Options Agreement Template

10 Downloads

Client, Vendor & Commercial Agreements, Company Formation & Governance Documents, Finance, Loans & Payment Agreements

February 17, 2025

FreshDox

Equity compensation plans compensate employees financially with the issuance of shares of common stock. These plans, including employee stock options (stock options agreement), are tools that help align employees’ goals with the growth of the company.

The grant of options on stock is usually based on an incentive plan, wherein the holders are incentivized to make contributions towards the success of the company. The shares represent more than financial gain to the employee; they represent their commitment and interest in the company’s trajectory.

Types of Employee Stock Options

There are two types of stock options agreements for employee compensation plans available under the applicable laws.

Incentive stock options, usually granted to key employees and executives, are given preferential tax treatment under the law if certain conditions are met. Gains from ISOs, when held long enough, qualify as long-term capital gains under the securities laws.

Non-qualified stock options, or non-statutory stock options, are different with regard to taxation. These options can be offered to employees, consultants, and board of members, and profits are taxed as ordinary income according to the laws of the state.

Other nuances for taxation of stock options schemes are provided by the governing law of the jurisdiction.

Stock Option Contracts for Startups

Stock options agreements are a common feature in compensation packages startups offer their employees, using the value of these shares as a mechanism to attract and retain talent.

The exercise of the option, of course, depends on the fulfillment of the vesting criteria that give employees a chance to share in the growth of the company. The conditions of this agreement usually outline the terms of vesting and exercising the options.

If an employee were to leave the firm before such a time when the options are vested, they’ll generally forfeit those options. Stock options agreements are not accompanied by dividends and voting rights, aligning them with their intended purpose as a long-term incentive rather than an immediate benefit.

Benefits to Employees and Employers

Stock options agreements provide employees with unique money-making opportunities. Employees can purchase shares through a notice of exercise at a discounted price and realize the appreciated value of their shares as profits.

The incentive brings financial benefits and pride in ownership to the employee experience. This term agreement clarifies their rights and responsibilities so employees understand the future value of their stake in the company.

Equity compensation is a tool for employers. It helps with acquiring the best available talent, and incentivizing performance.

Important Concepts in Equity Compensation

In the case of stock options agreements, there are two major parties concerned: the grantor and the grantee. The grant of option under the governing law of the incentive plan is provided by the grantor, or the company specified in the agreement.

Such shares are granted to a grantee—usually an executive or employee—who receives the shares subject to covenants such as vesting schedules and performance benchmarks.

The vesting schedule, established at the time of grant, requires employees to meet certain specified conditions before full ownership of all underlying shares is vested.

Vesting: Time and Other Conditions

The vesting concept means that options can only be exercised after certain conditions have been satisfied under the provision of this agreement. The whole vesting period is spread over a number of years, basically encouraging the continuing commitment of the employee.

While the option can be exercised by employees upon the fulfillment of vesting requirements, restrictions may limit immediate liquidity. For instance, some agreements block the selling of shares immediately after exercising options to protect the interests of the company.

Review and Negotiation

Employers must closely consider the plan for offering this incentive and the template for option agreements used in the transaction.

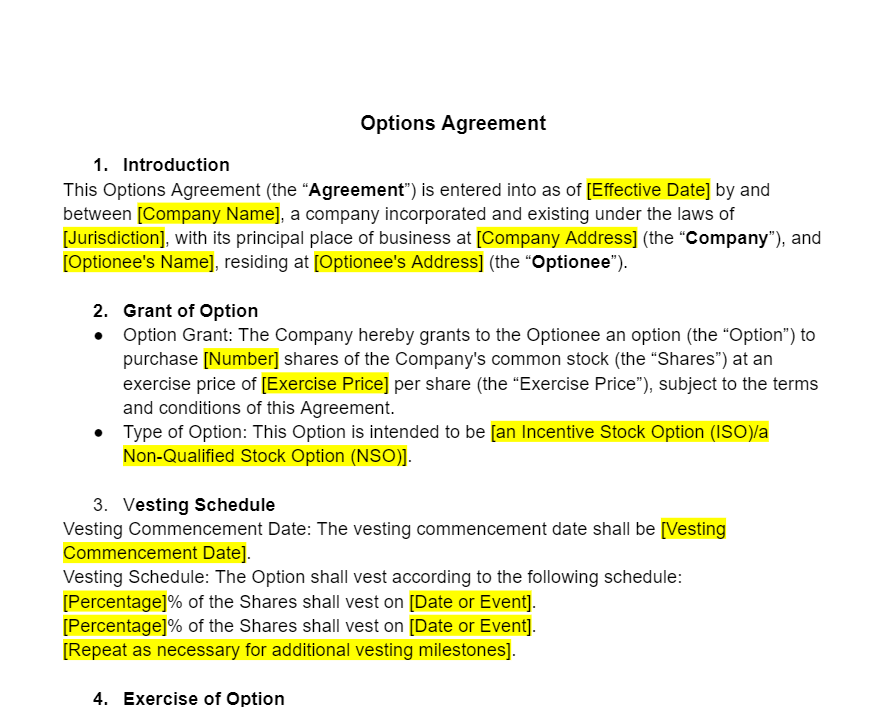

The agreement outlines critical information like the company name, number of shares issued, exercise price per share, vesting schedule, warranties, disclaimer, and provisions for severability in the case of unpredicted events and the need for early exit.

Key employees may, depending on their negotiating power, be able to negotiate better terms, such as an accelerated vesting schedule or a reduced exercise price.

Such amendments may be made through written notice and mutual agreement. Legal experts, well-versed in securities laws and the laws of the state, are instrumental in ensuring that the agreement is in conformity with the governing law.

They review the contract for severability, waiver clauses, and superseding terms that ensure the agreement is for the benefit of the company’s objectives and not detrimental to employee’s rights.

Breaking Down the Stock Option Agreement

Stock option agreements involve a number of documents, all of which serve a different purpose in defining the subject matter and mechanics of option grants. The effective date of these agreements often marks the starting point for numerous rights and obligations.

What follows is an overview of some of the key documents and provisions from each of these agreements.

Stock Option Plan

The stock option plan serves as the governing document hereof, providing the general terms upon which options shall be issued. It includes the purchase price, eligibility criteria, and limitations. This document is standardized for all employees receiving options at a given time, ensuring consistency across grants.

Individual Stock Option Agreement

This agreement is unique to each employee, unlike the overarching plan. It identifies the number of options granted, the type of options, and the vesting schedule. Additional details, such as expiration periods and special conditions, are outlined at the company’s sole discretion.

Exercise Agreement

This document governs the process for exercising options. Employees will have to follow the terms mentioned herein in order to convert their rights into shares.

Notice of Stock Option Grant

Although not always necessary, this document summarizes the material terms of the option grant. It may include disclosures mandated by securities laws and, in some cases, fulfill notice requirements.

Key Terms and Provisions of the Options Agreement

Date of Grant

The grant date is the beginning date of the employee’s option rights. This date also gives the timelines for vesting and exercising options.

Exercise or Strike Price

The exercise price is expressed per share and, according to agreement terms, is generally oriented based on the fair market value. The closing stock price will be a common reference for publicly listed companies, while formal valuations will be used for private companies.

Expiration Date

The expiration date sets the limit for when options are exercised. Such options become void once this date has passed.

Exercise Date

Exercise date: The date when an employee converts the options into shares. Compliance with the terms hereof ensures proper execution of this right.

Vesting period

Vesting schedules define the timing of employee rights to their options. Vesting, in general, takes several years and is a way of encouraging long-term commitment to the company.

Cliff

A cliff is a period in which no options vest. For example, no shares may vest in the first year, but after that, monthly or quarterly vesting may begin.

Clawback Provisions

These provisions enable the firm to reclaim unexercised options when certain conditions are met, or when an event occurs that supersedes the terms of this agreement, like bankruptcy or the employee’s firing.

Receiving Stock

Upon their vesting, employees have an entitlement to take the shares in the said option at the strike price. Assume 25% of options vest after a year; using the same math, he could buy 250 shares. Regardless of the market price, the transaction is governed by the exercise price specified in the agreement.

Reload Option

Some agreements allow for a reload whereby, upon exercise, employees will be granted extra options. This is often provided at the company’s sole discretion and adds value to the incentive over the long term.

The Signature Page

This page confirms the stock option agreement, making it legally binding.

Stock Option Agreement Contracts and Taxation

The critical point of focus, when analyzing stock options agreements, is the ESO spread, which is defined as the difference between the exercise price and the market price.

The grant doesn’t give rise to any immediate tax liability. No taxable income needs to be reported upon the grant by the optionee. However, taxation does not begin until the date of exercise. At that time, the bargain element, or ESO spread, is taxed as ordinary income.

A second taxable event arises when the shares of the company are sold. If such shares are sold within one year of exercise, then the transaction becomes a short-term capital gain and is taxed correspondingly.

Gains beyond the one-year threshold may also qualify for lower long-term capital gains tax rates. This two-tiered structure of taxation emphasizes timing as a key determinant in maximizing after-tax value.

Intrinsic Value vs. Time Value for Stock Option Agreement Contracts

There are two components of options valuation: intrinsic value and time value. Intrinsic value is the difference between the stock price and the strike price, while time value reflects variables such as volatility and the remaining time to expiration.

For most stock options agreements, the expiration date extends up to 10 years from the grant date, resulting in significant time value. This value is easy to calculate for exchange-traded options but much more difficult for non-traded options, such as those contained in employee agreements.

Stock Option Agreement Contracts vs Listed Options

Stock option agreements have a very different nature as compared to listed options. Due to the lack of trading in public exchanges, these agreements also lack market liquidity and valuation benchmarks. Whereas exchange-traded options enjoy the benefit of standardized terms, such as contract size and strike prices, agreements in stock options are specifically tailored to the terms hereof.

Vesting requirements pose special challenges. Employees may be required to meet performance milestones or remain with the company for a specified period before options vest. In other situations, the concern of restrictive covenants on vested shares makes such agreements further differentiated from listed options.

Stock option agreements do not have an auto-exercise feature and the optionees have to notify their employer in writing during the specified business day providing a notification to initiate the exercise.

Valuation and Risk Considerations

Stock option agreements derive their value from the volatility, time to expiration, the risk-free rate of interest, and the price of the underlying stock. These factors interplay in determining the perceived value of the option.

Counterparty risk is often overlooked, but it is an important consideration. Historical events, such as the collapse of technology firms during the dot-com bust, serve to outline the possible risks due to employer insolvency.

Other Types of Equity Compensation

Stock options agreements are one form of equity compensation among alternatives.

Restricted stock grants are those wherein the employee if he or she meets specific criteria such as acquiring tenure or reaching performance goals, gets shares.

Stock appreciation rights (SARs) enable employees to benefit from share price increases, with payments made in cash or stock.

Phantom stock grants cash-based bonuses that mirror the value increase in the shares, while employee stock purchase plans provide participating employees with company shares at a discount.

Key Takeaways

Stock option agreements are the very foundation of equity compensation plans, whereby employees can buy shares in the company at a pre-defined exercise price.

These agreements may have vesting schedules that may limit immediate exercise rights and include detailed terms regarding taxation.

Tax liabilities arise both on the exercise date and at the time of the sale of shares acquired.

If done correctly, the interplay of the valuation factors identified herein will allow optionees to maximize their agreements while minimizing potential risks.

The signature page below formalizes these commitments, binding all parties to the terms hereunto detailed by law.

Download a Customizable Options Agreement Template with a Free Trial of FreshDox

Sign up for a free trial of FreshDox and you get 7 days to download a free, fully customizable option agreement template for your stock option program. Premium accounts get unlimited downloads while Basic accounts get three downloads. Browse our catalog of professionally designed templates for business, edit them to your requirements, and download them in PDF or Word formats.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Start your 7-day free trial and access professionally drafted legal documents built for business use.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews