Blank Invoice Form Template

9 Downloads

Commercial, Money and Finances

February 17, 2025

Sayantani Dutta

In the competitive small business economy, presenting customers with a well-designed invoice and clear billing is a standard transactional expectation. Proper invoicing systems show the customer that they’re dealing with a professional outfit. B2C and B2B companies need a consistent invoicing process for efficient settlement of all transactions, verifying the legitimacy of the sales contract.

Below, we’ll discuss the nature of the invoice and its role in small business. We’ll also present you with a template solution you can incorporate into your company’s sales systems, without adding to your overhead expenses.

What is an Invoice in a Small Business?

Invoices are tools that show a business is committed to professionalism and transparency. It’s proof of delivery and payment for products or services, and a detailed invoice shows that your business treats clients honestly and with respect. By itemizing services or products, small businesses cut out any uncertainty that may arise and cause disputes between the business and the customer.

Adding a Personal Touch

A personalized invoicing format allows for an essence of care and attention to detail. While using a free blank invoice template or pre-designed layouts is a common strategy for many small business owners, tailoring the design to reflect your company identity and branding gives it a greater degree of professionalism.

Smaller businesses or freelancers who issue professional-looking business invoices show they value service quality. Simple adjustments in formatting or adding personalized fields can turn an invoice into a tool that demonstrates the service level customers can expect from your brand.

Building Long-Term Trust

Consistency in invoicing best practices lay the bedrock for transparency and reliability in the customer experience and their relationship with your business. Whether you’re running a B2B or B2C company, adhering to proper product service invoice template standards is a prerequisite for doing business in any state, in any country, and anywhere around the world.

This predictability also helps small businesses work with larger organizations. Larger entities often have more stringent requirements for invoice formats, and meeting these expectations shows that your small business is ready to handle professional corporate standards.

By using the same proven invoicing practices for all transactions, small businesses can increase their credibility.

Clear Communication to Avoid Delays

A well-developed invoice template systematically organizes payment expectations. Modern invoicing tools, such as invoice generator software, help small businesses eliminate barriers to issuing invoices and receiving timely payments.

Offering simple payment options, such as online payment links or credit card portal links embedded into digital invoice templates makes the settlement process easier for customers. This convenience provides an improved payment experience for the client and speeds up the accounts receivable timeline to receive outstanding funds.

Addressing these details in advance helps small businesses keep their operations running smoothly without encountering frequent delays or disputes in the payment process. An invoice isn’t just a tool but a direct reflection of the professionalism, reliability, and care that a business brings into customer relationships.

Why Do You Need an Invoice for Small Business Transactions?

Invoices are more than just paperwork; they are crucial to the financial and operational stability of a small business. These documents are necessary for customer transactions, building credibility, showcasing transparency, and maintaining tax compliance.

Driving Financial Organization and Accountability

A proper invoicing process ensures that financial records are maintained correctly. Every transaction is documented, allowing a business to track its income and accounts receivable. When invoices are issued on a consistent basis, it becomes much easier to manage income, prepare for recurring expenses, and plan for the future.

This streamlined approach to financial management and transparency aids in stabilizing cash flow, which is vital to sustaining business operations. Application tools, such as invoice templates, create records and track transaction flow, keeping the invoicing process efficient.

Establishing Legal and Tax Records

Invoices also provide legal evidence for business transactions. These serve as documented records of services rendered or goods delivered. In cases of disputes or audits, they contain the agreed terms of payment.

For tax reporting, invoices make it easier to determine income and calculate deductions. Business owners can save customizable templates as PDFs or Word Documents in cloud storage for easy access and compliance, without holding onto paper records that take up space.

Encouraging Timely Payments

Late payments shake the financial stability of a small business, and a well-prepared invoice reduces the chance of delays. Highlighting the due date and specifying payment options, like credit card or bank transfers, simplifies things for customers. Automated systems like recurring invoices or invoicing software can also remind clients about upcoming deadlines to help small businesses maintain consistent cash flow.

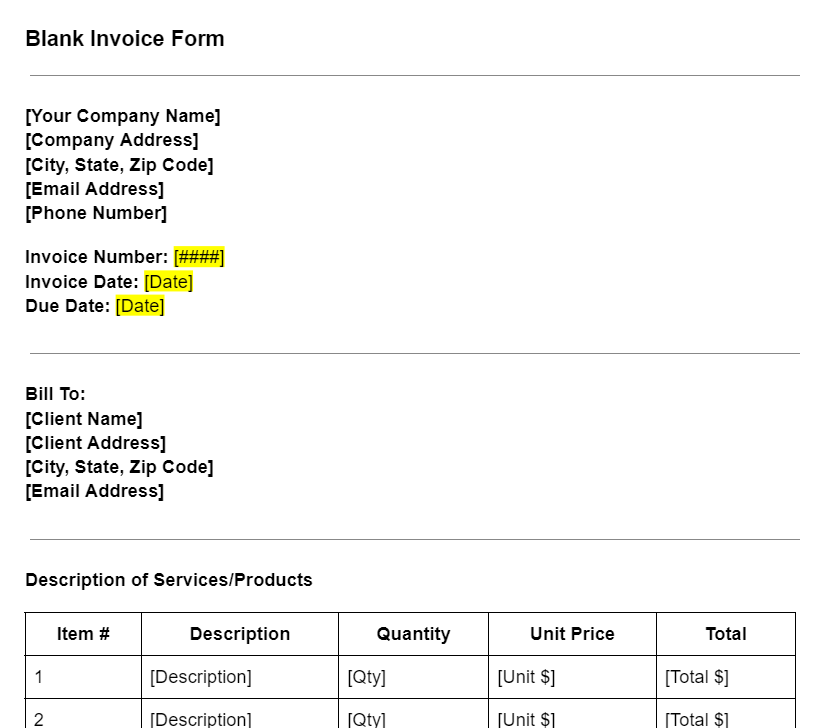

What to Put in the Invoice

An invoice is a bill, and it needs to have certain elements to be effective. Every detail contributes to its clarity and functionality, making sure the recipient understands their obligations and you stand on common ground with the financial obligations between the business and the customer.

Business Information

Your business name should be there with the company’s address and contact information. Including a logo or branding elements provides more personalization and makes the invoice easily recognizable.

Customer Details

Include the customer’s name, address, and any relevant contact information.

Invoice Number

Each invoice number should be unique for reference purposes.

Issue Date and Date Due

Note the date you are issuing the invoice and the due date for payment. This timeline sets expectations and helps both parties stay accountable.

Itemized Breakdown of Services or Goods

A detailed itemized description is paramount. For example, an auto repair invoice might list parts replaced, labor charges, and diagnostic fees, while a freelance invoice might break down hours worked or project milestones. This would also include unit prices, a subtotal, and any applicable taxes.

Amount Due

Highlight the total amount prominently to avoid confusion. When applicable, provide clear instructions regarding payment options such as credit card, bank transfer, or mobile payments.

Payment Terms

Establish the terms of payment, and specify any late fee or discount in case of early or preferred payment methods. This feature makes the transaction process easier, whether your business accepts payments online or offline.

Optional Notes or Customizations

A custom invoice can include a thank-you note, extra terms, or even reminders. Though not essential, these creative additions add a personal touch and can build a business relationship.

Common Challenges in Invoicing

Despite their seemingly simple purpose, an invoice can cause problems if it is not accurate or complete. One common mistake is incomplete information, such as not including an invoice number, due date, or customer information.

These oversights create confusion which results in late payments, especially when dealing B2B with larger organizations. Calculation mistakes, such as the incorrect entry of subtotals or a total amount may lead to the customer raising disputes and can lead to loss of faith in the company.

Inconsistent formatting in the invoice design looks unprofessional, giving a bad impression to customers.

Choosing appropriate fonts and allowing for a neat, organized flow in the text improves the document’s readability. Compatibility with different formats is a significant factor for organizations that produce online invoices. A PDF invoice template avoids technical glitches during issuance.

Failing to set clear payment terms—such as specifying accepted methods like credit card payments or mobile transfers—can lead to misunderstandings that disrupt cash flow.

These pain points can be effectively neutralized and addressed by leveraging tools such as invoicing software or utilizing customizable templates.

Digital Invoicing for Small Businesses

The trend of shifting toward online invoicing solutions continues as more companies execute digital transformations. Digital invoices are much easier to share, track, and archive without the headache of using paper forms to create invoices manually.

It integrates with accounting systems, saving time and enhancing transaction accuracy with an invoicing software platform. These tools are convenient for businesses operating across multiple locations or offering remote services.

But for those with smaller operations looking for a more affordable solution that’s a step up from the hassle of drafting a business invoice template from scratch on Google Sheets, Microsoft Word or Microsoft Excel, try professionally designed free invoice templates from FreshDox.

Download a Customizable Blank Invoice Form from FreshDox

Sign up for a free 7-day trial of FreshDox and get instant access to a customizable blank invoice form for your small business. Edit our professional invoices template to your business requirements and download it in Word or PDF formats. Your free trial of a Basic account gives you access to three free downloads, and a Premium trial gets you unlimited downloads of anything in our template catalog. Choose FreshDox for all your business template requirements, we have everything you need to get your paperwork on track.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews