Founder’s Agreement Template

15 Downloads

Corporate

February 17, 2025

Sayantani Dutta

When two or more people come together to start a business, there is often an assumption that everything will fall into place without any issues. Yet, not even the most complementary skill sets and mutual ambitions can clash in disagreement.

When a divergence in opinion rises to the surface, a founders’ agreement becomes an important tool to lean on and bring about a resolution between parties. This document formalizes vital aspects of the partnership to ensure that clarity, and not ambiguity, is paramount.

This legally binding document acts as an anchor in instances where the ownership structure is complex, involving partners, corporations, or limited liability companies. Although not legally required, it’s recommended by entrepreneurs through the generations to form this agreement for the interests of all parties involved in the business.

Why a Founders Agreement Matters

Drafting a founder agreement is not just a formality; it’s a foundational step that affects the direction and mission of the business.

It Aligns Owners

Documenting the terms ensures transparency. It defines roles, protects founder equity, and preserves personal relationships under the weight of entrepreneurial pressure.

It Structures Business Operations

This legal document is the basis of operational conduct from the allocation of initial capital to how fundraising situations or the dissolution of the business are handled. It serves as the guide to operations in the early stages of the newly formed business.

It Creates a Mechanism for Dispute Resolution

Conflicts need not amount to irreparable damage to founder relations. Parties can establish guidelines for arbitration or mutual written consent to avoid costly civil court proceedings.

It Reassures Investors

A founder’s agreement is a sign of professionalism and foresight when the business is looking to raise investment capital. It covers aspects like equity ownership and intellectual property rights, assuring investors.

What is a Founders Agreement?

A founder agreement lays down the guidelines for any business partnership. It defines roles, responsibilities, and compensation so founders can see their interests and duties in writing. The agreement goes further into specifics like related intellectual property and equity vesting schedules. Importantly, this document goes beyond what you’ll find in the financial statement.

While a shareholders’ agreement generally dictates the relationship between shareholders, a founder’s agreement can be specific to the dynamic within the founding team. This distinction means not all shareholders bear the same responsibility or stake in the company as founders do. How the agreement deals with critical contingencies is equally important.

Founders Agreement vs Operating Agreement

For limited liability companies, the operating agreement serves a distinct purpose. It describes the operational and financial relations among members of the LLC. A founder’s agreement is only concerned with the founders and is formed well before the company is founded. Now let’s consider the scenario when, after the formation of the company, new partners are added to the LLC.

The founders’ agreement stays specific to the role and stakes signed by the founders. Meanwhile, the operating agreement encompasses all the members, reflecting the changing structure of the liability company. For entrepreneurs who have to navigate these complexities, having clarity about the nature of these documents is key to mutual transparency.

Draft the Founders Agreement

Preparation sets the tone for clarity in discussions. Identify your personal goals and expectations from the business.

Define success.

Reflect on the values most important to you. Establish how you envision the company’s trajectory aligning with your objectives. This introspection is a great starting point for constructive dialogue with your co-founders.

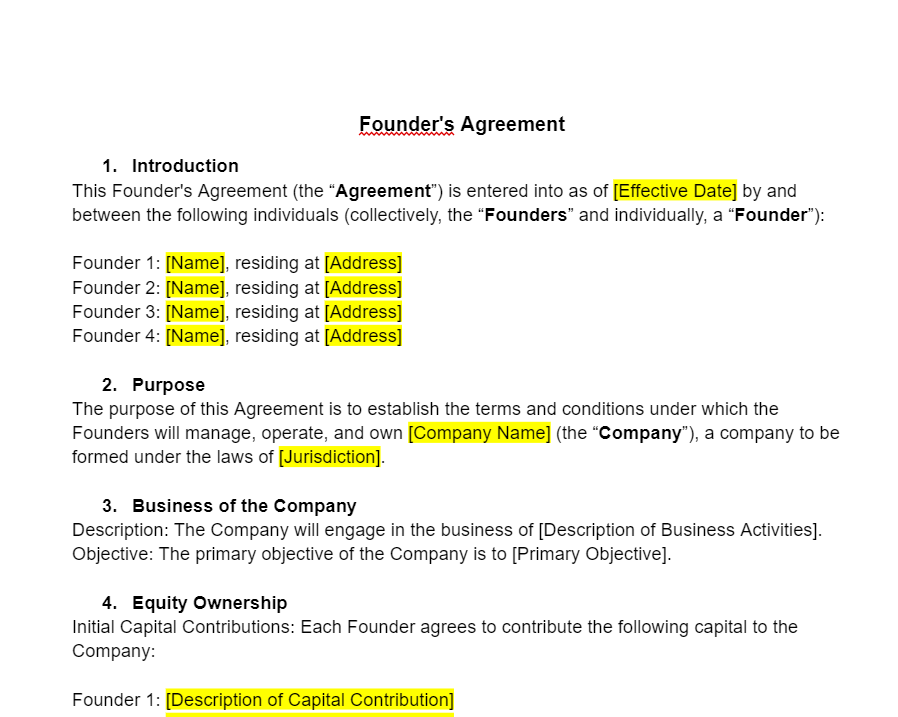

Once foundational discussions yield consensus on key points, the next step is drafting the document. Each section should capture essential details, offering both clarity and protection.

Basic Information

Include basic information such as the company name, the names of founders, and their roles. Add an overview of the business plan, mission, vision, and objectives. These elements solidify the groundwork and establish transparency.

Responsibilities and Roles

Clearly define the scope of each founder’s contributions. Assign responsibilities according to their strengths. Where skills overlap, define boundaries. For example, if two founders focus on marketing, detail responsibilities such as inbound marketing for one and outbound for the other.

Additionally, include;

- Title expectations and limitations.

- Clear role descriptions to prevent misalignment.

- A statement that addresses the fact that roles are reviewed periodically.

Decisions and Rights

Founders’ rights go beyond equity and voting. Decision-making protocols should cover everything from operational approvals to major strategic moves. Include provisions for situations such as;

- Hiring or firing key personnel.

- Removal of a founder.

- Assigning board positions.

Plan for deadlocks. Elect decision-makers and outline veto powers. Anticipate questions such as the following.

- What are the circumstances where special decision-making rights come into play?

- Who arbitrates disputes if there is an even number of founders?

- How are overrides or vetoes handled?

Equity

Dividing equity (founder’s shares) requires careful deliberation. Contributions, ideas, and financial investments all play a role in the fair division of equity. Aim for an equitable arrangement that aligns with incentives. Ask these questions.

- How much equity does each founder have?

- What is the vesting schedule, and does it accelerate upon acquisition?

- What percentage of shares is fixed versus performance-based?

This would typically be on a four-year vesting schedule with a one-year cliff. This approach aligns long-term interests and safeguards against premature exits.

Leavers

A good co-founder agreement should cover what happens if one of the founders leaves. Distinguish between voluntary and forced exits and between exits in good faith and bad faith.

Consider the following for leavers.

- Vested versus unvested shares’ fate.

- The fair market value of shares in buyout cases.

- Timing provisions for post-exit conditions.

Categorizing leavers into distinct scenarios avoids ambiguity and makes the exit process nondiscriminatory.

Commitments and Contributions

Define what each founder brings to the table, whether that be time, money, or skill. Sections to include the following.

Time commitments: Specify hours of work and days off.

Resources: Capital contributions and intellectual property rights.

Confidential Information: Include clauses related to the protection of sensitive business information.

Dissolution and Termination

Look to the future with dissolution and termination clauses. These are the clauses that deal with possible exit contingencies such as an IPO or business failure.

State conditions for;

- Handling of unvested shares and intellectual property.

- Reassigning technical knowledge and positions.

State that termination shall only be possible by mutual written consent of the founders. Also, include the nonsolicitation and non-compete clauses protecting the interests of the company.

Founder Restrictions

A co-founder agreement must have restrictions on competing ventures. Founders could be prohibited from starting competing businesses during their time in the company and for a certain time after exiting. Typical restrictions range from six to twelve months post-exit.

A Note on Transparency

Transparency regarding external business interests must be treated as non-negotiable. A clear expectation for disclosure minimizes the risks of conflicts between the startup’s objectives and a founder’s other ventures. This requirement is not a nonchalant suggestion but a necessary safeguard for aligning individual and organizational priorities.

The founders are obliged to disclose any existing or planned business enterprises with the board. Board approval must precede any pursuit or continuation of these external activities. The requirement applies equally to pre-existing commitments and future opportunities.

Transparency ensures integrity and full disclosure prevents misunderstandings. It enables the board to determine if external commitments might interfere with the founder’s ability to contribute effectively. Establishing this practice early builds trust and ensures operational alignment across all stakeholders.

Have an Attorney Review the Agreement

Lawyers analyze the document, identify ambiguities, and refine its language to make it enforceable. Every clause should be scrutinized, with every term worded to convey, without any ambiguity, the founders’ original intent for the business and their relationship.

At this stage of forming the agreement, legal advice is not optional. A founders agreement is not a mere formality between the founders but substantiates a foundation for the corporate governance of the company itself.

Lawyers review whether any of the terms pose a risk or conflict to the company. They can highlight unclear provisions that need rephrasing and address overlooked considerations. This step turns a draft into a legal document that can stand up as evidence in court.

Once revisions satisfy all parties, the agreement moves from a draft to a formally recognized contract. All parties need to understand the definitions of each clause before signing. If there are doubts, ask the attorney for an explanation.

Download a Customizable Founders Agreement Template with a Free Trial of FreshDox

Sign up for a Premium or Basic account with FreshDox and get a free 7-day trial of our platform. Download a free founders agreement template, customize it to your needs, and protect the founder’s equity shares and voting rights. Our free trial gives you full access to our catalog of professionally designed templates for business, with three downloads a week for Basic accounts and unlimited free downloads in PDF or Word for Premium accounts.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews