LLC Operating Agreement Template

9 Downloads

Client, Vendor & Commercial Agreements, Company Formation & Governance Documents

December 12, 2024

FreshDox

LLCs are one of the best forms of company structures. They are especially an excellent option for small businesses that want liability protection and to save money. LLCs protect the personal assets of the owners in the event of a lawsuit or financial damages. Creating a comprehensive LLC Operating Agreement is fundamental to the smooth operation as well as the legal safeguarding of a Limited Liability Company, or LLC.

A template for an LLC Operating Agreement is the skeleton that outlines the business structure, defines member roles, and details the operational processes. The job of your LLC is to ensure clarity and consensus among members.

Today, we are going to talk about the necessity of an LLC Operating Agreement, its many benefits, and the potential risks for any business that is operating without a solid agreement. We will also introduce you to the sophisticated solution provided by FreshDox.com’s LLC Operating Agreement that is 100% ready for customization! So, without further ado, let’s dive right into it.

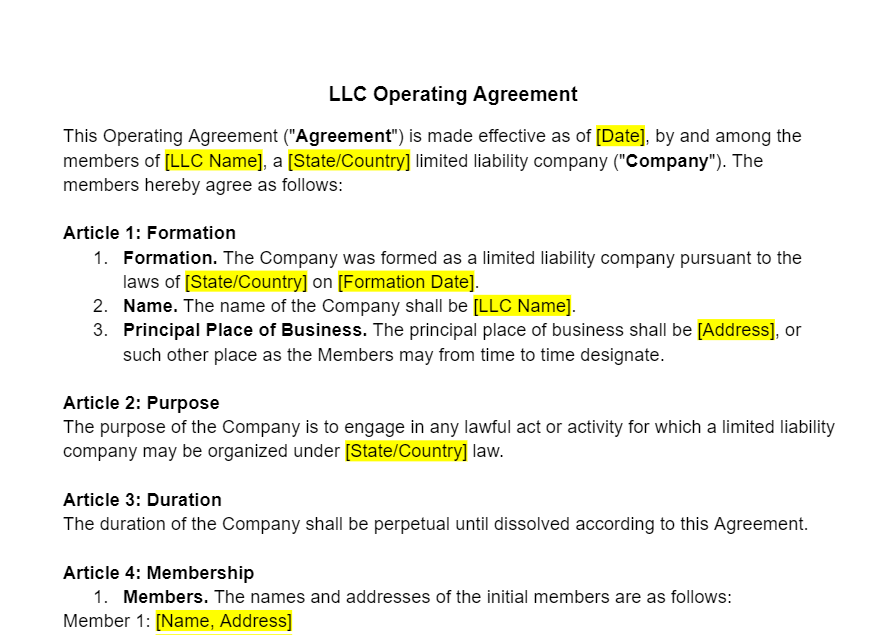

What is an LLC Operating Agreement Template?

The LLC Operating Agreement is a legal document that outlines the structure, capital contributions, ownership interests, articles of organization, and so much more for a company. A template for such an agreement is a customizable document used by LLCs to specify the financial and working relationships among business owners (members) and managers.

The document, as a result of this template, will often encompass various things—ranging from the provisions for the distribution of profits and losses to the procedures for adding and removing members. State laws play a vital role here, as do the form of LLC. For example, a multi-member LLC in California will be significantly different in its structure and terms than a single-member LLC in Delaware or New York. As such, it is important that the template you are using is customizable enough to fit multiple use cases.

The allocation of managerial rights and responsibilities is also covered in detail within this document, making it pivotal in establishing clear guidelines and expectations so that any misunderstandings and disputes (among members) can be prevented.

Why Use an LLC Operating Agreement?

The short answer? Because you are legally bound to have one in place before starting an LLC. The long answer is a little complex. The LLC has many benefits. Whether it concerns new members who are just starting an LLC for the first time or long-time business owners who are starting a new company—the LLC Operating Agreement is single-handedly the most crucial piece of document to share company assets, voting rights, and financial obligations, among other things.

A business entity (LLC in this case) needs a legal foundation to avoid internal disputes. Also, the IRS would rather you have one in place.

As such, it is safe to say that the LLC Operating Agreement is very important. It is the bedrock on which your business’s whole legal and operational structure rests. It reinforces the LLC’s status as a separate entity, protects members’ personal assets from business liabilities, and allows for the customization of profit shares, management, and operational roles.

What’s more, the LLC Operating Agreement is the tool that will, on behalf of the company as an entity, specify the various member-managed and manager-managed roles and responsibilities so the company can function efficiently.

The document is quite adaptable—and as such, allows the business to operate optimally and in line with the members’ objectives. It also makes sure that your business can operate beyond the default state regulations, which may not always align with your business needs.

Consequences of Not Having a Good LLC Operating Agreement Template

So, what happens if you hit the road (start an LLC) without first having an LLC Operating Agreement? The nightmare of personal liability, income tax, and any member’s interest aside, there will be all sorts of troubles. There will be no indemnification against losses, no recourse in case of liquidation, and no member of the company will be able to function efficiently, in a nutshell.

Without a detailed LLC Operating Agreement, a business risks great operational inefficiencies. Worse yet, member disputes down the line (due to the reliance on broad state laws for governance) can also arise. It is also generally better to have an LLC Operating Agreement for tax purposes and if you have plans to onboard additional members to the manager and membership teams.

State laws may not reflect the unique structure and preferences of your LLC company. This can easily lead to potential conflicts over profit distribution and responsibilities, for example. Additionally, the absence of a formal agreement might also compromise the legal distinction between the LLC and its members. This, in turn, endangers personal asset protection in legal disputes.

The business of the company should wholly be a concern of the business itself, as a separate entity. And it is very important for this separate entity to have a foundation as per its unique requirements, the industry, and the priorities of the members—for which, having an LLC with clearly outlined terms in place is crucial.

Key Elements of an LLC Operating Agreement

Now that you understand the importance of having an LLC, let’s take a look at what such a legal document actually needs to do everything from protecting membership interests, streamlining tax returns, and helping in the arbitration to paving the way for unanimous consent in matters of serious risk and the division/use of assets such as the real estate owned by the company.

A comprehensive LLC Operating Agreement begins with the member details. It outlines the names and ownership percentages of all members. As compared to, let’s say, a sole proprietorship, there are several members in an LLC company. As such, the day-to-day operations of all the members and their initial capital contributions should be clarified.

Next, the LLC Operating Agreement will also contain the management structure. This specifies whether the LLC is member-managed or manager-managed. As per the laws of the state and the Limited Liability Company Act, this has to be defined so that it is clear who has the majority vote, how decision-making is carried out, which members of the LLC have which responsibilities, what the principal place of business is, and so on.

The LLC also outlines the initial contributions, of course. Each member’s financial investment in the LLC has to be clearly outlined and understood by all other members or managers. It is the member contributions outlined here that will save you from legal disputes down the line.

Furthermore, make sure that the Operating Agreement has all the necessary information about the company itself—starting right from the name of the company, the certificate of formation, and the business purpose under the governing law to any bank account or other assets that will be managed in a shared capacity by the company.

That pretty much covers the essentials of an LLC Operating Agreement. Once you have all that in the document, with specifics and details, you have a sound document. The provisions of this agreement will save you expenses and time in case of any dispute by completely avoiding them, and help you keep your focus on the purpose of the company, not technicalities and legalities.

But there are a few more considerations here.

For once, you need to clarify the profit and loss distribution among the members. The Operating Agreement should also include the information about the voting rights and decisions. This means that you will be defining the process of making business decisions and voting powers—who can veto, who has the final say, which matters need a majority vote, and so on.

Clauses for membership changes, such as the procedure for adding or removing members and the suggested process for transferring ownership rights to avoid problems, should also be present in the LLC Operating Agreement.

Lastly, the agreement also needs to talk about dissolution—as distasteful as that topic sounds. There should be clear, well-thought-out guidelines on how the LLC will be dissolved and its assets distributed.

FreshDox.com’s LLC Operating Agreement Template

You need a comprehensive and customizable LLC Operating Agreement Template to succeed here, given the complexities of LLC management. The document needs to be robust and ensure that all members are on the same page. That is where FreshDox.com comes into the picture.

Here at FreshDox.com, we offer a dependable solution to business owners with our professionally designed LLC Operating Agreement Template. It is tailored to meet the specific needs of your LLC, covering all essential aspects of your business operations—from financial arrangements to member duties and dispute resolution mechanisms. A well-managed LLC is a successful LLC, and a free LLC Operating Agreement from the Internet might not be adequate for your purposes.

Subscribing to FreshDox.com provides access to an extensive library of legal document templates, including the LLC Operating Agreement Template. Our platform offers a 14-day trial period, which you can use to discover the many benefits of our plans. We have two plans to cover multiple use cases—the Basic Plan gives you access to up to three downloadable templates a month, and the Premium Plan has unlimited access to all of our legal and business document templates available in PDF and Word formats!

With FreshDox.com’s LLC Operating Agreement Template, anyone can ensure that their LLC is structured to thrive—with clear rules that safeguard the company’s operations and protect individual interests. So, don’t wait any longer! Avoid the pitfalls of operating without a comprehensive, legally sound agreement today by signing up for FreshDox.com. With our expertly crafted template, you too can establish a strong foundation for your LLC.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Start your 7-day free trial and access professionally drafted legal documents built for business use.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews