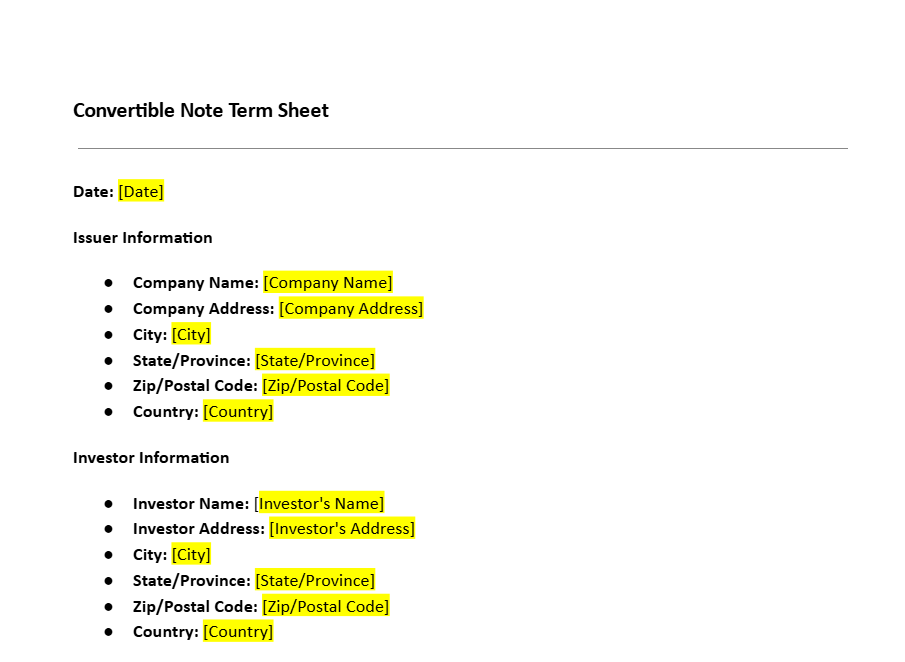

Convertible Note Term Sheet Template

8 Downloads

Money and Finances

March 4, 2025

Sayantani Dutta

A non-legally but morally binding document that is necessary for the parties, i.e., the company and its investors, to execute a convertible note instrument to record the binding terms in full is known as a convertible note term sheet.

A convertible loan is one of the ways by which a startup company can raise capital. This loan gets triggered and converted into equity in the future under predefined conditions by the issuance of a convertible note sheet. Instead of paying back the principal amount with accrued interest, the lender/investor receives common stock or preferred stock in the company.

A convertible note term sheet is a convertible security generally used in the following cases:

- While preparing for seed round investment, you explain all the negotiated terms to an investor, convincing them to join your business.

- When the company is under a convertible loan arrangement, which has relatively standardized terms. When converting debt into equity the conversion price is set at a discount known as discount rate or linked to a valuation cap that limits the price investors will pay after the conversion.

These notes are investor-friendly versions of SAFEs (simple agreements for future equity). Signed at the beginning of the transaction once the preliminary terms of the financing have been agreed upon, before beginning detailed due diligence and drafting of definitive agreements. They include practical guidance, drafting notes, alternate clauses, and optional clauses. They also have additional features like maturity dates and interest rates that attract investors’ interest.

The maturity date is one of the crucial components of this term sheet which specifies when the loan becomes due. The noteholder can demand repayment if no equity financing takes place before this date.

Interest rate per annum compensates the investors for the risk they take by investing in the early stages of startups.

Importance of Convertible Note Term Sheet

Startups, before they are ready to value their shares, use convertible note financing to raise capital. This helps them save time and focus on market expansion and product R&D. Here are some benefits of using a convertible note:

- Quick and Simple to Create: A convertible promissory note can be drafted quickly. Startups can arrange a convertible note within a day or two. Also, it does not require any startup a hefty amount to issue shares immediately.

- No Dilution: When triggered by a certain event convertible notes turn into equity security or shares, which generally happens after a funding round or qualified financing round. As shares are not issued upfront, existing equity ownership is not diluted. This results in startup owners reducing the risk of change of control over their company after getting funds, resulting in a tax advantage as well.

- Valuation: In the case of a startup it is difficult to calculate the valuation using basic or any valuation method. A convertible note allows for no valuation or share price to be set. Instead, a discount or coupon can be used on the note that converts into equity at a later date or next round of funding. The number of shares is directly proportional to the financing amount plus the additional profit in the form of dividends if the company grows in the future.

Risks of Convertible Notes

To save your startup or your investment in a startup, an accessible template solution should be used to outline all the necessary financing terms of the note which significantly reduces the risk of any future financially draining legal advice.

Investors take a huge risk when they take a chance by investing at a very early stage in startups. Convertible Note templates by Freshdox.com help minimize that risk and clearly state the principal terms of this short-term debt in which the principal amount is paid back with accrued interest and the lender is given preferred stock or common shares in the company.

Outlining the obligations of the parties involved the note purchase agreement specifies the purchase price, aggregate principal amount, and all the conversion terms like indebtedness, convertible securities, and all the liquidity events such as IPO or acquisition of the company.

Without this note term sheet scenarios such as unpaid interests and outstanding principals are considered critical.

Key Terms and Definitions

While being relatively standardized documents, convertible notes need to have some key terms that need to be agreed upon by founders/board of directors and investors to ensure clarity and alignment, these are as follows:

- Principal Amount: The cash amount that the investor agrees to immediately give to the company.

- Investment Date: The date on which this transfer will occur.

- Maturity Date: The date by which the qualified financing and conversion of notes into equity or preferred equity must have occurred, creating a timeline for the funding round.

- Interest Rate: The rate, typically expressed as an annual percentage, at which interest accrues on the principal amount until conversion happens, compensating the investors for the invested period.

- Prepayments: It should be well-defined whether the startup can prepay the convertible notes without the written consent of the company or the convertible holder or not. Both the involved parties should be on the same page.

- Interest Accrual Method: Typically, interest due on the note accrues on a day count basis of Actual/365 or 30/360 and will accrue using simple (only on the initial principal amount or purchase price) or compounding (interest also accrues on accumulated interest) methods.

- Discount Rate: Provides a reduction on the price per share at the next equity financing round, rewarding the investor for their early commitment.

- Valuation Cap: Establishes the maximum company valuation at which the note converts into equity, protecting the investor from excessive dilution. (This provides enhanced upside potential to investors if the future equity financing occurs at an elevated price)

- Conversion Trigger: The fundraising amount that triggers the automatic conversion of the notes into equity or preferred equity.

FreshDox.com’s Convertible Note Term Sheet Template

Here at FreshDox.com, we believe our professionally designed Sale Agreement of Business Template is the right starting point for both startup companies and investors to take the first step of getting and multiplying the investment with a professionally designed convertible note term sheet template that can help them protect their own interest. Our template is created by legal experts who specialize in commercial transactions. It provides a detailed, customizable framework that addresses the critical components of businesses.

When you subscribe to FreshDox.com, you gain access not only to our Sale Agreement of Business Template but scores of legal and business-related documents, all designed professionally by experts! Furthermore, we also have the provision for a 14-day trial period, which means you can test drive both of our membership plans—Basic and Premium. Basic Members can download up to three document templates a month whereas Premium Members have unlimited access.

Whether you are a business broker, legal professional, or entrepreneur—we have the templates to cover all bases and all of your business requirements!

Using FreshDox.com’s Convertible Note Term Sheet Template can significantly ease the process of raising investment at an early stage of startup or investing in a potentially profitable business for the future, ensuring all legal bases are covered and helping parties avoid common pitfalls in business transactions. Sign up today to secure a professional, reliable, and effective agreement that supports the success of your business.

Popular searches:

- Convertible Note Term Sheet Template pdf

- Convertible Note Term Sheet Template sample

- Convertible Note Term Sheet Template download

- Convertible Note Term Sheet Template format

- Convertible Note Term Sheet Template template

- Convertible Note Term Sheet Template word

- Convertible Note Term Sheet Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews