Shareholder Agreement Template

4 Downloads

Tax

December 8, 2024

Sayantani Dutta

A Shareholder Agreement is a cornerstone document in the world of corporate governance and investment. It defines the rights, responsibilities, and relationships among the shareholders of the corporation. This is a legally binding document and the provisions of this agreement outline how the business is to be operated, as well as the details of the mechanisms for resolving disputes, selling shares, and protecting the interests of all shareholders—big or small.

We are going to talk about the importance of a shareholder agreement in this article, its critical components, and the many benefits of using a professionally crafted template from FreshDox.com for a legally sound and comprehensive agreement. Without further ado, let’s dive right into it!

What is a Shareholder Agreement?

At its core, a shareholder agreement is a legal contract among the shareholders of a corporation. It covers the essentials such as the parameters of their relationship to the company, the management and operation of the company, and the rights and obligations of each shareholder.

It differs from the company’s bylaws, which are more public and generalized. The terms of this agreement, on the other hand, provide a private, customizable framework to address specific concerns and scenarios relevant to the company’s shareholders. These can range from the subject matter of the shareholder’s shares and the right of first refusal to the purchase price of shares, accounting principles, transfer of shares, and other important covenants about the price of a share of how new shares can be created.

The entire agreement helps build the foundation for the allocation of whatever number of shares the company wishes to create. It then disperses the shares and responsibilities among the board of directors, before covering the obligations of the remaining shareholders.

This written notice will also cover key concepts crucial for the structure of the company, such as what happens in the case of insolvency, stock issuance, liquidation of assets, setting valuation, and so on.

Why Do Companies Need a Shareholder Agreement?

A shareholder agreement is very useful for a company. On the surface, it acts as a preventive measure against potential conflicts by clearly defining each shareholder’s rights and responsibilities. On a deeper level, especially for startups and small businesses, it ensures that the vision and direction of the company remain aligned with the founders’ objectives.

The shareholder agreement has more provisions as well—such as clear mechanisms for dispute resolution, arbitration, legal advice, obligations to stockholders, issuing of additional shares, etc. under the applicable law.

In essence, this document is vital to safeguard the company’s operations and shareholder investments not from market factors but from internal discord.

Consequences of Not Having a Good Shareholder Agreement

Operating without a robust Shareholder Agreement, or relying on a generic, insufficient template, can lead to significant risks for both the company and its shareholders. It will mean that the articles of incorporations are not protected under the governing law. This can negatively affect the overarching business plan in case a shareholder decides to be greedy. Such shareholder discord is not too uncommon in companies created on the basis of verbal confirmations.

A shareholder agreement has a disclaimer for the most important things—the class of shares, common stock, obligations of all shareholders, and so on. As such, it cannot be breached.

If there are no such clear guidelines and procedures, the company might experience disputes that will escalate quickly—potentially resulting in costly litigation and the disruption of day-to-day company operations.

Not to mention that without a comprehensive and legally robust shareholder agreement, everyone is getting exposed to unfavorable scenarios such as the forced sale of shares, dilution of ownership, or the lack of clarity in the decision-making process.

You don’t want any of that. All that will only hinder company growth. So, whether you are thinking of making an agreement for existing shareholders or beginning a new company, it is important to ensure the enforceability of the terms, responsibilities, and other structural aspects with the help of a solid shareholder agreement.

Ideally, all this should be planned following events such as a general meeting with all shareholders and one-on-one talk with the board of directors. New shareholders that will join the company in the future, whether they are minority shareholders or majority shareholders, also need to be factored in.

How will the issued shares be impacted in that case? What confidential information can be shared with potentially new shareholders? What will be the pre-emptive rights of minority shareholders? When will a prior written consent be required? All these provisions are important and only a shareholder agreement can come to the rescue here.

Key Elements of a Shareholder Agreement

A shareholder agreement is only effective when it covers all bases. There are some key elements that it must include.

For starters, you need shareholder information. This means the agreement should clearly identify all parties involved, including their shareholdings. If there are personal representatives of any shareholders, then they need to be mentioned as well. Next, you should also have the governance and voting rights clearly outlined in the agreement. This will define the governance structure of the company and the voting rights of individual shareholders, and no disputes can arise down the line.

After you have covered the basics, it is time to talk about the dividend policies and the transfer of shares. The dividend policies are the policies about the distribution of any dividends to shareholders. Not all companies have a detailed dividend policy, but you can look into creating a policy for the future anyway. The transfer of shares clauses specify the conditions under which the company’s shares may be sold or transferred, including pre-emptive rights, tag-along rights, and drag-along rights.

Your agreement should also have certain warranties against disputes. At the very least there should be detailed mechanisms for resolving any disputes among shareholders or between shareholders and the company. Any such provision held in this supersedes individual legal advice when such notice comes into force.

The agreement should also ideally include provisions for the buyout of shareholders, especially in cases of retirement, death, or voluntary exit. Taken together, these are called the exit strategies and no shareholder agreement is complete without these.

Some other clauses that are also important include confidentiality and non-compete clauses to protect the company’s proprietary information by preventing shareholders from engaging in competitive activities and amendment/termination clauses that establish the procedures for amending or terminating the shareholder agreement itself.

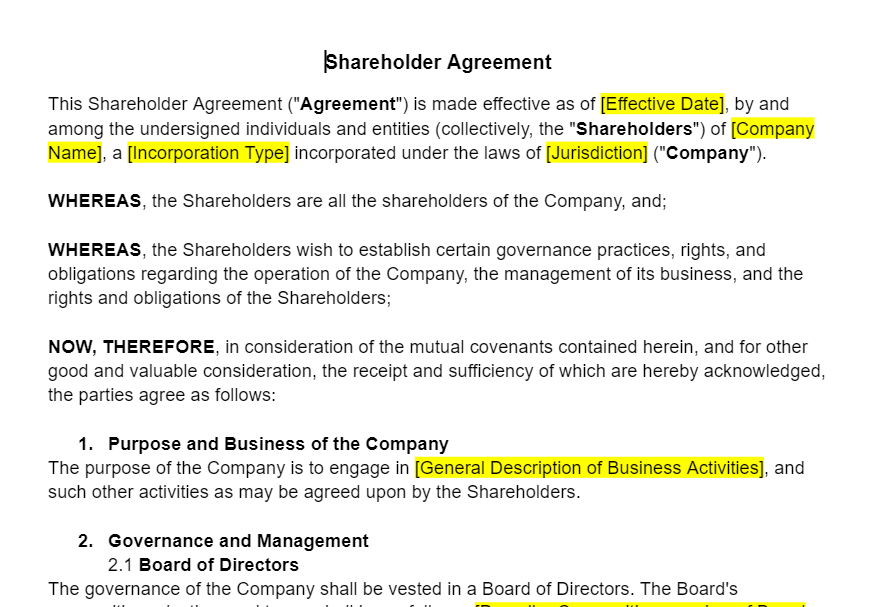

Introducing FreshDox.com’s Shareholder Agreement Template

Every shareholder should work in good faith toward the benefit of the company. But that is the best-case scenario. Stuff happens and disputes arise. In such time, it becomes important to rely on robust legal provisions already set down in the shareholder agreement.

That being said, it’s not really child’s play to write one. Every company is unique. All shareholders have their own responsibilities, obligations to the company, and priorities. How do you even begin writing a legally sound Shareholder Agreement?

Well, that is where we come into the picture.

FreshDox.com recognizes the complexities of shareholder relations and the necessity for a detailed, legally binding agreement. We offer an expertly developed Shareholder Agreement Template to that end. Our template has been created by legal professionals specializing in corporate law. It addresses all essential aspects of shareholder agreements in the modern corporate world. There is utmost attention to clarity, compliance, and the protection of all parties involved in our shareholder agreement template.

When you subscribe to FreshDox.com, you get access to our extensive range of legal document templates—all 100% customizable and available in Word and PDF format! We have a 14-day free trial period as well, which gives you full access to the benefits of our Basic and Premium Plans. Whereas Basic Members can download up to three document templates per month, Premium Members can enjoy unlimited downloads (ideal for the ongoing needs of businesses, legal practitioners, and individual shareholders as well).

Don’t wait! Make sure that your corporate enterprise has the stability necessary for long-term success today with FreshDox.com’s Shareholder Agreement Template. Sign up today to access our professional, legally vetted templates that can safeguard your company’s future and the interests of all shareholders.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews