Sale Agreement for House Template

14 Downloads

Real Estate

March 8, 2025

Sayantani Dutta

A real estate purchase agreement is a binding contract governing residential property sales between a buyer and seller. This document outlines financial terms, legal terms, and contingencies required for passing ownership. Every real estate transaction involves high financial stakes, and an agreement prevents misunderstandings that derail its closing.

Once implemented, the contract forms a binding agreement from the effective date to the final transfer of title. During this period, buyers conduct due diligence, sellers perform contract obligations, and third parties—such as lenders, title companies, and escrow agents—complete the required verifications.

Setting Property and Legal Boundaries

Metes and bounds refer to a legal description method that utilizes a survey to define boundaries in terms of physical features, directions, and distances. It’s commonly used in irregularly shaped land parcels or in rural areas where there are no official subdivision maps. Here are a few examples of metes and bounds.

- Natural elements such as rivers, lakes, or trees.

- Man-made features like roads, fences, or markers.

- GPS directions for each boundary line.

- Precise distances, typically measured in feet.

It proves useful when there is no official division and land must be demarcated by reference points. However, since natural landmarks do change with time, markers and GPS coordinates can be included to give a more precise reference. These facts help to distinguish the property from nearby similar parcels. If discrepancies exist, it can be required to correct them before the closing date for the transaction.

Types of Appurtenances

Appurtenances may be defined as physical facilities, legal entitlements, and land-use privileges that enhance a property’s value or use.

Physical Appurtenances (Attached Structures and Fixtures)

These are permanent fixtures affixed to the property and which constitute part of the sale.

- Driveways, sidewalks, and fences.

- Detached garages, sheds, and barns.

- Pools and decks.

- Wells and septic systems.

Legal Appurtenances (Ownership Rights and Easements)

Some appurtenances grant legal rights to the owner even though they may not be tangible.

- Easements – A shared driveway or utility access.

- Water Rights – Rivers, lakes, or wells connected to the property.

- Air Rights – Rights to develop or to possess use of space above land.

These rights attach to land and automatically pass to a new owner unless severed by statute.

Land-Use Appurtenances (Shared Amenities and Community Benefits)

- Private roads or gated community access.

- Usage rights to common parking facilities.

- Membership to a homeowner’s association with access to a clubhouse or a pool.

Appurtenances automatically transfer to a buyer when a property is being purchased unless otherwise stated in the contract. Real estate contracts specify appurtenances to avert disputes.

Financial Terms and Payment Structure

A real estate purchase contract must include clearly defined financial terms and terms of sale, like the total purchase price and payment terms, and fees to be paid by buyer and seller.

The down payment constitutes a vital component of the agreement because it shows that the buyer has a financial commitment to making a purchase. Sellers and buyers may also agree to an earnest money deposit that acts as a symbol of good faith in completing the purchase. It’s typically held in escrow until closing.

If a buyer cancels a contract in the absence of a valid contingency, a seller can keep this deposit as compensation for time wasted and opportunities missed. But if a seller cancels a contract unjustly, then a buyer does have a right to a refund.

Financial terms also define closing costs, which typically consist of title search and recording fees, which establish property ownership and document the transfer. Attorney fees and home appraisal and inspection fees generally fall under buyer responsibilities. If a buyer finances with a mortgage loan, financing terms must be included in the contract.

- Name of the lender and the details of the financial institution.

- The amount borrowed and rate of interest.

- Repayment terms and loan terms.

Buyers must provide proof of loan approval to confirm they have enough money to complete the purchase. The contract can contain a financing contingency, enabling the buyer to cancel the contract if their mortgage isn’t approved by a stated deadline. Under seller financing terms, a seller acts as a lender. This section of the agreement outlines the following terms.

- Repayment schedule and interest rate.

- Penalties for missed payment.

- Balloon repayments or loan restructurings.

Unlike traditional mortgages used in home lending facilities, seller financing entails direct negotiation between both parties. It requires proper documentation to avoid future disputes regarding payment, terms of default, or early settlement.

Legal and Title Considerations

Title search ensures there are no liens, legal disputes, or pending claims against a property. Outstanding issues must be resolved before selling to prevent problems that can delay or invalidate the terms and conditions of this agreement.

A warranty deed ensures the seller has absolute title rights and legal right to transfer property. A title insurance policy is generally purchased by buyers to cover them against previously unlisted title problems that can arise after closing. It safeguards the buyer in case there are prior disputes regarding possession, clerical mistakes, or unrecorded claims.

Zoning regulations dictate whether a property can be developed for residential, business, or mixed-use. Covenants, enforced by homeowners’ associations dictate modifications to a property, maintenance, and appearance. Overlooking these legal details can lead to unintended restrictions and can affect a buyer’s long-term plans.

Escrow and Title Transfer

Funds and legal documents like the title are held in escrow account until buyer and seller obligations under the contract terms are fulfilled. An escrow agent oversees the facility, to prevent early access to funds or property. A title company verifies the history of ownership to confirm there are no outstanding claims.

Under a few circumstances, written notice must be provided to confirm all obligations are satisfied before disbursing the money and transferring the property. At closing, the title to the property and possession pass to the buyer, and local government offices record the title transfer. This step finalizes the sale and makes the buyer the legal owner.

Contingencies and Special Conditions

Most real estate purchase contracts include contingencies, which allow buyers to cancel a contract under specific circumstances. These clauses protect against buyers being forced to close a sale in unwanted circumstances, such as discovering hidden defects or being unable to secure financing.

One of the most common contingencies includes a home inspection, which permits the buyer to have the property professionally inspected before closing. It typically involves examining foundations to ascertain structural integrity and examining for potential damage or leaks in the roof.

Electrical, plumbing, and HVAC systems are checked to see if they’re in working order, and a termite, pest, or mold test is conducted. If a major defect is disclosed by the inspection, the buyer can have it fixed by the seller, accept a purchase price reduction to offset the repair expense or cancel the purchase.

A sale contingency allows the buyer to complete the purchase after the sale of their current home. Subsequent contract addendums can address a variety of items that may arise before closing. Contracts often have provisions for which party will be responsible for making repairs.

Tax Obligations and Prorations

Real estate transactions have tax consequences that must be addressed before closing. The real estate purchase agreement defines whether and how the seller and buyer will split property taxes and municipal fees.

As property taxes come due annually or twice a year, prorations ensure each side pays for their tax liability in accordance with their occupation of the property. If there are prepaid property taxes, the buyer must reimburse the seller for the remainder.

On the contrary, in the event there are taxes owed, these monies must be paid before title transfer. There may be additional tax-related costs included in the final transaction. Special municipal assessments to fund infrastructure developments may be added to outstanding amounts at closing.

School district taxes may also influence the assessed value of property and future tax burdens. One factor to consider is reassessments in property taxes, which may lead to increased tax rates once the sale is finalized.

Legal Considerations and Customization

Each side will seek legal advice before signing. Contracts must be consistent with state laws and regulations. Certain contracts have arbitration clauses, which offer a means for resolving disputes outside of court to avoid costly litigation.

Contracts specify business days in contract timelines and clarifying what constitutes a business day prevents timing conflicts, particularly when time-sensitive obligations—such as loan approval or property inspection—must be met.

If unforeseen circumstances delay the transaction from proceeding as planned, buyers and sellers may agree to postpone it or include penalties for delay. There can be further disclosures beyond those in typical provisions in generic contracts surrounding the condition of the property, such as a lead-based paint disclosure.

They can request more detailed reports about a property’s history, and sellers can be asked to give information about prior renovation, zoning restrictions, or legal disputes that can impact future use. Formal contracts remove ambiguity by ensuring that whatever is required is clearly defined, reducing opportunities for misinterpretation.

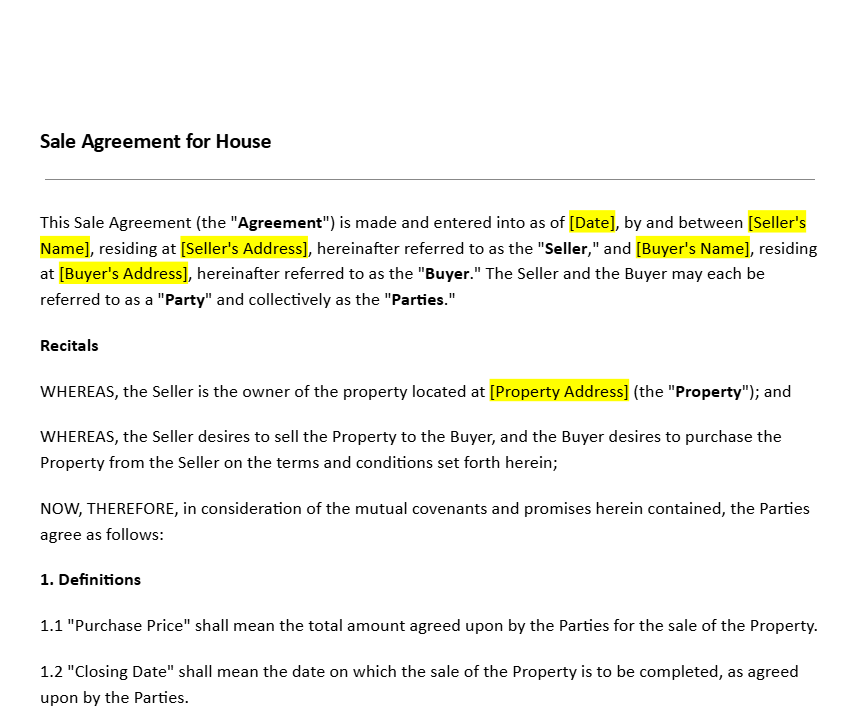

The Importance of Utilizing a Sale Agreement Template

A purchase agreement template provides a standardized legal framework in accordance with state and industry standards. Most buyers and sellers use pre-formatted forms to simplify the process and ensure that each necessary clause—required property disclosures, terms of financing, and contingencies—are addressed.

Although templates make drafting easier, real estate agents or attorneys must review the contract to ensure the details are correct. A customized agreement template brings a balance between efficiency and legal security, ensuring that both parties’ interests in the transaction are preserved.

Download a Free Sale Agreement for House with a Free Trial of FreshDox

Sign up for a free trial of FreshDox and get instant access to a free Sale Agreement for House template available in Word or PDF formats. Customize the template to your needs and protect your interests. Our professionally designed templates for real estate transactions give you everything you need to ensure a safe, secure, and transparent transaction.

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews