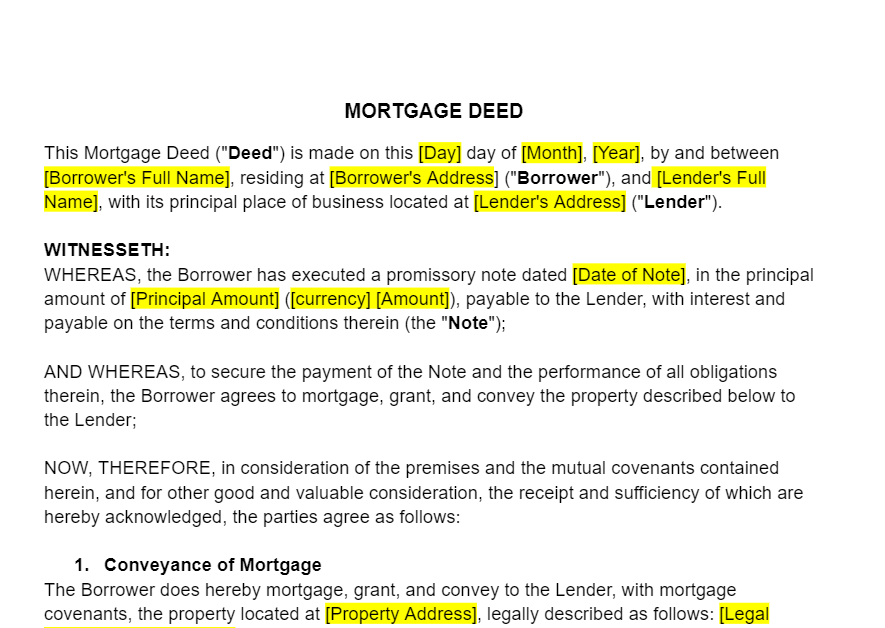

Mortgage Deed Template

8 Downloads

Real Estate

January 11, 2025

Sayantani Dutta

A mortgage deed is a mortgage agreement that secures a loan against property, binding the mortgagor and lender in a legal document. It is a security instrument that gives the lender legal rights to the ownership of the house in case the loan is not repaid.

When you take out a mortgage, the lender places a charge on your mortgaged property, ensuring the loan remains payable under the conditions of the loan. This gives them a legal right to sell the property in case of failure to pay on time, providing a risk-mitigation strategy that protects their investment.

This is also where all terms, including the principal amount, security interest, and any warranty, are well defined to ensure clarity and protect liabilities. A mortgage offer is an assurance from the lender on the amount they are willing to lend and under what terms; hence, this offer is a formal agreement in the form of a deed. The borrower pledges to the terms on signing and gives authority to the lender’s claim over the property in the event of default.

In states like California and New York, the function of a mortgage deed may be modified. Whereas California generally depends on deeds of trust, involving three parties: the borrower, lender, and trustee, New York depends on mortgage deeds.

Another difference between the two relates to the foreclosure process. While usually, mortgage deeds are subject to judicial foreclosures, a deed of trust allows for non-judicial foreclosures and hence makes the process of foreclosure and recovery easy for the lender. The title deed shows the ownership of a property. If you’re not certain where your title document is then the Land Registry or its equivalent can help you request a new one.

Understanding these distinctions not only protects your interests but also gives you clarity as you move through the financial intricacies of property ownership and loan management.

Mortgage Deeds as Security Instruments

Unlike a promissory note, which is an instrument of the borrower’s personal acknowledgment of their obligation to repay and, as such, requires only their signature, a mortgage deed involves all parties to the transaction, both borrower and lender, where the real property is used as security in the said loan.

A simple mortgage deed gives the lender certain rights in case of default by the borrower, including the ability to recover the principal sum, reasonable attorney’s fees, and any additional security.

Included is the right to sell the property to cover the outstanding balance of the loan owed to the lender. This legal mechanism serves to protect both the lender’s investment and the borrower’s obligations. This right is executed only when the deed in question is recorded with the relevant authorities and the public record.

In the case of a mortgage by deposit, the title deed of the property is delivered to the lender as security against the loan. This process, however, is unlike an outright mortgage and is not documented in any written papers or registration.

The borrowers deposit the title deed of their immovable property with a bank, which pledges the property as collateral without any formal legal processes. This security instrument is an easy and inexpensive way of raising cash.

The Components of a Mortgage Deed

The agreement gives a broader view of the loan and provides clarity between the parties obligations.

The contract is usually a short document, one or two pages, and contains an identifying reference number that connects it to the particular property being mortgaged.

Deed and Property Description

The deed clearly states the purpose of the contract and its timeline. In this regard, it states the effective date when the agreement takes effect; the date the agreement was signed, and the date when this deed was duly recorded with the appropriate recording authority. This information allows the mortgage deed to be considered legally binding in court and to relate it to a specific financial transaction. The deed description sets up the basis upon which the rest of the document is developed.

Parties

The name of the borrower (the Mortgager) and their address are mentioned in the mortgage deed along with details of the lender who will be referred to as the Mortgagee herein.

Property Description

The property description contains the street address and all other identifiers of the property pledged as security. Other than its physical location, this section could provide a legal description, including property boundaries and GPS coordinates.

Loan Amount and Terms

The amount lent to the mortgager is mentioned in the mortgage deed along with the time and way in which the principal should be returned along with interest, if any. This paragraph may contain a repayment schedule, such as weekly, monthly, or quarterly installments, or another mutually agreed-upon period. It will also contain any fines issued for late repayments or early repayment terms if the mortgager settles before the due date of the last payment.

Covenants

A covenant is a contractual condition tied to the property and details specific restrictions or obligations concerning its use. Conditions can include maintaining a public footpath, not building in certain areas, or being compliant with applicable law. Covenants are legally binding and serve to protect property integrity and the interests of the parties involved. They can also include assessments or other encumbrances that could affect the value or use of the property.

Clauses

These clauses ensure the integrity of the loan agreement and clarity in the relations between borrowers and lenders.

Due-on-sale clause: This is a situation whereby on the eventual sale or transfer of such property to a third party, the borrower is required to repay this loan in full. The whole idea behind such is to ensure settlement of the loan before ownership of such asset changes hands.

Acceleration Clause: This is a clause that allows the lender to accelerate, otherwise known as “demand in full” if the borrower defaults on the mortgage by failing to make payments or violating other conditions that may have been agreed upon.

Possession

These provisions detail the responsibility for upkeeping the property as mentioned in the contract. The eligibility criteria for home loans should be judged using a home loan eligibility calculator before applying for the facility. This gives the mortgager a proper picture of the qualification criteria, interest rate (APR), and monthly installment they’ll have to pay, making it easier to prepare for the financial implications of servicing the debt. Since eligibility criteria vary from bank to bank, check the terms before applying.

Signatures and Notarization

Signing means that both parties confirm their mutual agreement to the conditions within the deed. In most jurisdictions, signing in front of a notary public or other legal officer who verifies the signatures with their seal ensures the deed holds legal validity. This seals the agreement and registers the real estate as collateral for the loan.

Taxes and Insurance

The mortgage deed may provide that the borrower shall bear the cost of insurance of the property to safeguard the interests of the mortgagee against damage. He may also be required to pay real estate taxes, which will keep the property free of liens against it that would affect the rights of the lender. These requirements protect the lender’s investment while preserving the financial and physical integrity of the property.

What to Consider Before Signing Your Mortgage Deed

A mortgage deed is a more common financial vehicle for borrowing, but it is not something to be treated lightly. Any document that binds you to a long-term financial commitment requires due care in its review. Conditions might be overlooked, leading to unexpected issues, and therefore this step must not be performed with negligence.

Check everything is accurate before you sign. Check all the key information about the price of the property, the valuation, and the spelling of your name. The terms and conditions should be carefully checked to ensure they reflect the original mortgage offer.

Lenders expect a question or two, so ask anything that puzzles you before signing on the dotted line. The time spent now sorting out any misgivings will save you a headache later on.

Choosing a Witness

The execution of a mortgage deed follows specific rules as to who can witness it. The witness cannot be a family member and has to be over 18; also, they should have no beneficial interest in the property—meaning they won’t reside in the home. Possible people to ask are professionals such as attorneys, colleagues, or neighbors.

If you are having trouble finding someone qualified to witness your signature, most contract lawyers will perform this function for a small fee. Remember, a deed with an invalid witness will not be accepted by the lender because it is not legally valid. Most deeds also require a “wet” signature, meaning they must be signed in person with pen and paper, though digital options may apply in limited circumstances.

Receipt and Return of Mortgage Deed

Normally, your mortgage deed is sent to you by your lender or lawyer for review and signature. Once signed, it should be returned as soon as possible to avoid any delays in its processing. Proper execution of the deed, including witnessing, makes the deed valid and takes you one step further toward completing your transaction.

What Happens After Signing?

The last steps in the process involve some important milestones that bring you closer to the completion of your property transaction. You pay the deposit through your lawyer, then you exchange contracts with the lender whereby both parties become legally bound in the sale. Finally, you choose a completion date that is mutually agreed upon.

Note: Refinancing may involve the execution of a new deed to supplement the original while the revised agreements are registered in the Land Registry.

What are the Ramifications of Mortgage Deed Default?

Defaulting on a mortgage loan has serious financial and personal consequences. If no mutual agreement is reached with the lender, the result, in most instances, is foreclosure. In this course of action, the lender repossesses and then sells the property to claim the outstanding balance.

The repercussions do not stop with losing your house but go deeper. It could wreck your credit, cost you future housing opportunities, and damage your overall financial stability.

Waiting Periods to Qualify for a New Mortgage

Waiting periods to obtain a new mortgage after foreclosure depend on the type of loan.

Conventional Loan: The waiting period, under normal circumstances, is seven years, but in instances of extenuating circumstances, it is two years.

FHA or USDA Loan: These are government-backed loans, and the minimum waiting period is three years but may be exempt in cases of hardship.

VA Loan: The Department of Veterans Affairs guaranteed loans usually have a two-year waiting period, but there are some exceptions to this rule.

Mortgage Deed Default vs. Foreclosure

In case of the borrower being in arrears by 30 days, a notice of default can be issued by the lender. This gives ample opportunity for the borrower to try and make amends regarding the missed payments.

In the event of no resolution, the lending party can exercise its right to “power of sale” and then foreclose once six months have passed.

A distinction has to be drawn between “default” and “foreclosure.” While the former indicates some urgency that calls for an immediate corrective measure, the latter is essentially the legal process for recovering an investment made through a lender.

Download a Customizable Mortgage Deed Template from FreshDox

Don’t leave anything to chance. Download a customizable mortgage deed template from FreshDox with a free 7-day trial of our platform. Basic accounts get three free downloads and there are no limits on a Premium account. Browse our catalog of professionally designed templates for business, edit them to your requirements, and download them in PDF or Word format.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews