Prenuptial Agreement Template

10 Downloads

Family and Inheritance

December 19, 2024

Sayantani Dutta

If you’re planning a wedding, it’s time to get your affairs in order. You’ll need to make changes to your estate planning and your instructions for distributing assets like your real estate and retirement accounts to family members. When you sign the marriage register on your wedding day, you’re actually signing a legal document binding you and your partner.

While no couple sets out to fail, over 50% of marriages in the United States end in divorce. That means you could be liable for spousal support in the form of alimony. In some states like California, your spouse can legally claim title on half of your assets.

Divorce can be an expensive exercise, and a solid prenuptial agreement (also known as an antenuptial agreement) can save you stress, money, and time. Preparing a prenuptial agreement before marriage lets you outline what you think is fair for your ex-partner to receive in the event of your marriage ending.

Explaining the Specifics of Prenuptial Agreements

The prenup includes your obligations to each other and your expectations for the marriage. The prenup provides guidelines on the distribution of your assets in the event that one of you dies or you end up in divorce court.

State law ultimately determines the division of property in divorce cases. As we mentioned, state laws differ, so New York state law will have different provisions regarding the distribution of assets in divorce compared to California or Florida. However, the court will recognize a prenuptial agreement and its instructions to divide assets and property that differ from state law.

The purpose of the prenup is to take control of your assets from the state in the event of a divorce or your passing. For the prenuptial agreement to be deemed a valid contract by the courts, it must present full financial disclosure of both partners, including a full accounting of their assets and liabilities. The prenup must offer protection for both parties; it can’t be a one-sided agreement. The document must be executed and acknowledged with the legal formality required for the recording of a property deed.

How Does A Prenup Benefit Both Parties in a Marriage?

You might think that prenups are just for the rich, but that’s not true. While A-list actors and business titans are always in the news for breakups, and they have a lot of wealth to protect, the prenup agreement is a key estate planning document every married couple needs.

Some future spouses have concerns about signing a prenuptial agreement, but the legal protection it affords is invaluable. Ending a marriage or unwinding an estate in the wake of a spousal death isn’t an easy process, and the prenup fast-tracks legal processes, providing clear instructions for the division of assets and property.

The prenup allows you to pass separate property to children from a previous relationship. The spouse and the family get clear instructions on the decision of assets to your demands. The document clarifies the financial obligations, rights, and responsibilities the spouses have to each other during their marriage.

Drafting a valid prenuptial agreement addresses the following issues.

Defining Separate Property

Couples must understand their financial situations before entering into the prenup agreement. They’ll need to disclose everything to their partner, including any separate debt commitments they have or any debt they still have from a previous marriage in the provisions of this agreement.

The prenup acts like a property division tool, clearly defining what belongs to whom in terms of the partner’s financial responsibilities and their relationship. The party’s separate property may be included in the agreement, for instance, if the couple plans cohabitation of the spouse’s homes as their marital residence.

Defining Marital Property

The prenup can define the couple’s community property they’re bringing into the relationship.

Defining Maintenance Responsibilities

The prenuptial agreement establishes maintenance responsibilities for you or your spouse, particularly if one of you plans to give up their career to raise the children. The prenup can establish the type of support you or your spouse will pay during or after finalizing a divorce, or it can state that there will be no ongoing support for the spouse after the marriage ends.

Pre-Marriage Debt Liabilities

If your partner is bringing substantial debt into the relationship, the prenup can declare that that debt stays as the spouse’s liability and is not shared by the couple. This clause alone can make a huge difference for couples’ future finances, especially if one of them has significant student debt they’re struggling to settle.

Support for Children from a Previous Marriage

One or both spouses may enter the marriage with minor children from a previous marriage. The prenup ensures that the kids are taken care of financially in case of a divorce or unexpected passing.

Child Support and Visitation or Custody

The prenuptial agreement doesn’t definitively outline custody or support issues for unborn children. The couple will need to address these concerns based on the situation at the time of the court’s finalization of the divorce. The court is obligated by law to determine whether child support and custody arrangements are in the child’s best interests.

Are Prenuptial Agreements Legal Contracts that are Enforceable in Court?

The enforceability of the agreement can depend on whether or not it’s notarized. Different states have different rules that may or may not require you to have the prenup witnessed by a notary public.

Hire a law firm specializing in family law for independent legal advice and legal counsel you can trust. Seek professional legal advice, especially if you have a sizable estate and generational wealth to protect.

There are a few arguments legal counsel can present in court to undermine the validity and enforceability of the prenup agreement.

Separate Law Firms

Both you and your spouse will need individual representation when entering into a prenuptial agreement. If you don’t use separate law firms, the court may not enforce the terms of the prenup because they rule it unfair.

Fraudulent Disclosures

The court may not enforce the terms and provisions of the prenup if one or both of the spouses don’t fully disclose their finances honestly or choose to hide assets.

Signing Under Coercion or Duress

The prenup might be deemed unenforceable if there is evidence of one party being pressured or coerced into signing. The spouse must have sufficient time to review and assess the document before signing.

Inequitable and Unfair

If the prenup benefits one party more favorably than another, or if it’s unfair—such as the spouse leaving their partner nothing—the court may rule the document unenforceable.

What Happens If You Don’t Have A Prenuptial Agreement?

A prenup is like a disclaimer to a marriage contract outlining what happens if it doesn’t work out. Its protection isn’t merely one-sided; it benefits both parties to sign it. Couples who decide not to form a prenup subject themselves to the state distributing the couple’s assets as it sees fit.

State law usually has some determination of property acquired by each spouse prior to their marriage. Marriage is a contract between participating spouses. With the signing of that contract comes specific automatic property rights for the couple or surviving spouse.

In the absence of a valid, signed, notarized prenuptial agreement, each spouse has the right to the following under the laws of the state.

Shared ownership of property acquired during the couple’s marriage, with the expectation the property is divided between spouses if they divorce or one of them passes away. Incur debts in their marriage that their partner will be liable to pay. Share in the control and management of marital property, including the right to give it away or sell it.

These laws are known as divorce, probate, and marital property laws. A premarital agreement is the legal solution you need if you want to avoid the state taking control of the distribution of your assets in the wake of divorce or death.

Postnuptial Agreements and Reconciliation Agreements

The terms of a prenup can change during the course of the marriage if the situation calls for it. If you want to change the terms of the agreement, you’ll need to use a Postnuptial agreement, aka a “mid-marriage agreement.”

If either spouse comes into a significant inheritance or amount of money, or if one of them wants to stop working to raise children, they can change their spousal obligations in the contract to the circumstances of the new situation.

The reconciliation agreement is for a situation where you and your spouse separate but don’t divorce and then get back together. It’s a tool to heal the marriage and bring peace of mind to both of you as you try to reconcile the relationship.

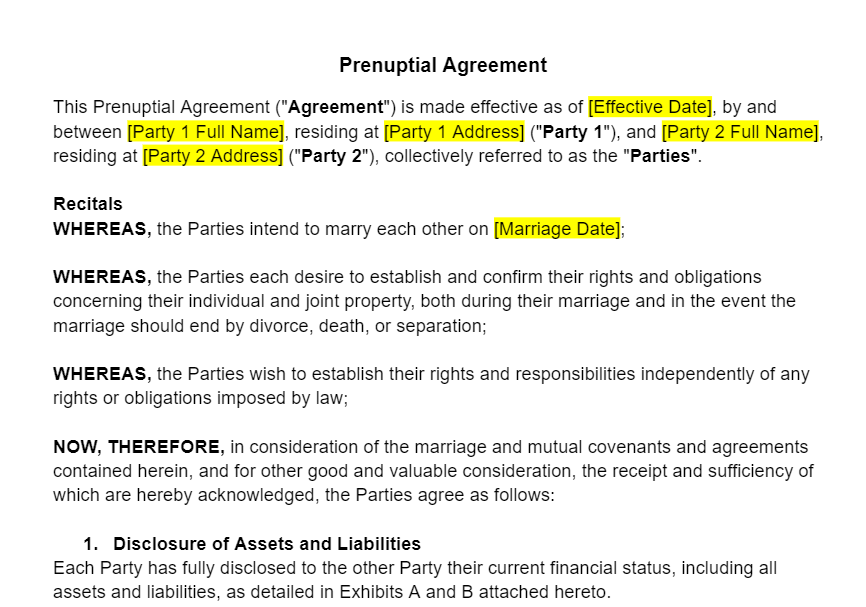

Download a Prenuptial Agreement Template with a Free Trial of FreshDox.com

Get a customizable prenuptial agreement template with a free trial of the FreshDox platform. A meticulously drafted marriage contract saves a lot of time, stress, and expense associated with the dissolution of your marriage. Edit your prenup and download it in Word or PDF for your records. Sign up for a 7-day trial of FreshDox and get free downloads for a week while you explore the benefits of your Basic or Premium account.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews