Irrevocable Master Fee Protection Agreement Template

20 Downloads

Commercial, Corporate

March 8, 2025

Sayantani Dutta

Irrevocable Master Fee Protection Agreement Template is a powerful legal tool that protects intermediary commissions in high-value international trade, financial transactions and brokerage deals. In a typical ICC Irrevocable Master Fee Protection Agreement (IMFPA), the buyer, the seller and the broker (or chain of intermediaries) formally agree how commissions will be calculated, paid and protected once a deal closes. This gives brokers confidence that their efforts, contacts and expertise will be rewarded, even in complex cross-border transactions.

Under an ICC-approved IMFPA structure, the Irrevocable Master Fee Protection Agreement Template ensures the seller (and/or buyer) pays a pre-agreed brokerage fee only when the transaction is successfully completed. This way, the seller does not have to invest heavy funds upfront in brokerage services, while the intermediary is still fully protected once the sale proceeds are received. Everyone operates with a clear, written understanding of commissions, timelines and responsibilities, drastically reducing scope for disputes.

The IMFPA, as recognised by the International Chamber of Commerce (ICC), acts as a professional, legally valid assurance that the business broker will receive the agreed commission once the seller verifies that the deal is completed. A well-drafted Irrevocable Master Fee Protection Agreement Template clearly safeguards the intermediary who has created the business opportunity through their network, know-how and time. Often combined with non-disclosure and non-circumvention clauses, it promotes fair sharing of profits among all signatory parties exactly as agreed.

In practical terms, the Irrevocable Master Fee Protection Agreement Template sets out the purpose of the transaction, roles of the undersigned, payment orders, bank details, fee structure, dispute resolution process and applicable law. Because everything is defined upfront in a single document, the ICC IMFPA makes high-value deals more predictable, transparent and secure for everyone involved.

Typically, an IMFPA is used in international trade for large commodity deals—such as raw materials, food ingredients, fuel, mining products or other bulk goods—where multiple brokers and mandates may be involved. The intermediary’s commission is paid after the deal is concluded, usually directly from the seller’s or buyer’s bank, based on pre-agreed instructions. The fee is commonly calculated as a fixed amount per unit or as a percentage of the total contract value, which is why the Irrevocable Master Fee Protection Agreement Template often includes full banking coordinates and paymaster details.

Because it is irrevocable, the IMFPA cannot simply be cancelled by one party once it has been duly signed. Any termination or amendment requires written consent from all signatories. This irrevocable structure is precisely what makes the Irrevocable Master Fee Protection Agreement Template so vital for brokers and intermediaries who invest effort upfront and need peace of mind that their commissions are contractually locked in.

For companies using introducers, mandates or intermediary brokers—whether domestic or international—an Irrevocable Master Fee Protection Agreement Template is not a luxury; it is a risk-management necessity. It protects the intermediary’s right to commission, supports trust-based business relationships and helps serious players stand out from unreliable counterparts in the global marketplace.

Why You Need an Irrevocable Master Fee Protection Agreement Template

The ICC Irrevocable Master Fee Protection Agreement Template is widely used in sectors such as commodities trading, mining, oil and gas, infrastructure, construction, financial services and cross-border project financing. In long-term or multi-step transactions involving numerous brokers and parties, a structured IMFPA is often the only practical way to keep everyone aligned.

By adopting a professionally drafted Irrevocable Master Fee Protection Agreement Template, all parties become fully aware of their respective obligations, rights, expectations and payment structures. This significantly reduces the risk of confusion, disputes, delayed payments, commission “disappearances” and outright fraud.

Here are some of the key advantages of using a customisable Irrevocable Master Fee Protection Agreement Template:

1. Irrevocable Contract Structure

As the name suggests, the ICC IMFPA is designed to be irrevocable. Once the Irrevocable Master Fee Protection Agreement Template is executed—whether via wet ink signatures or electronic signatures—it cannot be changed or cancelled unilaterally. Any amendments require written consent of all involved parties.

This gives brokers reassurance that even if the buyer and seller later renegotiate pricing, volume or other deal terms between themselves, the original commission obligations remain intact. In essence, the Irrevocable Master Fee Protection Agreement Template ring-fences the broker’s entitlement and recognises that they have already invested time, contacts and resources to bring the parties together.

2. Secures Payment and Bank-Level Protection

In cross-border deals, payment security is everything. Under a well-written Irrevocable Master Fee Protection Agreement Template, the buyer or seller typically provides an irrevocable payment instrument—such as an irrevocable letter of credit or bank guarantee—in favour of the intermediary or paymaster.

Once shipment or performance is confirmed, the bank executes payment orders as per the IMFPA, sending the agreed commission directly to the broker or paymaster account. This structure ensures that the intermediary receives full payment as initially agreed, even if there are commercial disagreements later between buyer and seller. For serious intermediaries, an ICC Irrevocable Master Fee Protection Agreement Template becomes a key part of their commission-protection strategy.

3. Reduces Risk, Confusion and Disputes

Because the Irrevocable Master Fee Protection Agreement Template lays out all the key details upfront—fee percentages, pay orders, roles, responsibilities, banking details—there is much less room for “creative interpretation” later. Everyone sees the same written terms, and everyone signs against the same obligations.

This clarity dramatically lowers the risk of non-payment, under-payment or last-minute circumvention. It also reduces the likelihood of lengthy legal disputes, as the IMFPA can be enforced under clearly specified governing law, typically with arbitration clauses for cross-border comfort.

Risks of Not Having an Irrevocable Master Fee Protection Agreement

Ignoring an IMFPA may seem convenient in the early stages of a deal, but in reality, it exposes intermediaries and even principals to significant risk. If you choose not to use an Irrevocable Master Fee Protection Agreement Template, you may be inviting unnecessary complications.

1. High Risk of Non-Payment

Without a written, signed IMFPA, intermediaries are dangerously exposed. In large international transactions, it is not uncommon for one party to attempt to cut out the broker once direct contact with the buyer or seller is established. When there is no ICC Irrevocable Master Fee Protection Agreement Template in place, the intermediary often has limited recourse—even if their introduction or efforts directly led to a completed transaction.

2. Lack of Transparency and Clarity

The Irrevocable Master Fee Protection Agreement Template forces everyone to put the agreed fee structure, company names, commission percentages and bank details in writing. When you operate without this structure, discussions remain vague, verbal assurances get forgotten, and expectations are not aligned. This lack of transparency can lead to mistrust and breakdown of business relationships.

3. Legal Disputes and Costly Delays

Without an ICC IMFPA or similar written contract, disagreements over who introduced whom, what commission was promised, and when it is due can easily escalate. Litigation across borders is time-consuming, expensive and uncertain. An Irrevocable Master Fee Protection Agreement Template, correctly executed, gives intermediaries a solid legal basis to enforce their rights, often through arbitration mechanisms written into the contract.

Primary Elements of an Irrevocable Master Fee Protection Agreement Template

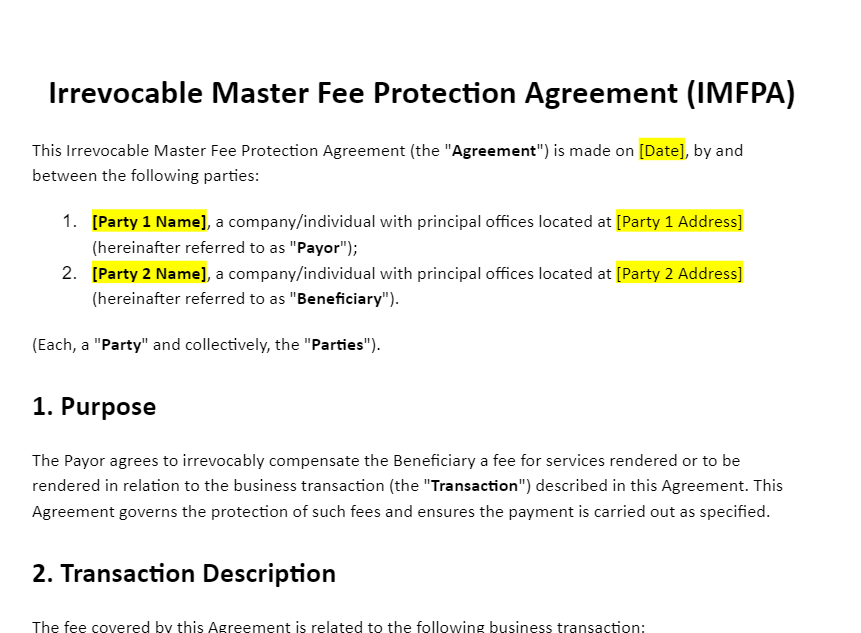

A professional ICC Irrevocable Master Fee Protection Agreement Template usually contains a number of standard sections that make it enforceable, transparent and reliable. While the exact wording may vary, the core structure tends to include the following elements:

- Parties Involved: This section clearly identifies every party to the IMFPA—buyer, seller, intermediary, paymaster and any other broker in the chain. It typically includes full legal names, company names, addresses, contact details, passport or ID numbers (where relevant), and bank details. A robust Irrevocable Master Fee Protection Agreement Template also clarifies which side (buyer or seller or both) is responsible for paying the commission, and in what share. Clear identification helps prevent impersonation, confusion and fraud.

Build Stronger Partnerships with FreshDox’s IMFPA Template

For serious intermediaries, mandates and trade facilitators, an Irrevocable Master Fee Protection Agreement Template is not just a document—it is part of their professional toolkit. It supports ethical, transparent and structured business, where brokers are recognised and rewarded for their contribution, and principals gain access to vetted counterparties through trusted networks.

However, drafting an ICC-compliant IMFPA from scratch can be complex, time-consuming and risky if you are not a legal expert. This is where FreshDox.com simplifies the process. Our professionally drafted Irrevocable Master Fee Protection Agreement Template is designed to protect intermediaries, provide clarity to principals and align with best practices in international trade documentation.

By subscribing to FreshDox, you can instantly access a curated library of business and legal templates—including the Irrevocable Master Fee Protection Agreement Template, Non-Circumvention and Non-Disclosure Agreement (NCND), commission agreements, brokerage contracts and more.

With our Basic Membership, you can download up to three templates each month, while Premium Members enjoy unlimited downloads—ideal for brokers, mandates, legal professionals and trading firms handling multiple deals. All templates are available in both Word and PDF formats for easy editing, branding and sharing.

Our platform is built for hassle-free customisation, so you can adapt the Irrevocable Master Fee Protection Agreement Template to different products, transaction sizes and counterparties while maintaining a consistent structure. A clean, intuitive interface helps you generate multiple contracts quickly without losing control over legal language and formatting.

Register at FreshDox.com today to secure your commissions, protect your legal rights and bring more professionalism to your international trade deals with our expertly crafted Irrevocable Master Fee Protection Agreement Template. Sign up now, explore our library with a 14-day trial, and make your brokerage relationships more transparent, structured and secure.

Popular searches:

- Irrevocable Master Fee Protection Agreement Template pdf

- Irrevocable Master Fee Protection Agreement Template sample

- Irrevocable Master Fee Protection Agreement Template download

- Irrevocable Master Fee Protection Agreement Template format

- Irrevocable Master Fee Protection Agreement Template template

- Irrevocable Master Fee Protection Agreement Template word

- Irrevocable Master Fee Protection Agreement Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews