Buy-Sell Agreement Template

8 Downloads

Real Estate

January 7, 2025

Sayantani Dutta

Running a business is so much more than just day-to-day operations. Business owners need to be able to anticipate what could go wrong (because things often go wrong). The company should be resilient enough to survive such events. And one such event is the transfer of ownership. A partner could leave the business, pass away, or simply desire to sell their shares. Regardless of the triggering event, you need a proper plan here.

That is where the Buy-Sell Agreement comes into the picture. It is a document that ensures your business keeps ticking, no matter what curveball is thrown its way. Think of it as insurance for your company’s ownership structure to prevent chaos and confusion if someone decides to make their exit.

This agreement, also often dubbed a buyout agreement, is critical for business continuity and to protect everyone involved. Today, we are going to talk about protecting the business interest of all parties involved, and the business entity itself, from unforeseen circumstances using your Buy-Sell Agreement. We will also talk about the consequences of not having a well-drafted agreement in place and the unparalleled benefits of using FreshDox.com’s comprehensive template as a starting point for your agreement. So, without further ado, let’s dive right into it!

What is a Buy-Sell Agreement?

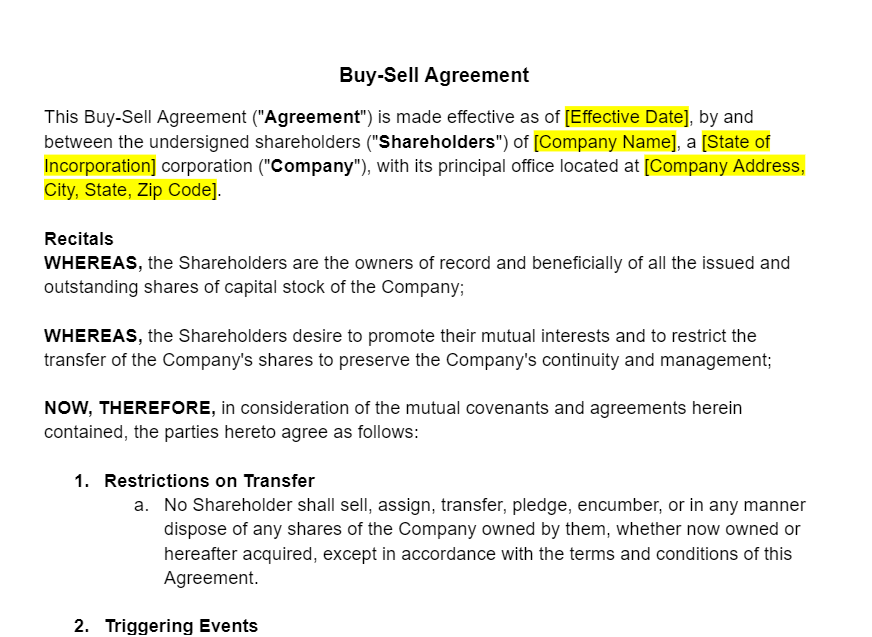

A Buy-Sell Agreement, also known as a buyout agreement, is a legally binding contract between co-owners of a business that controls the transfer of ownership in the event of an owner’s death, disability, retirement, or desire to sell.

The document is kind of like a business will—outlining the terms under which business shares can be bought and sold, the valuation methods to be used, and the financing of the purchase. Mainly, the Buy-Sell Agreement concerns itself with the remaining owners of the company. So, whether you want the remaining shareholders to buy out the shares of a leaving member in installment payments or protect the remaining owner’s interest in the case of the incapacity of another partner—it is the Buy-Sell Agreement that will facilitate these processes under the laws of the state.

Much like estate planning, you need to consider various factors before you can succeed in a smooth transition. The idea behind this document is to prevent conflicts between the remaining owners and the outgoing owner or their heirs. Ultimately, such an operating agreement is critical for any type of business, such as a limited liability company or a partnership, to protect ownership interests and legally transfer the leaving partner’s shares.

Why is the Buy-Sell Agreement Important?

Because you cannot legally and peacefully transfer the ownership of shares without one! But there is more. This document clearly outlines an agreed-upon path for the transition of business interests. As such, it is instrumental in mitigating the risk of disputes and ensuring the ongoing viability of the business.

In that context, the document serves as more than just a tool to prevent legal disputes. Though it is true that the #1 objective here is to establish predetermined terms and agree upon the transition of shares to minimize the potential for disputes among owners and heirs, there is more to the terms of this agreement than meets the eye.

For starters, it ensures business continuity. Without it, the business will simply fail to continue and get plagued by legal disputes. The document includes a clear roadmap for ownership transition regardless of which types of Buy-Sell Agreements we are talking about. This helps maintain stable operations during potentially turbulent times within the organization. After such sale offers, the transferee and the transferor both enjoy peace of mind and the value of the business is protected. No insurance company claim or law firm is brought into the equation and everyone gets what they expect—nothing more or less.

Furthermore, the Buy-Sell Agreement also protects the interests of all parties involved in the transaction, particularly in terms of valuing the business and determining fair compensation for ownership shares. Depending on the liquidity and the initial purchase price of shares, when a departing owner is bringing the value of things in question, the Buy-Sell Agreement can be referred to in order to find the right value of the shares within the governing law. In the case of the death of an owner, this becomes even more important because the ability to raise a dispute is diminished, potentially causing the undervaluing of the earlier owner’s shares.

That is why the provisions of this agreement need to be airtight—so as not to leave no ambiguities and confusion about how the shares and company’s value will be determined in this subject matter.

This legal document additionally facilitates estate planning. Business owners can integrate it with their personal estate planning for added peace of mind regarding the future of the business and how it will be handed over to any heirs.

More than a promissory note or a written notice, the Buy-Sell Agreement is equipped to determine the correct value of the company and provide the necessary rights and protections to all members—from waivers and the right of first refusal to arbitration, legal action, and the determination of a fair market value.

Not Having a Reliable Buy-Sell Agreement

What a lot of business owners do is simply fail to acknowledge the seriousness of this endeavor. They believe other documents, verbal understandings, or mutual respect for each other will prevail in the off chance someone wants out. Well, that is a very narrow and amateur look at things. Every member needs to be protected in a legally sound and comprehensive way. Not only will this make sure everything is done legally and fairly, but it also makes sure that your business does not face any unforeseen hurdle—which will be a separate issue that you might not be equipped to handle.

A solid Buy-Sell Agreement helps you lay the groundwork for a smooth transition and peace of mind for everyone involved in the business transaction. And that is precisely why you should not be relying on an inadequate template grabbed off the free web to do this task!

Operating without a comprehensive Buy-Sell Agreement, or relying on a generic template, will most certainly expose a business to significant risks. As you will not have clear, enforceable guidelines for ownership transition, any departure of a key owner will most likely lead to disputes among remaining owners and heirs. And we do not need to tell you this but this will definitely paralyze business operations.

This lack of a formal agreement can also result in unfair valuation and financial terms for the departing owner or their estate—leading to protracted legal battles in the future and undermining the financial stability of the core of the business itself.

You do not want any of that. That is why you should choose a dependable, rock-solid template as a starting point to draft your own, unique Buy-Sell Agreement and protect all parties involved in your business.

Key Elements of a Buy-Sell Agreement

There are four key components of a good Buy-Sell Agreement—trigger events, valuation method, funding mechanisms, and the terms of the sale. Let’s take a closer look at each one of these:

- Trigger Events: The Buy-Sell Agreement should ideally define all the circumstances under which the agreement is activated. Typically, this will include death, disability, retirement, or a desire to sell. Be thorough in the scope here—these events will invoke the document and at that point, nobody can stop the terms from taking precedence.

- Valuation Method: The value of a company and its shares changes over time (preferably going up). As such, the Buy-Sell Agreement also needs to set down a robust method for determining the value of the business or ownership shares at the time of the trigger event. This is done for fairness and transparency purposes, but in reality, it helps protect the departing partner and preserve their rights.

- Funding Mechanisms: The document also includes information on how the buyout will be financed. This can have provisions for insurance, external financing, or other means. There needs to be absolute certainty regarding the financial aspects of the transition to avoid problems down the line. Often, nailing this down is the most complex part as you need to be prepared for every possibility here. For example, it is important to protect the business from any type of unfair distribution of shares or hostile takeover during these phases, and the funding mechanism clauses will ensure how successful your attempt is.

- Terms of Sale: Lastly, the document also lays down the terms under which shares of the departing member can be bought or sold. This includes any restrictions or rights of first refusal for existing owners.

A Buy-Sell Agreement needs to be clear, orderly, and a facilitator of an equitable process for transferring ownership interests to be able to protect all parties involved and the business itself. Ideally, you also want to include the information about dispute resolution here—these are clauses for resolving any disagreements that may arise in interpreting or executing the agreement with the singular aim of avoiding litigation when such a transition happens.

Streamline Ownership Transition with FreshDox.com

We understand the critical nature of Buy-Sell Agreements all too well. That is why we have a meticulously designed template that exceeds the limitations of generic online versions you will find on the internet for free. Our template is crafted by legal experts and is suited to provide comprehensive, clear, and enforceable provisions for the smooth transition of business ownership and shares.

You can subscribe to FreshDox.com today and gain access to this vital resource, along with a wide array of legal, business, and professional document templates. Our service is supported by a 14-day trial period for new users as well. This allows you to test drive our Basic and Premium Plans (Basic Members can download up to three document templates per month and Premium Members enjoy unlimited access).

Whether you are establishing a new business venture or looking to secure the future of an existing one, FreshDox.com will make sure that your Buy-Sell Agreement meets the highest standards of legal soundness and clarity. So, wait no more! Opt for FreshDox.com’s Buy-Sell Agreement Template and safeguard your business’s future, minimize potential disputes, and ensure a seamless transition of ownership today! Backed by the expertise and reliability of FreshDox.com, you can draft the perfect agreement with confidence. Our customizable templates can be downloaded in both PDF and Word formats.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews