Personal Guarantee Template

8 Downloads

Money and Finances

December 12, 2024

Sayantani Dutta

Securing a loan or credit for a business often requires more than just a promising proposal or a solid business plan. Lenders will often seek an additional layer of security—leading many to request a Personal Guarantee. The Personal Guarantee document is a formalized way to provide this assurance. It outlines an individual’s commitment to repay a loan if the primary borrower fails to do so. The guarantor is taking a risk on behalf of the individual taking the loan.

In this guide, you will learn all about the necessity of a Personal Guarantee and the problems you could face if you do not have one. We will also introduce you to FreshDox.com’s reliable Personal Guarantee Template—an indispensable tool for both lenders and borrowers. So, without further ado, let’s dive right into it!

What is a Personal Guarantee?

A Personal Guarantee is a legal document where an individual (the guarantor) agrees to accept responsibility for the financial obligations of a borrower (typically a business) in the event that the borrower defaults. The document will include the terms under which the guarantor’s liability kicks in. In other words, it explains when and how the guarantor is liable for the repayment of the loan to the creditor.

The document further clarifies the extent of the liability and any conditions or limitations of this guaranty. Personal guaranty is the technical term here, different from “guarantee.” “Guaranty” is a noun that means an undertaking or promise from a guarantor to a guarantee. In a financial or lending context, such as taking a loan, it means an assurance of the future payment of another person’s debt. For example, a co-signer on a loan agreement is providing a guaranty to the lender.

This document solidifies the guarantor’s commitment. At the same time, it also clearly defines the scope of this obligation, this providing security for lenders on one hand and giving guarantors a precise understanding of their personal liabilities and obligations on the other.

Importance of a Personal Guarantee

A Personal Guarantee is a very important document concerning people who wish to get a loan (or a bigger loan). It introduces an additional safety measure, so the lender is less anxious to give the loan. The entire agreement outlines all the terms under the laws of the state about this guarantee—such as the extent of the liability and how the repayment will be made if the primary borrower fails to meet the payment terms.

In the case of the non-payment of a loan, the remaining full payment has to be made by the personal guarantor. The enforceability of this depends solely on the Personal Guarantee document, a legally binding document.

This document is particularly important in the business financing process. It reassures lenders by providing an additional layer of security, often making the difference between obtaining financing or not.

For new businesses or those without a substantial credit history, a personal guarantee is often instrumental in facilitating the loan approval process or to get a loan in the first place. It is one thing for the business to know that it can repay the loan, and another for a lender to offer valuable consideration for the same. A personal guarantor, who is well aware of the business, let’s say, can take the guarantee in this case. This helps the business get the loan while making the process of considering giving a loan easier for the lender. Both sides win.

By doing so, the guarantor is basically displaying confidence in the business’s viability and commitment to its success. As a result, this leads to more favorable loan terms for the business. Personal guarantees are crucial for ensuring a smooth path toward indebtedness by making it easier for businesses to acquire loans despite their weaker financial standing.

Not Having a Good Personal Guarantee

If you are guaranteeing a loan without actually having a well-defined Personal Guarantee document, then you are exposing yourself to undefined risks and liabilities.

An ambiguous or generic template might not clearly limit the guarantor’s obligations. This, in turn, leads to disputes over the extent of liability if the borrower defaults. What’s more, a poorly structured and inadequate Personal Guarantee Template may not even be enforceable in court! This leaves the lenders unprotected as well.

There should be no confusion, ambiguity, or half-measures in financial matters—or you might as well begin looking at reasonable attorneys’ fees. Any lack of clarity and protection can strain the relationship between a lender and a borrower, further deterring any future financial support.

Also, if a borrower is eligible for a loan, then with a personal guarantee, they might be eligible for a higher amount. Though it relies mainly on who the guarantor is and the amount being asked for, it also relies, in part, on the comprehensiveness and legal soundness of the Personal Guarantee document under the applicable law. As such, the document should clearly outline all the obligations of the guarantor and the terms for the payment in case of a default.

This offsets the risk from the borrower, though not entirely, and waives some of the risk from the loan. All in all, the lender feels more at ease and the borrower gets what they need easily and faster with a Personal Guarantee. And of course, nobody is going to guarantee someone else’s repayment unless they are sure about it—so it is safe to assume that in the majority of cases, the personal guarantor has a very small amount of risk involved in the transaction. In fact, mostly, the guarantor does not even need to interfere. The loan gets passed and repaid over time in due course.

What Makes a Good Personal Guarantee?

Now that you know the benefits and necessity of having a robust Personal Guarantee document, it is time to understand what makes a good one. Keep in mind that based on the governing law of the state, some clauses might be different. For example, a Personal Guarantee for a large business loan in New York can look substantially different from a Personal Guarantee for a small business loan in Maine.

That being said, there are some key components that any good Personal Guarantee document should ideally have. More importantly, there is a structure that such a document needs to follow.

Often, the structure begins with the formal identification of the parties in the transaction or loan. This means you should start your Personal Guarantee document by mentioning the names and details of the three parties—the borrower, lender, and guarantor.

Next, cover the details of the guarantee. This includes briefly mentioning the scope of the guarantee—including which debts are covered. Any conditions of liability should also be mentioned here, meaning the specific conditions under which the guarantor is liable. Typically, a guarantor is not liable generally in the case of a failure to repay loans. Certain conditions have to be met to ensure that the borrower first attempts its best to repay the loan on its own. If that basic due diligence is not done, then the risk to the guarantor is unnecessary. Hence, these conditions hereof the guarantor’s risk and any prior written consent are presented to hedge against that.

Guarantees are also often limited by amount. For example, a guarantor might only be responsible for the repayment of up to a particular amount or percentage of the loan amount, not the whole thing if the repayment plan collapses on month one! Mention any limitations on the amount or duration for which the guarantor is responsible. Also, briefly talk about the term of the guarantee here—meaning for how long the guarantor’s obligations exist, beyond which point the guarantor cannot be asked to help in the repayment of the loan.

If applicable, also mention a clause on the revocation terms. This is a clause holding all conditions under which the guarantee can be revoked. For example, some Personal Guarantees only apply in the case of the business failing to turn a profit. If a profit was made and the debt still not repaid as per the terms, then the guarantor is not responsible for making the repayment. Discuss any such requirement first, and then put it in words within the Personal Guarantee document.

In the end, the document will have signatures. This is the formal endorsement by the guarantor, and possibly any witnesses, to affirm the agreement’s validity and bring the document in full force.

Include all of these elements in your Personal Guarantee document to make sure that it is clear, fair, and legally binding. That is the only way to protect the interests of all parties involved when money and loans are concerned.

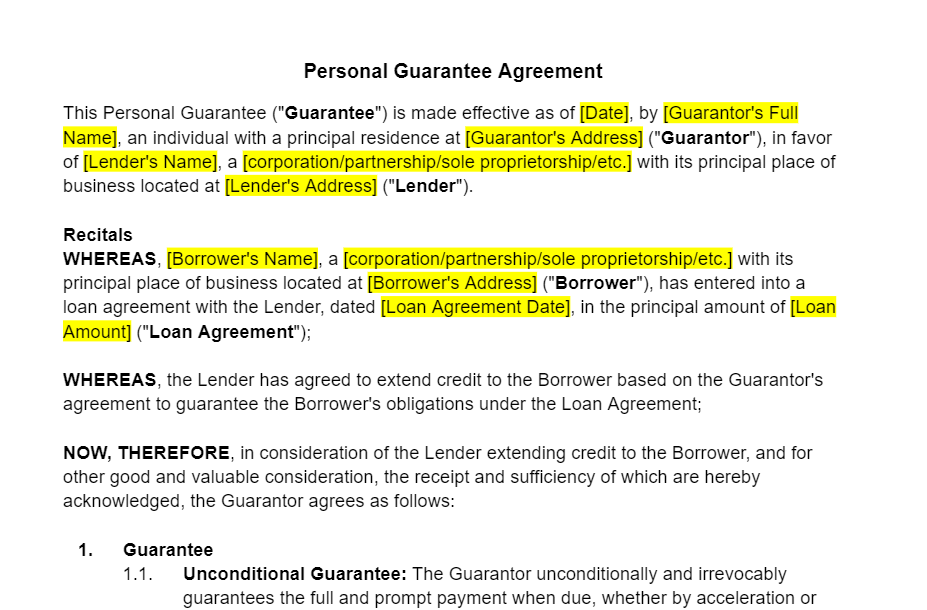

FreshDox.com’s Personal Guarantee Template

We understand it can be a bit challenging to draft the perfect Personal Guarantee. That is why FreshDox.com provides a meticulously designed Personal Guarantee Template that can help you out when dealing with the nuances of securing business finances while also safeguarding personal interests.

Furthermore, with our template, you have the promise of clarity, fairness, and enforceability to the degree that you need! It can help you easily delineate the guarantor’s liabilities while offering security to lenders at the same time.

Subscribing to FreshDox.com gives you access to our wide range of legal document templates, including the Personal Guarantee Template. And with our 14-day trial period, you can explore the multitude of benefits of our Basic and Premium Plans. Basic Members can download up to three legal document templates per month, while Premium Members enjoy unlimited access to our wide-ranging catalog of business, legal, and professional document templates that are customizable, legally sound, and available in both Word and PDF format. Built specifically for the ongoing needs of business owners, financial institutions, and legal professionals, our Premium Plan offers value like no other template repository.

Use FreshDox.com’s Personal Guarantee Template today by signing up! Now, guarantors and borrowers can confidently enter into financial agreements, knowing that their obligations and protections are clearly defined to leave no space for legal ambiguities that can cause troubles down the line. With us, you too can avoid the uncertainties and risks associated with inadequate personal guarantee documents and templates.

Don’t wait! Sign up for FreshDox.com today and secure your business financing with our expertly crafted Personal Guarantee Template.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews