Credit Card Payment Form Template

8 Downloads

Commercial, Money and Finances

March 4, 2025

Sayantani Dutta

Processing credit card details requires a systematic approach to obtain and protect the transaction details. A credit card authorization form provides a standardized way to capture necessary payment information, authorizing the charges and in compliance with security specifications.

Businesses that are processing customer data require a structured, compliant document to conduct the transactions accurately, avoid errors, and maintain security. A well-defined payment form helps avoid disputes, chargebacks, and compliance breaches.

Without a clear framework, businesses risk handling payments inefficiently, leading to processing delays or security breaches that damage reputation and customer relationships.

Why Do I Need a Credit Card Payment Form?

Businesses handling credit card details must operate with accuracy and security s top priorities. A credit card authorization form standardizes the processing of the transactions, minimizing risks associated with errors and chargebacks.

One reason the documents are so essential in the retail environment is to prevent fraud. Without written authorization, merchants are unable to obtain the credit card number to initiate a charge. A signed, digitally authorized card, and the cardholder’s signature, are used to offer evidence in case of a dispute, reducing the risks involved in chargebacks.

Payment forms also simplify record-keeping. Instead of relying on handwriting and verbal agreements, enterprises are in a position to maintain structured histories of transactions. This function simplifies tracking and accounting and provides an open trail to accommodate auditing and compliance.

For businesses providing installment billing or one-time payment options, a credit card authorization form also sets the terms and conditions of regular payments. Customers acknowledge the rate and total to eliminate confusion in future transactions.

Legal protection ranks as another major element. Payment forms outline terms and conditions relating to refunds, cancellations, and charge disagreements. Businesses can use these terms in case any conflict arises, minimizing liability while smoothing out the resolution of disagreements.

Certain industries, such as law, healthcare, and professional counsel, require signed authorization to pay out because of the nature of the transaction. A well-designed authorization credit card template helps to maintain compliance with industry laws, making business owners feel confident to accept payments.

E-commerce businesses and subscription services depend on payment modes to ease web-based transactions. A digital form integrated into a secured gateway, like an ACH payment, offers smooth processing, reducing customer friction in web-based purchases.

Businesses operating internationally utilize the mechanisms of card-based payments to pay currency exchange rates and facilitate the terms of cross-border payments. Outlining these stipulations prevents confusion, making global transactions easier.

Without a standardized credit card authorization form, businesses are exposed to the risks of chargebacks, entry errors, and compliance issues.

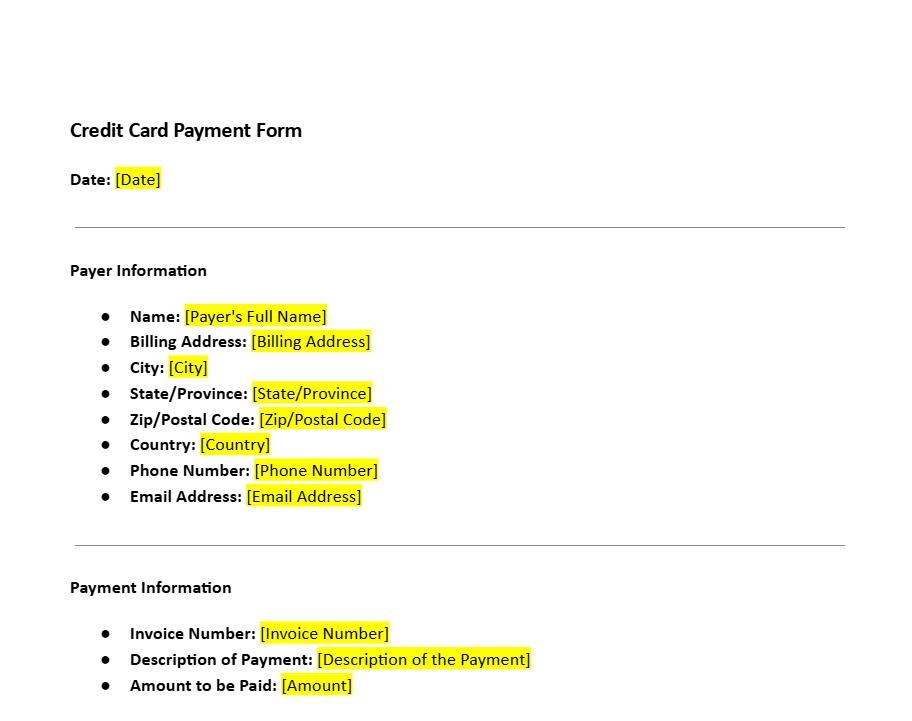

What Does a Credit Card Payment Form Include?

Essential Payment Information

The form typically includes fields to fill in the full name, cardholder’s billing address, credit card number, expiration date, and security code (CVV). These details are necessary to establish the legitimacy of the transaction and to authorize the transfer.

Some businesses also offer additional fields, such as account numbers, customer reference IDs, or order numbers, to facilitate the reconciliation of the payments. Different card types, such as Visa, Mastercard, and Amex, are typically defined in the form to provide the appropriate payment processing rules.

Recurring Billing and Subscription Payments

Beyond standard terms of a simple one-time payment, some authorization forms also offer fields to support recurring billing. Businesses offering subscription-based services and installment plans use them to obtain customer authorization to debit their account weekly, monthly, or annually.

In such circumstances, the form outlines billing frequency, deductions to be applied in each billing cycle, and the terms under which the customer may pause or end the subscription. Recurring payment authorization reduces administrative burden and offers consistent revenue for the businesses.

For businesses that use ACH payment processors, the forms offer lines to fill in a bank branch and account number to withdraw funds from savings and/or checking accounts, in place of credit card numbers or customer data.

Security Features and Compliance Considerations

Security measures are a necessary component in any authorization form. Fields may also include disclaimers about how sensitive information is stored and processed, noting compliance with PCI DSS (Payment Card Industry Data Security Standard) requirements. Encryption and tokenization are typically embedded in the chips to obscure the details of the credit card details.

Legal Disclaimers and Use Terms

A credit card authorization form typically consists of contractual language defining terms and phrases associated with refunds, chargebacks, and responsibility in case of unauthorized use. This protects the owners of small businesses from disagreements by making sure the customer’s payment responsibilities are well understood.

A section to recognize the customer is usually added, confirming they are voluntarily authorizing the transaction. This signed authorization helps to solve the issue of chargeback complaints by providing evidence of authorization to the institution.

Electronic Signatures and Payment Processing

A well-structured authorization card template is easy to read, and the cardholder instructions are laid out in simple language. Many businesses provide electronic signature options, where the customer signs electronically to approve the transaction.

For e-commerce, the various payment modes are integrated into secured gateways, avoiding the use of paper documents while upholding security compliance. This approach ensures efficiency and reduces paperwork for the customer and the small business owner or store manager.

What Value Does a Credit Card Payment Form

The value of a credit card payment form lies in its ability to strengthen security, reduce customer conflict, and encourage efficiency in operations for small and large companies alike.

For corporates dealing in large transaction volumes, a structured payment mechanism reduces administrative workload. Instead of having to check the payment details of each transaction manually, businesses automatically authorize and store the required documents.

Security remains a significant concern in the case of facilitating credit card payments for customers. Encryption and proper handling practices protect customer information from misuse and theft. Businesses that are PCI compliant reduce the risks associated with experiencing and enduring a data breach and the resulting fines and reputational loss associated with this type of event.

A well-structured payment page also establishes customer trust. When customers are shown a proper, neatly printed form, they’re likely to provide the business with their card details. Transparent policies in terms of refunds, billing schedules, and handling data promote a good customer experience.

Businesses offering subscription-based services, installment purchasing, or membership packages are in the position to establish precise billing schedules, terms, and terms of payment modifications. This prevents disagreements over unwanted bills and encourages customer retention.

For companies involved in chargebacks or disagreements, a thoroughly documented credit card payment form serves as irrevocable evidence of the transaction. Payment processors and banks require evidence of authorization in the event of a charge disagreement. A signed authorization form assists the company’ in making a case, reducing revenue loss from bogus chargebacks.

Many industries require legal protection when processing payments. A clear terms and conditions agreement protects the businesses from liability in the event the customer sues for conducting unauthorized transactions. Including legal disclaimers in the payment form sets the groundwork for dealing with possible customer disagreements.

By maintaining proper record-keeping, businesses are simplifying the reconciliation and accounting processes. Instead of depending on isolated payment documents, they refer to standardized reporting and compliance audit forms. A credit card payment form also encourages scalability. As businesses build and expand the size and breadth of their processing, standardized forms offer consistency in various channels.

How You Can Benefit from Using a Template When Drafting a Credit Card Payment Form

Creating a credit card payment form from the ground up demands care, compliance, and knowledge of the company’s security best practices. Using a template simplifies the task and provides a standard format adaptable to fit specific needs.

Template fields, such as cardholder information, authorization phrases, and security disclaimers are easily edited and amended to your needs. Instead of building a form from scratch in Word or Excel, download a template and use the existing fields to fit your payment processing requirements.

Download a Credit Card Authorization Form Template with a Free Trial of FreshDox

Start a free 7-day trial of FreshDox and get immediate access to our credit card payment form template and hundreds of professionally designed templates for business. Our extensive archive is available to you when you take a free trial of a Basic or Premium account.

Our catalog of professional templates for business is designed by professionals and easy to edit to your needs. When you’re finished designing your template, download it to Word or PDF format. With FreshDox you have a partner for all your contract and form needs and access to the most comprehensive catalog of professional templates for business.

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews