Cryptocurrency Sales Contract Template

9 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

Blockchain has taken the world by storm—and as a result, the use and transaction of digital assets such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), etc. has increased a lot. People are buying crypto and other digital assets and selling their coins all the time, converting them into fiat such as USD. This functionality paves the way for transactions, trading, and investments. But under the applicable law, you need protections for selling cryptocurrency legally, particularly if you are a business or a massive sum is involved.

Digital currency shares some protections with typical currencies. But largely, cryptocurrencies, that exist on the blockchain technology, are very different from the money in your bank account. If you lose some Ether, for example, by transacting to the wrong wallet address, there is no recourse. The money cannot be recovered by financial institutions.

More importantly, selling cryptocurrencies requires nuanced considerations—such as an escrow mechanism, dispute resolution clauses, conditions for arbitration, protection from anti-money laundering laws and KYC laws, agreements on the market prices, any necessary disclaimers for the sale of cryptocurrency amid price fluctuations, and so on. All of this needs to be under the governing law.

This is what you can ensure with a robust Cryptocurrency Sales Contract.

In this article, we will explore the importance of having a Cryptocurrency Sales Contract, the key elements that should be included, and why using a generic or inadequate template could leave you vulnerable to risks. We will also introduce FreshDox.com’s Cryptocurrency Sales Contract Template, a comprehensive and customizable solution designed to meet the unique needs of cryptocurrency transactions.

So, if you are involved in selling or buying cryptocurrency, keep reading to understand how a well-structured contract can safeguard your transaction and make your dealings more secure and transparent.

What is a Crypto Sales Contract?

The rise of cryptocurrencies has surely transformed the world of finance. U.S. Dollars are not the only global, powerful notes now. Digital tokens such as BTC, ETH, and USDT are quickly rising up everywhere—from the treasure of a limited liability company integrating alternative assets in its portfolio to the most popular trading platforms serving the common citizen. The volatility has created an opportunity beyond the typical fear for individuals and businesses alike.

However, with the growth of this market comes the need for greater security and clarity in transactions. Whether you are selling Bitcoin, Ethereum, or another cryptocurrency, having a well-drafted Cryptocurrency Sales Contract is essential to ensure that both parties are protected, and the terms of the sale are clear and legally binding.

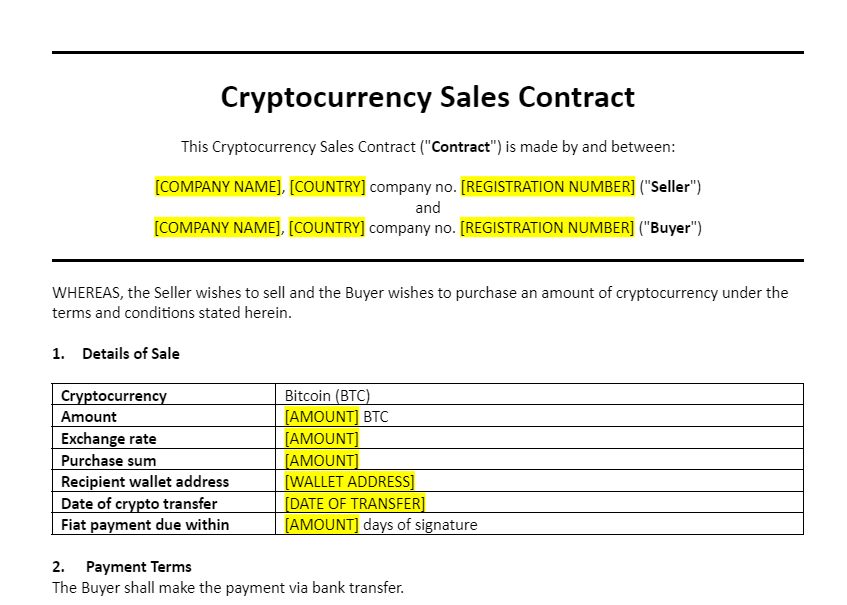

A Cryptocurrency Sales Contract outlines the conditions under which the cryptocurrency is being sold, specifying key details like the quantity of the asset, the price, the payment method, and the timing of the transaction. In today’s volatile market, these agreements provide a much-needed framework for handling price fluctuations, confirming payment methods, and ensuring compliance with local and international regulations, such as AML and KYC laws.

The entire agreement is quite useful. In the next section, we will talk about just how.

Why is a Cryptocurrency Sales Contract Necessary?

Having a Cryptocurrency Sales Contract is not just a good idea—it is absolutely necessary when it comes to buying or selling cryptocurrency. While cryptocurrency transactions are often seen as digital and decentralized, the need for legal protection remains as strong as ever. The volatility of the market, the potential for misunderstandings, and the complexity of legal compliance all make a well-drafted contract essential for anyone involved in a crypto sale.

First and foremost, a Cryptocurrency Sales Contract provides legal clarity. Without a formal agreement, there is room for confusion between the buyer and the seller regarding the specifics of the transaction. The contract specifies crucial details, such as the exact amount of cryptocurrency being sold, the agreed price, and the method of payment. These details might seem simple, but any lack of clarity can lead to disputes—especially when the value of cryptocurrency fluctuates rapidly, and deadlines or expectations are missed. A solid sales contract makes sure that both parties are aligned on these fundamental terms, which, in turn, reduces the risk of any disagreements down the line.

But that is not all. There is so much more beyond waivers and warranties.

Beyond clarity, a Cryptocurrency Sales Contract offers protections as well. Cryptocurrency transactions often involve large sums of money, and without a formal agreement, there is no guarantee that either party will follow through with their obligations. The contract serves as a safeguard to confirm that the buyer receives the agreed cryptocurrency upon payment and the seller receives the agreed payment once the transaction is complete. Without this agreement, one party may refuse to complete their side of the transaction, potentially leading to financial loss. The contract protects both the buyer and the seller to help the transaction proceed as agreed.

Regulatory compliance is another critical reason why a sales contract is necessary.

Cryptocurrency is under increasing regulatory scrutiny worldwide, and the rules governing these transactions vary from one jurisdiction to another. A Cryptocurrency Sales Contract is recommended for compliance with relevant laws, such as AML and KYC regulations. The contract can include clauses that ensure both parties are following these regulations, protecting them from potential legal issues or penalties. It is not uncommon for parties without such a contract to inadvertently violate these laws, leading to fines or legal action. Even if you are using a service provider that is facilitating a payment from, let’s say, New York to Hong Kong, you need to factor in the cross-border regulations.

Finally, a Cryptocurrency Sales Contract provides legal recourse in the event that something goes wrong. If either party fails to meet their obligations, the contract lays out the steps for resolving the issue, whether through mediation, arbitration, or legal action. This adds an additional layer of protection that provides both the buyer and seller a clear path to resolve any disputes that may arise, without resorting to lengthy and expensive court battles.

The bottom line is that such a contract is absolutely necessary in today’s world—it offers clarity, protection, regulatory compliance, and legal recourse. It ensures that the transaction is conducted securely and transparently, with all parties aware of their rights, obligations, and legal responsibilities. Without it, you are risking confusion, financial loss, and potential legal consequences.

The Ideal Crypto Sales Contract: Key Elements

A Cryptocurrency Sales Contract is only as good as the details it covers. Certain key elements need to be made certain in this contract, only then can you call your transaction clear, secure, and legally enforceable. These elements not only protect both the buyer and the seller but also provide the necessary framework to handle potential issues that may arise during the transaction. Here are the critical components that should be present in any well-drafted Cryptocurrency Sales Contract:

- Identification of Parties: The first step in any contract is to identify who is involved. In the case of a cryptocurrency sale, the contract should clearly state the legal names, addresses, and contact information of both the buyer and the seller. This makes sure that both parties are fully accountable and traceable, preventing any confusion regarding who is responsible for which obligations under the agreement. Whether the buyer and seller are individuals or businesses, their details need to be outlined clearly to establish their roles in the transaction.

- Description of the Cryptocurrency Asset: Next up, the contract should provide a detailed description of the cryptocurrency being sold. This includes the type of cryptocurrency (e.g., Bitcoin, Ethereum, Litecoin, etc.), the exact amount being sold, and the current market value at the time of the agreement. If the sale involves fractions of a coin (such as satoshis for Bitcoin), these should be specified as well. This section ensures that there is no ambiguity about what is being bought or sold and protects both parties from disputes over the type or amount of the asset.

- Transaction Terms: This section outlines the agreed-upon price for the cryptocurrency, as well as any terms that could affect the price. Whether the price is fixed or subject to change (based on market fluctuations) needs to be clearly stated as well. The agreement should also include the payment terms: the method of payment (e.g., bank transfer, cryptocurrency, or escrow service), the currency in which payment will be made, and any conditions related to the timing of the payment. Doing all this will make sure that both parties understand exactly how and when the exchange will occur. Ultimately, this helps reduce the chances of confusion or disagreement down the line.

- Payment Method: Clearly specifying the payment method is also very important. Will the buyer pay in fiat currency (USD, EUR, etc.) or cryptocurrency? If fiat currency is used, how will the payment be made? Will it be via wire transfer, PayPal, or another method? If cryptocurrency is involved, the exact coin or token should be specified. And of course, the payment method needs to be secure and agreed upon upfront—both parties need to be comfortable with how the transaction will be conducted.

- Transfer of Ownership: In cryptocurrency transactions, ownership transfer does not happen in the same way as traditional goods. The transfer of cryptocurrency is recorded on the blockchain, making it critical for the contract to specify when and how ownership of the digital asset will change hands. This section should clarify that ownership is transferred once the cryptocurrency is sent to the buyer’s wallet address. Additionally, the exact process for the transfer—whether it occurs upon receipt of payment or once the payment has cleared—should be clearly defined too.

- Representations and Warranties: This part of the contract involves both parties stating that they are legally able to enter into the agreement. The seller should confirm that they are the rightful owner of the cryptocurrency being sold and that it is free from any liens or claims. The buyer should confirm that they are legally authorized to purchase the cryptocurrency and that they are aware of the potential risks involved in the transaction. This section is more or less a formality to help pave the way for the transaction. In other words, it helps ensure that both parties are legally and financially able to proceed with the sale, offering further protection against fraud or legal complications.

- Compliance and Regulatory Considerations: With the global rise of cryptocurrency, many jurisdictions have implemented regulatory measures to combat money laundering, tax evasion, and fraud. This section of the contract should confirm that both parties agree to comply with all relevant laws and regulations, including any relevant KYC and AML requirements. It may also include provisions for reporting the transaction to tax authorities. This is important to make the sale legally compliant in some jurisdictions.

- Dispute Resolution: No one likes to think about conflicts, but the reality is that they can arise in any transaction. That is why having a dispute resolution clause in your contract is essential. This section outlines the process for resolving any disagreements that may arise between the buyer and seller. Will you go to court, or will you use arbitration or mediation? The dispute resolution clause provides a clear path for handling conflicts to minimize stress, time, and legal costs should a disagreement occur.

- Governing Law: Since cryptocurrency transactions can occur between parties in different regions or countries, it is important to specify which jurisdiction’s laws will govern the agreement. This section outlines which state or country’s laws will apply in case of any legal disputes. When they sign the contract, both parties essentially agree to a governing law and understand the legal framework they are operating within, which provides much-needed clarity in the event of a dispute.

Risks of Inadequate Crypto Sales Contracts

Often volatile, always fast—this is the world of cryptocurrencies, smart contracts, blockchain apps, decentralized finance, NFTs, and the like. Not having a proper, legally binding sales contract can open the door to a range of serious risks. While cryptocurrency transactions may seem straightforward, the reality is that the lack of a well-drafted contract can lead to costly financial losses, legal issues, and even reputational damage. Let’s break down the primary risks associated with using an inadequate crypto sales contract.

- Ambiguity in Transaction Terms: One of the biggest risks of using a poorly crafted crypto sales contract is the potential for ambiguity. Without clear and detailed terms, both the buyer and the seller may have different expectations of the transaction. For instance, the price of cryptocurrency can fluctuate rapidly, and a vague contract may leave both parties unclear about how the price is determined. Is it the price at the time of signing, or at the moment of transfer? Without specificity, either party could argue over the terms, leading to disagreements or, worse, disputes that could derail the entire transaction. A solid contract removes this risk by clearly stating how the price is fixed and what payment methods are accepted.

- Legal Non-Compliance and Regulatory Issues: As cryptocurrency continues to grow in popularity, it is increasingly subject to government regulations. Failure to comply with local and international laws—such as the aforementioned AML and KYC requirements—can lead to severe penalties for both parties involved. Without a proper contract, there is a real risk that these legal obligations will be overlooked. Many jurisdictions have specific laws regarding the sale and purchase of digital assets, and an inadequate crypto sales contract may not account for these requirements, leaving both the buyer and seller exposed to legal liabilities. A well-drafted contract will address these regulatory concerns and ensure that both parties are complying with all applicable laws, protecting them from potential fines or legal action.

- Failure to Protect Intellectual Property and Ownership Rights: Cryptocurrency, by nature, involves the transfer of digital assets that exist on the blockchain. Without a proper agreement, there is a risk that the buyer may not gain full control over the cryptocurrency being purchased. For example, there may be confusion about when the transfer of ownership occurs. Is it when the payment is made, or when the transaction is confirmed on the blockchain? What if the confirmations are too slow or the network congested? If ownership transfer is not clearly defined, there could be a situation where the seller retains control of the asset, leading to significant losses for the buyer. A solid contract should include a clear transfer of ownership clause, specifying exactly when and how ownership of the cryptocurrency will change hands, making sure that the buyer has full control once the transaction is complete.

- Disputes and Difficulties in Enforcement: Without a well-defined dispute resolution process, the parties involved in a crypto sale are at risk of being unable to resolve conflicts effectively. Whether it is a disagreement about the price, the transaction timing, or the quality of the asset, a lack of a clear framework for dispute resolution can result in expensive legal battles and drawn-out conflicts. Inadequate contracts may fail to specify how disputes should be handled or which jurisdiction’s laws will apply, leaving both parties vulnerable to prolonged litigation or arbitration. With a comprehensive contract, you make sure that there is a clear and agreed-upon process in place to resolve any issues that may arise. This helps minimize potential disruptions and legal expenses.

- Financial Loss and Fraud: The transaction could fall prey to fraud or other financial risks if the contract is inadequate. Without a clearly defined payment method or escrow service, the buyer might end up paying for the cryptocurrency but never receive it, or vice versa. There have been numerous reports of individuals falling victim to fraudulent transactions in the cryptocurrency space, especially when no legal documentation is involved. A poorly written contract that leaves key payment and transfer details unclear increases the chances of such risks. A well-crafted sales contract specifies how the payment will be made, when it is due, and when the cryptocurrency will be delivered, providing both parties with the necessary protections against fraud.

- Regulatory and Financial Penalties: One often overlooked risk is the failure to report or disclose the transaction properly, particularly in relation to tax obligations. Cryptocurrency transactions can have tax implications depending on the jurisdiction, and failing to address this in a contract can lead to unexpected tax liabilities. An inadequate contract drafted from a free, generic template may not include the necessary provisions to ensure that the transaction is properly documented or reported to tax authorities. This could expose both the buyer and seller to regulatory scrutiny or tax penalties down the line. A well-structured contract will include provisions for compliance with tax laws to help both parties avoid any regulatory fines.

- Reputational Damage: Finally, it is not too rare for parties to suffer reputation damage due to a poorly executed cryptocurrency sale. If the sale goes wrong—whether due to misunderstandings, fraud, or non-compliance—both parties risk having their names tied to a problematic transaction. This can harm business relationships and make it harder to engage in future transactions. For businesses, a failed or mishandled sale could deter future clients or investors from getting involved. A solid contract helps mitigate this risk by ensuring that both parties meet their obligations and provides a clear process for handling disputes, making it less likely that the transaction will damage either party’s reputation.

Needless to say, failing to use a proper, legally sound Cryptocurrency Sales Contract exposes both buyers and sellers to a variety of risks—financial loss, legal trouble, regulatory non-compliance, and even reputational damage. It is essential to have a clear, detailed agreement in place to protect your interests, ensure the smooth transfer of assets, and guarantee that you meet legal requirements.

That is where we can help!

FreshDox.com’s Purchase Agreement for Bitcoin, Smart Contracts, and More

We know that digital assets change hands quickly and often. That is why having a solid, legally binding Cryptocurrency Sales Contract is non-negotiable. Whether you are buying or selling Bitcoin, Ethereum, or any other cryptocurrency, securing your transaction with a professional contract can make all the difference. That is where FreshDox.com’s Cryptocurrency Sales Contract Template comes into the picture—an expertly crafted template designed to ensure your crypto transactions are secure, transparent, and legally sound.

With FreshDox.com’s template, you can say goodbye to the uncertainty and potential risks of using vague, generic agreements. Our template covers every essential aspect of a cryptocurrency sale, ensuring that both the buyer and the seller are protected at every step. From specifying the exact amount and type of cryptocurrency being sold to outlining the payment method, transfer of ownership, and even dispute resolution procedures, this contract is designed to leave no room for confusion.

What makes FreshDox.com’s Cryptocurrency Sales Contract unique is its adaptability. Whether you are dealing with a one-time transaction or a series of ongoing sales, our template is customizable to meet your needs. It ensures compliance with all relevant regulatory requirements, including AML and KYC regulations, so you can rest assured that your transaction adheres to legal standards.

Additionally, our contract template includes provisions for dispute resolution, should anything go wrong. Cryptocurrency transactions can be tricky, especially when dealing with large sums of money or international parties. With a built-in dispute resolution framework, FreshDox.com’s Crypto Sales Contract helps you handle any conflicts efficiently and without unnecessary delays.

Using FreshDox.com for your cryptocurrency sales not only protects your assets but also provides peace of mind, knowing that every detail of the transaction has been accounted for in a professionally drafted contract. Our template is designed for ease of use—simply fill in the details, make any necessary adjustments, and you are ready to go.

When you sign up for an account here, you get access to this comprehensive, customizable Cryptocurrency Sales Contract template, as well as a wide range of other legal and business document templates. No more worrying about whether your contract is thorough enough or complies with the latest regulations—FreshDox.com has you covered.

Plus, we also offer a 14-day trial period. Using this, you can explore our Basic (up to three template downloads per month) and Premium (unlimited downloads) Plans. So, wait no more! Protect your cryptocurrency transactions with FreshDox.com’s Cryptocurrency Sales Contract template. Sign up today and experience a more secure, straightforward way to handle your digital asset sales.

Popular searches:

- Cryptocurrency Sales Contract Template pdf

- Cryptocurrency Sales Contract Template sample

- Cryptocurrency Sales Contract Template download

- Cryptocurrency Sales Contract Template format

- Cryptocurrency Sales Contract Template template

- Cryptocurrency Sales Contract Template word

- Cryptocurrency Sales Contract Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews