Promissory Note Template

5 Downloads

Money and Finances

December 18, 2024

Sayantani Dutta

Credit built the United States economy and fueled its expansion over the last 70 years. The loan agreement, whether it’s for business loans or a personal loan, is the more common financial instrument leveraged by private persons and companies. It provides a line of credit for small businesses and gives households access to near-instant money.

The loan agreement isn’t always the best option for getting quick access to funds. A promissory note is a written promise to pay an individual or organization a specified sum of money, with or without interest, at a future date, and it is not necessarily secured by collateral.

Promissory notes are legally binding documents serving both the debtor and creditor, provided they are drafted and presented properly. In this written agreement, the borrower promises to live up to the terms and conditions of the loan, including its repayment dates and interest responsibilities. We can think of the promissory note as a less heavyweight document than a loan agreement, but it carries more substance than an IOU.

You probably wouldn’t use a promissory note to buy real estate because it’s a short-term loan, and paying off a property is usually a long-term financing arrangement. The promissory note is probably the most straightforward representation of credit. It’s easy to structure and has fewer formalities than a loan agreement.

All you need on paper is who lends to whom, the amount, the date of the transaction when it should be repaid, and the signatures of the parties to the agreement.

How Does a Promissory Note Work?

For companies and small businesses, promissory notes come into play when they can’t access cash, credit, or financing via conventional lending institutions. A promissory note allows borrowing without loan guarantee insurance. But there’s an incentive for lenders to take more risk with promissory note loans. Because they are higher-risk liabilities, the money accessed through promissory notes may have higher-than-normal interest rates on the loan amount.

Angel investors will often use promissory notes when providing seed funding to startups. These amounts could range into the hundreds of thousands of dollars and have extensive terms buried in the agreement. But for the most part, promissory notes are semi-formal loan agreements between friends and family. For instance, Junior might want to buy a motor vehicle, and he asks his dad for a loan.

Pops wants to give his son more responsibility, so he agrees to a promissory note to cover the loan for the cost of the car. The loan outlines the principal sum loaned, the accrued interest over the loan period, and his son’s payment plan. Promissory notes are a good solution for easy, fast, short-term financing of small to large purchases. While our example saw Pops charging Junior interest on the loan, that doesn’t always have to be the case. Many promissory notes between friends and family don’t include interest on the loan.

That said, promissory notes also serve institutional financing purposes. We discussed how they make good vehicles for funding startups that can’t get funding from conventional lenders like banks and investment firms. Typically, banks will only lend to people who can prove they can afford to repay the loan, and they don’t like taking financial risks.

Promissory notes can be a springboard to achieving financing from institutional partners. For instance, you might take a promissory note on a few thousand dollars to provide collateral for a much larger loan from an institutional lender. The causal presentment of the loan, its favorable pricing, and the flexible terms make it an attractive way to finance business in the short term.

Since it’s a financial instrument, companies, and small businesses will record promissory notes as a liability on the balance sheet. That’s not always the case, though. The loan term is often the deciding factor in how the company records the loan. Typically, companies only record debts if the loan terms are longer than 12 months.

It’s recorded as a short-term liability if the note is payable within 12 months and a long-term liability if the payment terms are longer than 12 months.

Are Promissory Notes Classified as Securities By the SEC?

This section really only applies to businesses using promissory notes in their short-term financing strategy. Promissory notes can streamline your cash flow with working capital to keep your business moving forward while you sort out your creditors.

Companies should also pay close attention to securities laws when using these instruments. If the SEC rules the promissory note as a security, the party in violation could face huge penalties. Unfortunately, using promissory notes for business loans, especially in larger amounts, such as seeding startups, is a costly endeavor and not worth the hassle.

Typically, the SEC will not view a promissory note as a form of financial security provided it meets the following regulations.

- The repayment term is less than nine months.

- The money is used for business operations and purposes.

- The loan doesn’t offer the lender any shares in the company in return for the financing.

The longer the loan term of the promissory note is, the more likely it is that the SEC will view it as security. Also, promissory notes bearing interest are more at risk of being deemed as securities by the SEC.

Promissory Notes vs Bank Loans

So, should you go with a promissory loan or a conventional bank loan if you’re an average Joe or Jane looking for quick cash? Since these loans are a double-edged sword of convenience and higher APR, you don’t want to use them as your go-to way to access short-term financing.

However, they are a good way to access financing while you’re still building your credit. Just beware of predatory lending tactics. Many consumers end up deep in debt to payday lenders in a revolving cycle they can’t escape.

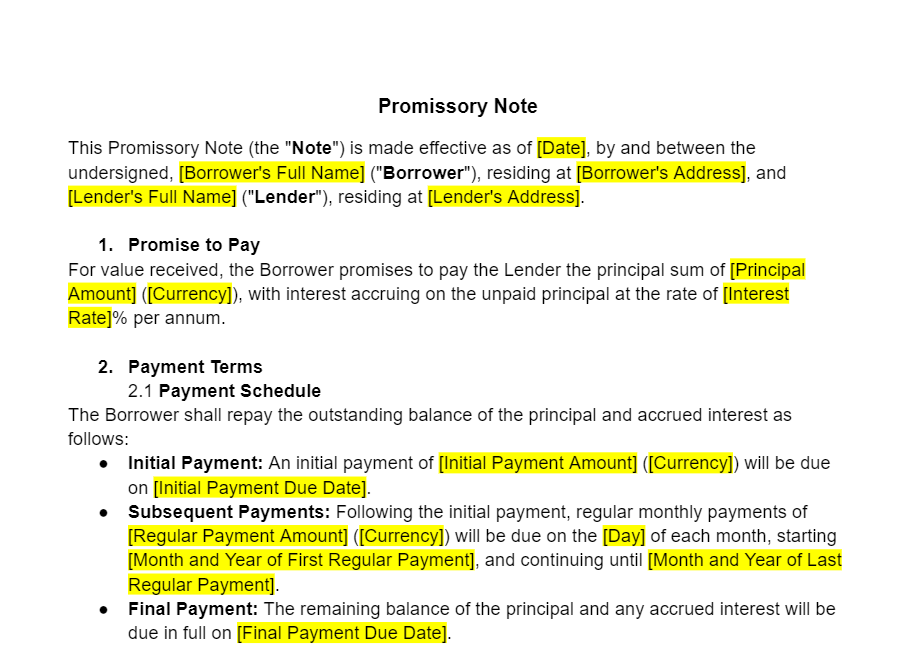

How Do You Write a Promissory Note?

The promissory note is drawn up by the lender, signed by the drawr and drawee, and witnessed by the lender. Once it’s inked, it’s a legally binding document. The payment terms and conditions are whatever the borrower and lender decide upon.

Here is the basic structure and information of the note.

- The names of the Drawer and drawee.

- The date of issue.

- The amount of money to repay (principal amount of the loan).

- The repayment terms. (Mention installment payments where applicable).

- The maturity date of the note (final payment).

- The interest rate per annum (APR).

- The signatures of the Drawer and drawee.

The promissory note may also have provisions outlining the prepayment of the loan and a clause with a waiver discussing the conditions under which the Drawer is no longer liable for repaying the loan. There may also be a provision talking about what happens if the drawer defaults and that the Drawer is responsible for paying any attorneys’ fees and legal costs incurred by the Drawer when attempting to recover their money.

The Parties to a Promissory Note

A promissory note typically involves two and sometimes three parties:

- Drawee: This is the lender.

- Drawer: This is the borrower who agrees to pay the drawee when the due date (maturity date) of the promissory note arrives.

- Payee: Any third party whom the Drawer or borrower has allowed or asked to receive the funds.

Is a Promissory Note a Secured Loan?

If you ask the bank for a loan, they’ll probably want collateral to “secure” it. That means the lender puts up an asset of value to cover the lender’s risk in the loan. It’s common for homeowners to take second mortgages on loans because the bank sees real estate as high-quality collateral.

Most promissory notes don’t require the Drawer to post collateral to secure the loan. An unsecured promissory note has no guarantee of repayment to the lender, but there are other actions the lender can take, such as damaging the Drawer’s credit or suing them in court for the money if they refuse to pay.

A secured promissory note is a thing, but it’s much less common. If the drawee does require collateral, the Drawer is usually allowed to use a co-signer, like a family member, to vouch for them. If the Drawer doesn’t repay the loan, then the co-signor is on the hook for it.

Is the Promissory Note Legally Binding?

After both parties sign the document, it becomes a legally binding contract. According to federal and state laws, it’s not necessary to have a notary public witness sign the document for it to be considered valid in the eyes of the law. If you do choose to notarize it, it adds more validity to the document in court.

If the Drawer fails to pay their installment on time or make their payment on the maturity date, the drawee is entitled to charge late fees for any late payment. Depending on the terms of the agreement, the late fee may be charged based on the unpaid principal or on the total loan or installment amount.

If the borrower defaults entirely on their obligations, the lender may sue them based on the terms in the note. A promissory note is legally enforceable if there is a claim of breach of contract on the terms of this note. If the drawee wishes to pursue the drawee in court, they must hire a law firm to get legal advice on the legal action and recourse available to them.

Generally speaking, a promissory note is enforceable in court if it contains the loan terms, legally acceptable interest rates, and the signatures of both the lender and borrower.

Can the Promissory Note be Amended?

Like any other legal document, the promissory note can be amended through the mutual agreement of both the borrower and the lender. Borrowers who are incapable of fulfilling the conditions involved in the promissory note can approach their lender with the aim of modifying terms. All modifications to this agreement shall, to protect both parties, be in an amendment in writing, dated, signed by the parties, and attached to the addendum of the original promissory note.

Download a Promissory Note Template from FreshDox with a 7-Day Trial

Don’t get lost in the details trying to draft a promissory note agreement on Google Docs or Word. Sign up for a free trial of a Basic or Premium account with FreshDox and access a free promissory note template for any short-term lending situation. Explore our wide variety of templates for your business, legal, educational, and professional document needs.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews