at all. Often, agreements drafted based on such templates do not cover all bases, address specific needs unique to your transaction, or adhere to the latest legal and regulatory standards—leaving your Bitcoin sale or purchase transaction insecure and both parties significantly vulnerable.

The Key Elements of a Bitcoin Sales Agreement

There are eight key elements that make up a good Bitcoin Sales Agreement. You are free to add, remove, and edit your own sections—but, generally speaking, these elements are quite important when it comes to drafting a solid sales agreement for your BTC. The actual matter within each category will differ, of course, depending on the nature of the transaction. Nevertheless, you will realize that a lot of good, legally sound, and comprehensive Bitcoin Sales Agreements have these sections and a lot of matters in common.

These sections include:

- Identification of Parties: First off, you need to identify the parties involved in the agreement. This means clearly stating the legal names and contact details of both the buyer and the seller. This is crucial as it sets the foundation for the transaction and ensures that there’s no confusion about who is responsible for what.

- Description of the Asset: Next up, the agreement should provide a detailed description of the asset being sold—Bitcoin, in this case. Specify the exact quantity of BTC being exchanged, and include the current value of Bitcoin at the time of the agreement. A timestamp is also important to avoid confusion later, especially if the price fluctuates between the time of signing and the actual transaction.

- Transaction Terms: Following that, the transaction terms should be clearly outlined. This includes the agreed-upon price for Bitcoin, the currency being used for payment, and any other conditions that affect the price or payment. If there are any contingencies or specific instructions for the transaction, they should be included here to avoid misunderstandings.

- Payment Method: Then, the payment method must be specified. This section should detail how the payment will be made, whether through fiat currency, another cryptocurrency, or via an escrow service. This makes sure that both parties are clear on the payment process and have the necessary protections in place.

- Transfer of Ownership: Next, you will want to include a transfer of ownership clause. This is especially important for Bitcoin transactions since ownership is not just about a simple exchange of funds—it involves transferring control of the cryptocurrency on the blockchain. Be sure to outline the exact process for transferring ownership, including the timing and steps both parties must follow.

- Representations and Warranties: Following that, representations and warranties need to be stated in the agreement as well. These include any assurances both parties make regarding the legality of the assets being transferred and their authority to complete the transaction. This helps prevent any legal issues down the road (which are more common than you think).

- Compliance and Regulatory Considerations: After that, compliance and regulatory considerations should be addressed. This is crucial, as cryptocurrency transactions are subject to different regulations depending on the jurisdiction. Here, do your due diligence to make sure that both parties agree to comply with relevant laws and regulations governing the sale and transfer of Bitcoin.

- Dispute Resolution: Finally, a dispute resolution clause is necessary to define how any disagreements will be handled. Whether through arbitration, mediation, or another method, this section provides a clear path for resolving issues without the need for lengthy litigation.

Sell Bitcoin Safely with FreshDox.com’s Bitcoin Sales Agreement Template

When it comes to selling Bitcoin, ensuring that your transaction is secure, transparent, and legally sound is non-negotiable. Without a solid, comprehensive agreement in place, you risk exposing yourself to misunderstandings, financial loss, and potential legal disputes. That is precisely where FreshDox.com’s Bitcoin Sales Agreement Template comes in.

Our expertly crafted template is designed to help you go through the difficulties often associated with Bitcoin transactions—especially bigger ones. With us, you have peace of mind and confidence. Our template includes all the essential clauses ranging from the identification of parties, transaction terms, and payment method to compliance with regulatory requirements.

So, whether you are dealing with large sums or smaller transactions, our template offers a clear, legally binding framework that eliminates ambiguity and safeguards your interests.

With FreshDox.com, you do not have to worry about outdated or incomplete templates. Our Bitcoin Sales Agreement Template is up-to-date with the latest regulations, so you can conduct your transaction in full compliance with the laws. Plus, it is fully customizable (and available in Word and PDF), so you can tailor the agreement to meet your specific needs, regardless of where you are located or the scale of your transaction.

Take the first step towards a secure Bitcoin sale today. Sign up for FreshDox.com, access our Bitcoin Sales Agreement Template, and protect your digital assets with a robust, legally sound document designed to keep your transactions smooth and dispute-free. Start your risk-free 14-day trial now and experience the peace of mind that comes with using a trusted, professionally crafted agreement template.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews