Last Will and Testament Template

5 Downloads

Family and Inheritance

December 8, 2024

Sayantani Dutta

No one likes to sit down and contemplate their mortality. Understanding that we’ll all eventually leave this world has a different effect on everyone who dwells on the thought. Some have a hard time coping with it, so they brush off thinking about it. Others meet it head-on and plan for a future where they won’t be around.

Don’t be the person who shies away from planning for the day when you shed this mortal coil. Your last will and testament is a legal document everyone needs to work out before they pass on. It’s an essential estate planning tool, and whether you have millions in the bank or you’re just the average American homeowner, you need a will if you want your assets distributed to your loved ones when you pass.

Without a last will and testament in place, the government will take ownership of your assets and possessions and liquidate them. The money raised from the firesale liquidation will be pennies on the dollar, and there’s a good chance your family won’t see a dime in it. Don’t let that happen to your loved one. They don’t need the hassle of trying to manage winding up your estate while dealing with the pain of losing you. Be prepared and have your will ready for unexpected life circumstances when they show up.

Understanding the Legality of Your Last Will and Testament

You don’t need a lawyer to write up your last will and testament to make it an official legal document. So whether you’re in Florida, Ohio, or Texas, you can form your will without going to the expense of hiring an attorney to handle it for you and make it a legally enforceable document.

What you do want is a document that clearly outlines how to allocate your estate and the assets you’ve worked for all your life. You want the right people to get the right assets, and your will takes care of the specifics of distributing your estate to your loved ones.

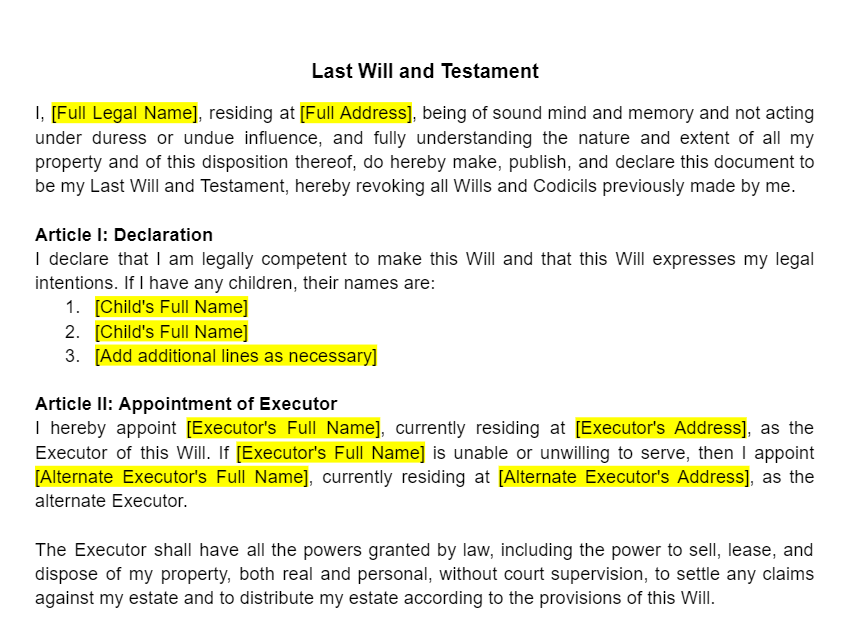

At FreshDox, we have a fully customizable template to help you with the task. But before you download it and start preparing your will, let’s walk you through what you need to know about the specifics of the last will and testament.

Listing the Beneficiaries to Your Estate

Nominating the beneficiaries of your estate is the first task involved in drafting your last will and testament. Who are the beneficiaries? They’re the people you leave your estate to. Your immediate and extended family are the primary beneficiaries of your estate, and you’ll need to list them in your will and mention what you’re leaving them.

Who gets your life insurance payout, and who are you leaving your tangible personal property to?

It’s important that, in some cases, your executor might be responsible for paying your debts from your estate. For instance, if you have a mortgage on your home, the executor will sell the property and settle the bank before giving your family the rest of the proceeds from the sale.

You might have special conditions for your executor to distribute your estate.

For instance, you might leave your home to your daughter and your business to your son. Or you might decide to liquidate your assets and give your family members equal shares of your estate. You’ll also need to add provisions for distributing your personal property, like your jewelry and sentimental items that you want people to have.

High-net-worth individuals will also list the philanthropic nonprofit organizations and charitable organizations to which they want to leave money or assets. These bequests can apply to your personal property and assets or your business dealings. You’ll need to be as specific as possible when outlining who gets what with your asset distribution and allocation to avoid disputes between the beneficiaries when the executor reads the will.

Designating the Executor of Your Estate

Don’t make the mistake of appointing a family member as the executor of your estate. Millions of people do this, and their family ends up paying for the decision when winding up their estate. A personal representative like a family member doesn’t have the legal experience to jump through the loopholes of the probate process in probate court.

They don’t know anything about state laws or the differences between a last will and testament, a living will, and a living trust. That’s going to hurt the family because it adds a considerable amount of time to the winding-up process. It might mean they’re left

Designate the responsibility of the executor to a law firm and let an attorney sort out the specifics of winding up your estate. After giving them power of attorney, they have the fiduciary duty of paying estate tax, winding up their real estate and businesses, and closing their bank accounts. Financial planners can recommend legal counsel for this purpose, and some attorneys specialize in estate planning services.

Professional executors like attorneys charge a fee for their services, but they’ll take a percentage out of your estate, and you won’t need to pay anything upfront for their professional estate planning and legal advice.

It might cost you a few dollars on the back end, but it’s reasonable compensation for the time and money it saves your family when they’re grieving your loss.

Nominating Legal Guardians for Your Kids

The last will and testament spell out what you want to happen to your dependents if they’re left without a parent in their lives.

The last will and testament also serve as a continuance of parentship for your minor children when you pass. Your will should entrust your executor to pass legal guardianship for children under 18 years of age to a nominated party. Obviously, finding the right legal guardian for your kids isn’t something you should take lightly, and extensive due diligence is required on prospective guardians.

You want to appoint a legal guardian who embraces the same values and parenting philosophy as you. You need someone with a strong character who you can trust to give your kids the opportunities they need in life to make something of themselves. The primary goal of choosing a legal guardian is to select the best candidate who promises to give your kids a stable home.

Things can change over time, so it’s a good idea to keep a secondary legal guardian waiting in the wings. If your will leaves your estate to your kids and they’re under 18, arrange to have the asset put in a trust until they meet specific criteria, such as turning 25 years old or graduating college.

There’s a chance the court may challenge your choice of legal guardian. If the kids have to uproot their lives to move to another state to live under the guardian’s care, it may cause concern with the courts. Another person might request guardianship, and you’ll need to provide motivation in your will that convinces the court to go with your initial request.

What Are Your Final Wishes?

With your assets and personal property properly distributed, it’s time to move on to listing your final wishes. What do you want your family to do with your remains? Mention if you want your family to hold a conventional funeral and burial or if you want them to cremate you and spread your ashes to the wind in a special location. Use the opportunity to leave a final message for your children and spouse and give them something to remember you by.

Do You Need a Notary Public to Witness the Signing?

No, it’s not a requirement to get your last will and testament notarized. Notarizing the document also proves that you were in sound mind when you drafted it and not under duress from a third party.

Then again, notarization might not be the right move. If you need to make changes to the document, you’ll need the notary public to witness any addendums to the agreement, and it might be a hassle to get over to their office for a minor change.

Changing Your Last Will and Testament

The only thing we can guarantee in life is change. You’ll need to update your will to keep it current. If you get divorced and remarried or welcome a new child into the world, you’ll need to update your will to reflect your new life circumstances.

Fortunately, if you have a template of your will saved on your computer, you can make the changes you need, download the document, and sign it, and you’ll be up to date with your estate planning responsibilities. Or you can make additions to your will by adding “codicils” that amend the initial document. When you snake these changes, it nullifies all previous wills.

Customize and Download the FreshDox Last Will and Testament Template

Writing your last will and testament might not sound like a fun Sunday afternoon activity, but it’s a necessity for your estate planning and something you can’t afford to procrastinate on. Fortunately, you can take action to secure your estate right now.

Just sign up for a 7-day trial of a Premium or Basic account with FreshDox, and you’ll get access to our last will and testament template in Word and PDF formats. Download it, customize it to your requirements, and you have the biggest task in your estate planning finished.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews