Loan Agreement Template

8 Downloads

Money and Finances

December 8, 2024

Sayantani Dutta

The golden rule of loaning money, even if it’s between a family member or friend, is to “get it in writing.” A personal loan agreement is a binding contract between a lender and a borrower, fleshing out the obligations both parties have to each other on each side of the deal.

Student loans, real estate loans, and trade agreements can be complex documents with many provisions and clauses. Essentially, they are heavy-weight documents with complex terms and conditions. The basic loan agreement doesn’t typically go into as great detail in the T&Cs, and it’s usually for much lower principal amounts. They’re more suited to situations where the parties have some sort of relationship, such as being family or friends.

The loan agreement is a legally binding document and stands as evidence of the transaction and financial liability in a court of law. So, if either party defaults on the loan obligations laid out in the contract, there are legal consequences attached to those actions. Most personal loans between friends are “unsecured loans.” That means there’s no collateral backing up the loan and more risk for the lender. In some instances, friends may post collateral for the loan with the lender making it a secured loan.

For instance, Jim might decide to post his boat as collateral for a $10,000 loan from John. He agrees to write into the T&Cs of the loan that John has the right to sell the boat if he defaults on payments. Jim might agree to the loan and the potential sale of his boat, but he might write in a clause saying that any additional money raised from the sale of the boat will be returned to him either in cash or by EFT to his bank account.

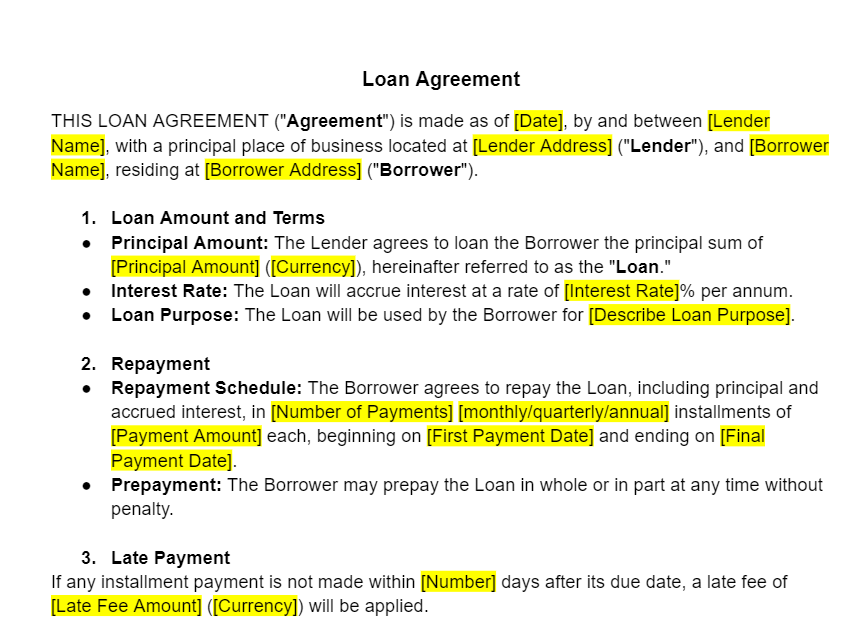

The other basic terms of a loan and the information you’ll find in these legal documents include information on the lender and borrower, the loan amount, fees and interest rate, as well as the repayment schedule.

Banks and other short-term credit lenders, like payday lenders, also offer personal loans. These lenders are great for access to instant cash, but they often charge extortionate interest rates, and you have next to zero flexibility on the loan terms and conditions.

These institutional lenders and businesses use a fixed personal loan template, and you either consent to take the loan under these terms or you don’t get approval. When you’re borrowing money from people you know, they’ll give you more room in the terms of the deal, such as the interest they charge you and how long you have to repay the loan.

Loan Agreement Vs. Promissory Note: Understanding the Differences

A promissory note is like an IOU. It’s a written, signed acknowledgment of a financial obligation to another party. The difference between the two contracts is that both the lender and the borrower sign the loan agreement, and only one signs the promissory note.

The Corporations Act 2001 states that promissory notes with extensive clauses and complicated terms and conditions may require a contract lawyer to write up the agreement.

What Information Do You Include in a Loan Agreement?

Title

The title is usually “Personal Loan Agreement,” but “Loan Agreement” will usually suffice.

Dates

The date the borrower offers the loan to the buyer and the expected date of the first payment on the loan.

Parties

The full names of the lender and borrower. You’ll also need to include the names of any guarantor to the loan, such as a co-signer.

Loan Amount

The lender must note the total amount of the loan, including the principal amount and the total amount with the interest expected to be paid on the principal. Include the final payment due date and the monthly or weekly installment amount.

Loan Term

Outline the specifics of the payment schedule and repayment terms to include the number of payments the borrower makes to settle the loan. Are they going to repay the lender with weekly or monthly payments, and on what date or day of the week or month will they pay? This section might also include a grace period for late periods, such as 48 hours, where the borrower can make their payment without incurring late fee penalties. This heading can include the rules around early payment of the loan in a lump sum.

Interest Rate

If the borrower is charging interest on the loan, mention the annual percentage rate (APR) charged on the money and the accrued interest rate. What’s important is that the interest rate isn’t “predatory.” It should be reasonable and in line with industry standards.

Collateral

Any assets pledged by the borrower to the lender to secure the loan and terms on what the lender can do with the assets to recover their money.

Cancelation Policy (Right of Rescission)

Can the borrower cancel the loan within a specific time after signing it?

Default Provisions

What happens if the borrower defaults? What recourse does the lender have if the borrower fails to meet their obligations to repay the loan? If you’re loaning a serious amount of money to someone, make sure you take legal advice on how to structure the loan agreement, especially with regard to this section of the document.

Penalties

Any late fees charged for tardy payments.

Jurisdiction

The county, city, and state where the borrower and lender sign the contract.

Severability Clause

This portion of the agreement ensures the rest of the agreement remains intact if sections of the document are deemed unenforceable or illegal.

Entire Agreement Clause

One of the most important covenants shows assets and dealings not included in the loan contract and how they’re indemnified from this loan agreement.

Warranties

The borrower promises to furnish the lender with accurate information regarding the details included in the loan application.

Waiver

Conditions surrounding the borrower being relieved of their responsibility to repay any remaining amounts due on the loan.

Signatures of Parties and Witnesses

The borrower and lender sign and date the agreement. Witnesses sign below the borrower and lender. As an extra precaution, the borrower and lender can initial each page.

Does a Notary Public Need to Witness the Loan?

No, there is no legal requirement to have a loan agreement notarized. However, many lenders in the institutional sector will opt to notarize the documents and send you an official copy for your records. It’s a further protection they have when chasing you in case of a default on the loan terms.

Download a Loan Agreement Template from FreshDox

Sign up for our 7-day trial of a Basic or Premium account with no obligation to take a subscription. Customize our library of legal, financial, and professional templates for immediate download to your device in Word or PDF. FreshDox.com gives you the templates you need to lay solid foundations for transparency in your loan agreement.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews