Share Certificate Template

8 Downloads

Commercial, Corporate

December 8, 2024

Sayantani Dutta

Are you taking your company public? Maybe you’re an aspiring tech entrepreneur and your vision is taking your startup to the next level with a VC investment. You’ll need to give your stockholders share certificates to serve as legal proof of ownership of their holdings of company stock.

The value of each share is a percentage of the company’s total valuation at its time of sale and a representation of the company’s equity. Some share certificates entitle the holders to dividends paid out by the issuing company, giving them a similar utility to the stable returns offered by banking instruments like CD accounts, which offer investors a fixed annual percentage yield (APY).

The share certificate is different from the LLC “membership certificate” issued to owners or investors during the company’s incorporation. Membership certificates don’t offer dividends like public company shares, and the ease of transfer of ownership involves different nuances, making it a longer process. In contrast, share certificates are easily purchased and liquidated at current market prices.

Every certificate has a unique number and shows the number of shares held by the stockholder. A share certificate is issued as a receipt of purchase and reflects legal proof of ownership of company shares. Before tech innovations like cloud services and digital markets disrupted the financial markets, the stock certificate was issued on paper, but unsurprisingly, today, they’re usually digital documents. Companies can issue share certificates for every transaction or issuance or collate the shareholder’s holdings into a single certificate.

How Do Companies Issue Share Certificates?

A share certificate is one of the many legal documents public companies need to maintain regulatory compliance. All public companies work with a law firm to flesh out the paperwork they need for contract law and compliance.

The company secretary prepares and issues the share certificates using the information they have on file about the shareholder. The company secretary must ensure the following three details on share certificates are accurate before issuance.

- Certificate serial number

- Number of shares being issued or transferred

- Stockholder details.

The share certificate is issued or transferred as per the company bylaws in the Articles of Association and the company memorandum.

What Is the Regulatory Compliance For Share Certificates?

The Securities and Exchange Commission (SEC) is the United States regulator overseeing the issuance and transference of corporate stock certificates. It’s a tightly controlled industry, and companies must remain in compliance with SEC regulations or face dire consequences for violations.

Investors and companies use share certificates to track how many shares each of their individual investors own, the company’s treasury stock, and the total shares outstanding on the market. The company needs to track changes to ownership and adjust its documentation to maintain compliance with SEC regulations.

Companies are regularly audited and report their financial statements publicly to maintain industry transparency standards. Companies will issue share certificates in the following scenarios.

Issuing New Shares in the Company

The company issues a share certificate to new stockholders. The company directorship has the authority to create new shares without affecting the current number of shares. New shares are issued to new shareholders.

Transferring Stockholders Shares

When a shareholder sells a percentage of their shareholding or their entire stockholding to an investor, company, or individual, the company must issue a new share certificate to each party showing them their shareholding in the company’s equity. The seller gets a revised certificate with their changed share balance, and the new investor gets a certificate with their shareholding equivalent to the purchase value of the company’s stock.

How Many Shares Do Companies Issue?

It’s standard company practice to issue one share certificate to the stockholder covering their entire holding of shares of the same class. The shareholder has the right to request the company to split the certificate into individual shares, but it’s rare for shareholders to make such a request. Companies will issue a separate certificate for each class of shares when allocating or transferring different classes of shares.

The Model Articles of Association (Part III, article #24.1) states that the company must issue the shareholder one or more certificates free of charge showing their total shareholding. This legislation means that companies can issue a single certificate per shareholder for their shareholding of shares of the same class issued or transferred on a specific date to the specific shareholder.

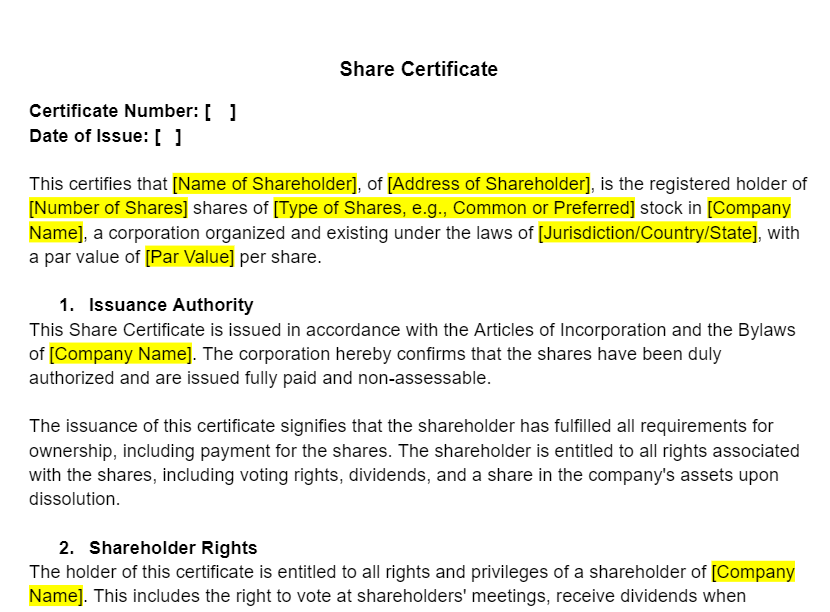

What Details are included on a Share Certificate?

- Name of the company.

- Company registration number.

- The registered address of the company headquarters.

- Number of shares issued (Displayed in both word and number formats).

- Shareholder contact details.

- Class of shares.

- Issuance date

- The transaction value (market value of the shares at the time of sale).

Unpacking the Differences Between Digital and Physical Share Certificates

Issuing paper stock certificates to shareholders is a straightforward process for the company. The company presents a physical share certificate to the stockholder, and this legal document certifies the shareholder’s ownership position in the organization. The first known record of the issuance of physical stock certificates was in 1606 by the Dutch East India Company.

While physical documents were the gold standard for proving share ownership for almost 400 years, computers eventually replaced the need for physical documents in the late 1990s with the introduction of computerized trading systems.

Electronic share certificates give the company and the investors a chance to offer or request digital or physical share certificates. When a shareholder requests a physical share certificate, the shares they receive on the certificate are called “certificated shares.” Digitally created shareholder certificates entered into the company’s books are called “uncertificated shares.”

In this book-entry accounting process, shares aren’t physically transferred to the new owner. The difference is that the exchange of ownership of shares when the company updates its ledger with the financial institution handling its investor accounts. It’s a similar process to maintaining the debit and credit records of company bank accounts.

In the past, share certificates featured the handwritten signatures of the directors, company secretaries, or witnesses. Today, it’s all done with e-signatures, and there is rarely a need for a real signature on the document.

Download a Share Certificate Template from FreshDox.com

Download a free share certificate template using your 7-trial of our platform. When you see the value our free stock certificate template brings to your business, sign up for a Premium or Basic plan and gain access to our library of thousands of printable, fully customizable templates for business and education. FreshDox.com gives you a great range of fully compliant legal documents you can customize to your preference. Check out our catalog and sign up for a free account right now!

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews