Business Purchase Agreement Template

8 Downloads

Commercial, Corporate

January 11, 2025

Sayantani Dutta

Buying or selling a business is not purely a financial transaction but a decision that involves a binding legal document governing the transfer of the entire business. To execute this process effectively, a particular document takes center stage.

This is the business sale agreement, commonly referred to as the business purchase agreement. The whole transaction does not have form, clarity, and legal protection without it.

Definition of a Business Purchase Agreement

On a basic level, a business purchase agreement is a binding legal agreement between parties. It meticulously outlines the critical aspects of the deal, including the closing date, payment terms, and a comprehensive sales contract.

This would involve the identification of the business assets being transferred, whether under an asset purchase agreement or other structure, the establishment of the purchase price, and fixing the timeline of the transaction.

The contract, as opposed to any informal agreement or verbal commitment, formalizes the sale so that there is no chance for any interpretation or misunderstanding. Once signed, both parties are legally bound to follow through on the transfer of ownership, payment terms, and any other conditions outlined within.

Why Every Transaction Needs a Business Purchase Agreement

Most business transactions, in the absence of a structured agreement, often lead to chaos, confusion, and even conflict. The business purchase agreement is indispensable in that it confronts these risks directly. It offers protection in three major areas: clarity, process structure, and legal safeguards.

Ensuring Clarity

A business purchase agreement leaves no detail to chance. It defines the scope of sale: what is included, what is not, and the buyer and seller’s terms and conditions for the deal.

Streamlining the Process

Orderly transactions are normally the result of carefully planned agreements. A business purchase agreement provides orders through the stipulation of timelines, payment methods, and milestones. It breaks up the deal into phases, where everything materializes step by step.

Providing Legal Security

Without the backing of the law, business transactions become susceptible to fraud and mishandling by one or both parties to the deal. If disputes arise, the agreement acts as evidence in a court of law, protecting the buyer and seller from sustaining a loss. More than a contract, the business purchase agreement lays the cornerstone for trust, clarity, and security in any transaction.

Start with a Letter of Intent

If you’re the seller, start by requesting a letter of intent from the buyer. This document shows the basic structure of the transaction and confirms that the buyer is seriously interested. While in most instances it is not legally binding, it does help both parties develop mutual expectations.

An LOI generally includes:

- Purchase Price: The total amount proposed.

- Deal Structure: This gives the method(s) of funding the purchase either all cash or financed or combination financing.

- Timeline: The time expected to complete due diligence.

- Deposit Requirements: Any deposit or initial payment to secure the deal.

- Key Provisions: Major conditions that will be part of the final purchase agreement.

The LOI might be thought of as a handshake between the buyer and seller. It reflects both parties’ willingness to proceed with the deal and is an important step before the actual drafting of the agreement.

Perform Proper Due Diligence

Due diligence represents your opportunity to uncover the true state of the business. This step is all about discovery and investigation: making sure that there are no hidden liabilities or surprises. Here’s what to focus on during the due diligence phase.

Financial Records

Review the balance sheet, profit and loss statements, and tax filings to determine whether the business is financially sound.

Legal Contracts

Review all current agreements: all leases, vendors, and litigation.

Customer Base

Know who the customers of the business are. Are the customers loyal? Are there major clients that the firm is dependent on disproportionately?

Due diligence is your protection. The information that you uncover here will be used to set the terms within your business purchase agreement so you know exactly what you are getting into. The financial statements are necessary appendices forming a full financial profile of the business entity.

These documents include the profit and loss statement, balance sheets, and cash flow analysis. They provide a quantified framework whereby the fiscal integrity and operational efficiency of the business concern can be looked at under a microscope.

The data they encapsulate provides prospective buyers with granular profitability margins, asset-to-liability ratios, and liquidity trends, facilitating evidence-based decision-making. The metrics ensure that the buyer has relevant performance indicators, decreasing information asymmetry.

Vendor Agreements

Vendor agreements form part of the operational setup that outlines the scope of supply and continuity of service. These agreements articulate the terms of supply, pricing matrices, and performance obligations that serve as some kind of structural blueprint for operational dependencies.

Having these contracts placed within the provisions allows the buyer to audit contractual health in the vendor relationships, find cost-efficient benchmarks, and highlight points of leverage for renegotiation.

Such transparency means the buyer can be assured their strategic perception would focus on supply chain dynamics, and the business functionality is literally based on a set of contractual commitments.

Request a Deposit

The procedural step towards facilitating a deposit transaction aims to consolidate the intent of the buyer to follow through with an acquisition.

This upfront financial contribution can be seen as an interim assurance mechanism, showing the buyer’s alignment of interest in the direction of the transaction. Nevertheless, the lack of a signed business purchase agreement keeps the negotiation stage fluid, during which time either party can pull out.

Sellers must state categorically the parameters for refundability of the deposit as a means of providing clarity and, more importantly, limiting the potential conflict if the transaction is not consummated.

This often means that, when outside financing is required, one of the most important preparatory steps involves seeking pre-approval from lending institutions. Buyers are encouraged to obtain institutional assurances that reflect their ability to pay for the purchase price.

Meanwhile, sellers have to make requests for documentation that will confirm the buyer’s funding strategy, source of funds, and preferred disbursement modalities. These measures enhance the predictability of financial flows and reduce transactional contingencies that would otherwise hamper finalizing the deal.

Implement a Non-disclosure Agreement

Execution of a non-disclosure agreement is a procedural safeguard to protect proprietary information disclosed during the transaction life cycle.

This legal instrument restricts the dissemination and misuse of sensitive data, ensuring that intellectual assets, trade secrets, and operational insights remain secure, irrespective of the transaction’s outcome.

The NDA also acts as a risk-mitigation tool, especially in situations where negotiations do not result in a binding agreement, to protect the disclosing party against reputational or competitive disadvantages.

A Comprehensive Guide to Drafting a Business Purchase Agreement

A structured approach will cover all the critical elements and reduce associated risks for both buyer and seller. The following steps will be helpful in drafting a strong agreement.

The agreement should identify, in unequivocal terms, all parties to the transaction. This includes the buyer, the seller, and any other parties connected with the purchase.

Full legal names should be captured, together with proper addresses and contact information for both parties. Missing or incorrect information at this stage can cause delays or legal complications.

Legal consultation is also highly recommended. Without legal advice, not only does one invite increased liability, but the validity of the agreement also can be in question later on. Ensuring accuracy here is not merely a recommendation—it is a requirement for successful execution of the conditions precedent to the deal.

Step 1: Describe the Business in Detail

Every detail about the business being sold should be described with precision. Begin by describing the kind of business it is, whether retail, hospitality, technology, or other.

Expand on its sphere of operation, market position, real estate holdings, incorporation status, and anything unique that may distinguish it from the rest. This is not just a narrative; it’s an important section that tells the buyer what type of enterprise they are buying under the purchase of business agreement.

The seller must confirm in writing that they have the legal right to sell the business. In the case of an incorporated business, note its status as such and how that bears implications on ownership transfer and liability distribution. These distinctions are fundamental because the legal framework has a direct impact on the transaction process.

Step 2: Define Financial Terms

This section should contain a clear breakdown of the financials involved in the transaction. Start by specifying the total purchase price and outline whether payments are payable as a lump sum or in installments.

Clearly state the payment plan, and dates, account for any applicable sales tax, and include details on how it will be calculated and paid. Clear financial terms avoid miscommunication during and after the sale.

Step 3: Terms of Sale

Terms of sale should outline the exact components of the transaction, with no room for ambiguity.

Assets Included

Identify all the assets of the business being transferred. These may be tangible, such as furniture, inventory, and vehicles, and maybe intangible, such as trademarks, customer lists, and goodwill. For each asset, attach the appraised value and condition. This will help the buyer understand what exactly they are acquiring through the sale of assets.

Accounts Receivable

Indicate whether accounts receivable are being sold or retained by the seller. This task clarifies the financial liabilities associated with the business after the sale.

Excluded Assets

Highlight excluded assets explicitly. This would include, but is not limited to, equipment, intellectual property, or other business elements the seller might want to retain. Clearly identifying exclusions prevents disputes and ensures a shared understanding of the agreement’s scope.

Management Systems

If the transaction involves proprietary or critical management systems, such as software or operational frameworks, include detailed descriptions. Explain how these systems support the business operations and ensure provisions for a smooth transfer to the buyer.

Step 4: Describe the Covenants

Covenants determine the promises and guarantees of both the buyer and seller, which they will have to keep during the transaction and after the deal is closed. These commitments are meant to ensure a smooth change of ownership while taking into consideration important responsibilities such as settling debts, legal guarantees, and continuity of operations.

The agreement should categorically establish that the seller has a legal right to sell the business.

This means verifying the absence of liens, encumbrances, or any other kind of legal hold that may stand in the way of the transaction. Additionally, specify whether the sale involves assets or stock, as this distinction impacts the transfer of liabilities and ownership structure.

Warranties play an important role here. The seller may also have to warranty that the business is free from any outstanding debts, litigation, or any other issues pending settlement. At the same time, the buyer may agree to maintain the business operation intact for a certain period of time.

Non-compete clauses are indispensable to safeguard the venture made by the buyer. These clauses ensure that the seller does not create, or work for, a rival business within a specific area and time period.

In this line, other significant issues involve the non-solicitation agreement, and confidentiality clauses dealing with sensitive business information shared intra-transaction, whose provisions correspond to governing law.

Indemnification and Areas of Protection

The idea behind indemnification is to hold one of the parties responsible for issues it creates, whether by action or omission, prior to the sale.

For instance, if there are undisclosed legal disputes or tax obligations, the seller would be liable for addressing them. This clause is important in safeguarding the buyer from any impending risk.

Clarify tax liabilities within the agreement. Indicate whether the seller is responsible for settling existing obligations or if the buyer assumes future liabilities. The same for employee benefits, outline how current benefits are to be maintained or changed under new ownership.

These specifics eliminate uncertainty and protect both parties.

Training provisions should also be provided. Specify the duration and scope of any training the seller will provide to the buyer or new employees. Add plans for notifying your customers of a change in ownership; this could be done through formal communication or direct contact to ensure minimum disruption and maintenance of trust.

Step 5: Describe the Transfer Process

The transfer will illustrate how business control will shift from the seller to the buyer. The process will require some logistics to be laid out, like transitioning employees, a timeline of the same, how inventory will be handled, and customer accounts.

During this phase, clear responsibilities must be distinctly outlined for each party. For example, is the seller staying on during the transition period, and if so, in what capacity?

Also, describe how the buyer will take over: for instance, any agreed-on training or onboarding of the staff.

Finally, document every element of the transfer. This would include ownership rights, operational protocols, and key contact introductions. By addressing each step with precision, the transition process becomes predictable, and extra delays are avoided.

Step 6: Finalizing the Closing Details

Closing is the final stage of the transaction, marking the actual transfer of ownership.

It is a procedure that involves several critical components, all of which require meticulous planning to avoid complications. The information should be clear, actionable, and relevant to the particular transaction.

The first thing to decide on is the date of closing. This is the time agreed upon when the transfer of ownership takes effect. The location and time of the closing should be specified, and all parties must be ready for this important event. This moment marks the culmination of negotiations and the execution of the agreement.

Transferring titles might include deeds for properties, titles to vehicles, a bill of sale, or intellectual property documentation prepared with the guidance of a law firm.

It is imperative that these transfers be in conformance with state laws and that all paperwork be prepared well in advance. Missing or incorrect documentation can delay the process or even affect the legality of the transaction.

The payment arrangements also need to be finalized. Whether the payment is a lump sum, by installments, or through an escrow account, the details should be crystal clear. Define the timing, method, and any conditions attached to the payment to prevent disputes or misunderstandings.

Finally, the parties must sign the agreement.

The document carries no legal weight without the signatures. Make sure all parties sign, and the agreement is in compliance with your state’s laws for it to be legally binding. A clean and thorough closing process signifies the completion of obligations and resolves the transaction without glitches. This process needs to be tailored to the specifics of the business being sold to ensure that the transition is as seamless as possible for all parties.

Identifying Third Parties in a Business Purchase Agreement

Business transactions require the parties to work with professionals and entities outside the enterprise like third-party brokers, legal advisors, and financial institutions.

From the very first negotiations down to the minute details of closing, their involvement can affect every stage of the process. Understanding their responsibilities helps streamline the transaction and addresses potential complexities early.

Brokers

Brokers liaise between buyers and sellers in small business transactions. Equipped with their experience in market trends and valuations, they are in a position to give critical insight into negotiations.

They act as intermediaries in ensuring both parties achieve their goals.

It is important to define the broker’s role in the agreement in a formal manner. Include their name, contact information, and the agreed commission, usually as a percentage of the sale price.

Setting these terms early will help avoid confusion, especially when closing the deal. A broker’s contribution, as invaluable as it is, needs to be documented in a very clear manner for transparency.

Legal and Financial Advisors

The lawyers ensure the agreement is compliant with applicable laws and regulations, making it legally enforceable while reducing exposure to potential legal challenges. Lawyers identify hidden risks and liabilities in the deal, such as ambiguities in business contracts or unaddressed financial obligations. They create clauses designed to mitigate these risks.

Every sale of a business is different. Lawyers draw up agreements suited to the particular transaction, considering such nuances as industry regulation or detailed operational specifics. Contracts can often be full of jargon and technical terms. Legal advisors simplify this language so that their clients can understand every word and clause.

A well-rounded dispute resolution clause, drafted with the help of legal experts, outlines the manner in which the conflict may be dealt with (arbitration, mediation, or litigation).

Financial Advisors

Financial advisors analyze numbers. They help determine whether the price paid is reasonable, whether the terms of financing are favorable, and the tax implications of the purchase. These professionals can run forensic audits on the company’s finances to ensure that everything is above board with the financial statements and the company’s profit potential for the prospective buyer.

Financial Institutions

Financial institutions play a vital role in financial or escrow dealings. They ensure that financial arrangements are correctly carried out, securing loans or holding funds during the sale. This also saves the parties from delays or confusion later during the closing phase by clearly defining their role upfront.

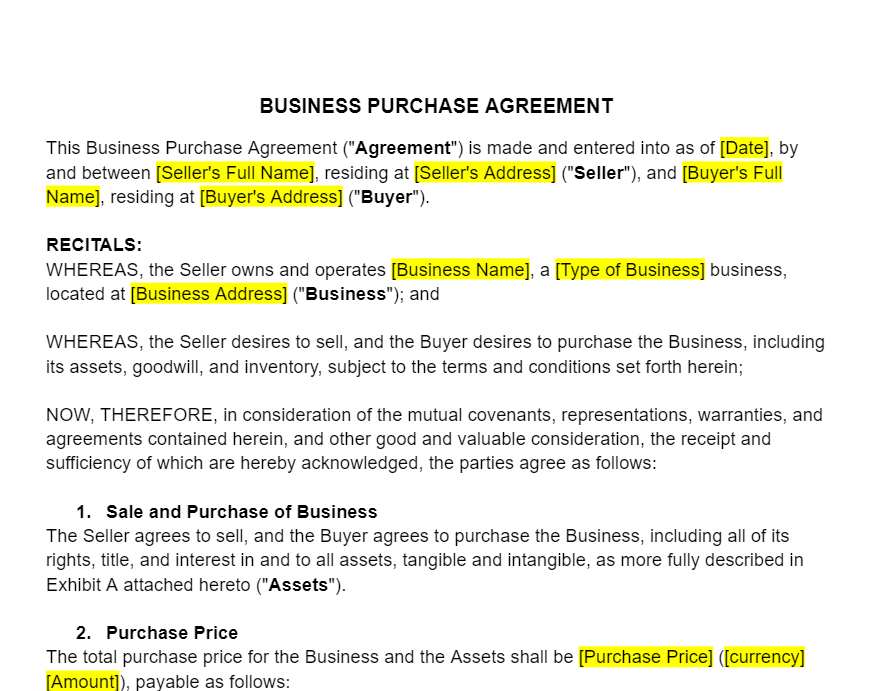

Get a Customizable Franchise Agreement Template from FreshDox

A business purchase agreement template provides the ideal framework for the transaction, and FreshDox has a fully customizable template ready to download. Sign up for a free 7-day trial of a Premium or Basic account and get access to a free business purchase agreement in Word or PDF format.

Popular searches:

- Business Purchase Agreement Template pdf

- Business Purchase Agreement Template sample

- Business Purchase Agreement Template download

- Business Purchase Agreement Template format

- Business Purchase Agreement Template template

- Business Purchase Agreement Template word

- Business Purchase Agreement Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews