Shares Subscription Agreement Template

A Shares Subscription Agreement is a document outlining the terms under which investors can purchase shares in a company. Especially for startups and private placement investments, this document holds a special place for being the go-to agreement for all things related to shares. This share subscription agreement simplifies the complex process of shareholders (subscribers) purchasing shares. With a clear framework that both sides of the transaction can rely on, this document proves vital for efficiency and avoiding disputes.

In this article, we will be discussing the importance of a Shares Subscription Agreement and the potential risks of not having a comprehensive template as a starting point. We will also introduce you to FreshDox.com’s Shares Subscription Agreement Template, which can prove to be an essential tool for securing investments under agreed terms. So, without further ado, let’s dive right into it!

What is a Shares Subscription Agreement?

A Shares Subscription Agreement is a legal document that formalizes the purchase of shares in a private company by an investor. It offers detailed terms and conditions about investment amounts, share prices, and the rights and obligations of both the investor and the company.

Unlike a public offering, where the company’s shares are open to be purchased by the general public, subscription agreements are used for private placements for companies that are not public. The agreement offers a personalized approach to secure investments from multiple shareholders, venture capitalists, or other investors.

The objective of the agreement is to offer clarity and ensure mutual understanding by outlining the terms of the investment—often including any representations, warranties, and legal conditions such as the maximum number of shares that a single investor can purchase. It is different from the shareholders agreement, but can share some clauses with that document, such as how the shareholders are expected to conduct the purchase and sale of additional or existing shares of the company.

Why is a Shares Subscription Agreement Important?

A Shares Subscription Agreement is crucial for several reasons. For starters, it provides legal protection for both the company and the investor. It does that by specifying the conditions under which the investment is made.

On one side, for the companies, having this agreement in place ensures that investments are always received under clear terms. This helps manage expectations and maintain control over the equity distribution—often protecting the company from hostile takeovers. On the other hand, for the investor, the agreement outlines the specifics of their investments, including any rights to future profits, voting rights, and information on how the investment will be used.

The entire agreement has the singular aim of offering clarity on this complex process under the laws of the state. And this clarity is essential for building trust and transparency between the company and the investors. When an investor executes the purchase of the shares of a company, they expect there to be certain protections in place. Any such indemnification clause is also clarified in the Shares Subscription Agreement. And the issuer can put their own requirements and conditions to make sure that shares are not purchased or sold in a way that can potentially harm the company or its balance sheet.

All in all, this agreement is single-handedly responsible for avoiding disputes and streamlining all the details from the subscription price to the issuance conditions for the entire investment. Any organizational structure—from a Limited Liability Company (LLC) to a Limited Partnership (LP) can have this share purchase agreement to set a purchase price. This is required by law as per the Securities Act of 1933.

In fact, if there is no such agreement and private investors seem to be purchasing and selling the corporation’s shares, then either the state securities laws will be catching up to you or you will be getting a knock on the door by none other than the Securities and Exchange Commission (SEC), which nobody wants.

Suffice it to say that it is pretty important for businesses.

What If You Don’t Have a Good Shares Subscription Agreement?

A Shares Subscription Agreement is a must. There are several reasons why your organization or business should have it. The most obvious reason is that you are required to have it under the applicable law if you are selling shares of your company to any private investor.

But what a lot of organizations get wrong about this is that you cannot have just about any subscription agreement. You need a robust, professionally crafted, personalized, and legally sound one.

If your business is operating without a well-crafted Shares Subscription Agreement or using a generic template, you are looking at significant issues down the line. And these issues will be requiring a lot of expensive legal counsel and legal advice. Worst-case scenario? The incorporation of your company itself will be threatened if a competent law firm is not hired in time.

A company that relies on a poorly drafted Shares Subscription Agreement will naturally have poorly defined agreements. These ambiguities will result in disputes over investor rights and can even lead to more serious issues such as the dilution of ownership or misunderstandings regarding the use of invested funds.

And it is not just the company that suffers here. The investors do too. If the company assigns shares to investors without a proper agreement for managing the common stock, then this is a grave concern for anyone who is invested in the company. The lack of a clear agreement will almost always lead to ambiguity and confusion about their investment’s terms, protections, and benefits at some point.

These uncertainties cause all sorts of troubles down the line and discourage additional investment or delay funding rounds. Potentially, they might also land you in legal trouble or cause legal conflicts between the investors and the company. The investor has their time wasted and the company’s growth and investor relationships are undermined significantly. Nobody wins—so the company might as well invest in a good Shares Subscription Agreement Template!

Key Elements of a Shares Subscription Agreement

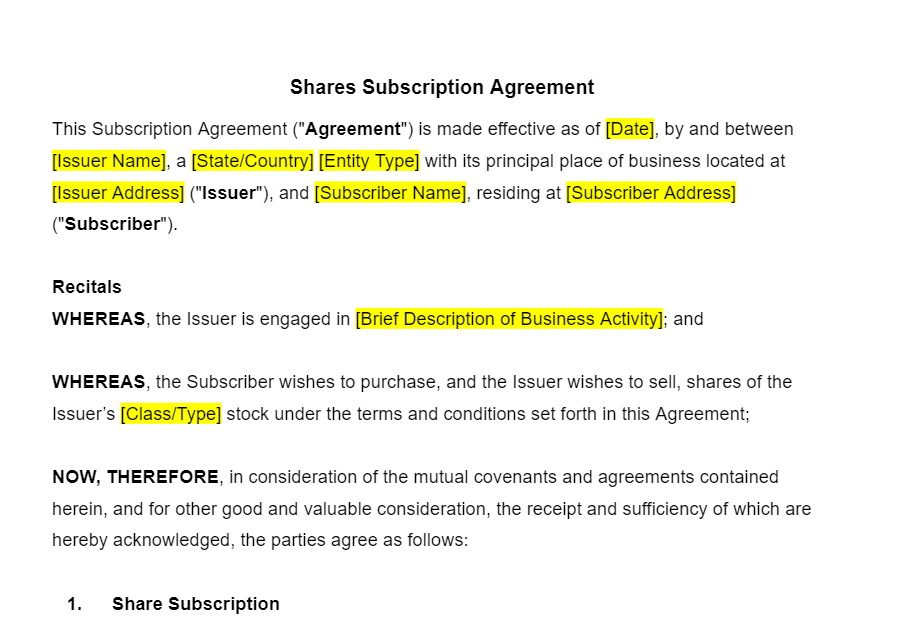

So, what should a Shares Subscription Agreement include? A comprehensive agreement should include a variety of things, but the exact subject matter will depend on the nature of the business and the priorities of the shareholders. Nevertheless, we can take a look at the key components that make for a solid shares subscription agreement.

- The agreement begins with a section on party identification. This means everything from the company name to the details of the investor(s). Mention all specifics, contact information, and amounts being pledged to the company.

- Next, highlight the investment terms. You should always have some protections for both the company and the investor(s) in this agreement. After mentioning the amount being invested in the introduction, here, take the space to clarify further on the number of shares or interest being acquired by each investor.

- The agreement will also need to discuss all the representations and warranties. These are essentially statements by both parties (the company and the investors) about the accuracy of the information being provided and compliance with laws.

- Any conditions that must be met before the investment is finalized have to be mentioned as well. The conditions clause can talk about previously agreed-upon terms that are important for the company. For example, if an investor is supposed to follow a particular payment structure, then it has to be mentioned here.

- Next, discuss the rights and obligations of all parties. These are the specific rights that are granted by the company to the investor(s). They range from voting rights and dividends to access to financial records. There is no “right” way to go about it—just negotiate the best common ground for all parties involved and formalize it in the agreement.

- Also, you need to end the agreement with proper risk disclosure and a clause on the governing law. Risk disclosure means outlining the potential risks associated with the investments, if any. And the governing law clause should discuss the jurisdiction that governs the agreement, in case any dispute shall arise.

The investment into a company has to be conducted transparently and with a mutual understanding of each party’s rights and responsibilities. It is not only important as a good faith measure but is also required for the smooth functioning of the company and everyone’s benefit.

Introducing FreshDox.com’s Shares Subscription Agreement Template

Private investments can be intricate—and managing them requires a careful, detailed approach through a Shares Subscription Agreement Template that you can customize. FreshDox.com has just the thing for you! We offer a professionally designed Shares Subscription Agreement Template that can help you meet this need and avoid the common pitfalls.

The template ensures that all aspects of the investment are defined clearly. This, in turn, protects the company and the investor, both.

When you sign up for a FreshDox.com account, you gain access to a wide array of legal, business-related, and professional document templates that are customizable and available in Word and PDF formats. What’s more, our 14-day trial period allows you to access all the benefits of our Basic and Premium Plans. Basic Members can download up to three legal document templates per month and Premium Members have unlimited access. Whether you are running a business or investing in one, our template is the one-stop solution that you need.

When you use FreshDox.com’s Shares Subscription Agreement Template, you are choosing a confident, secure investment for your company. Investors, on the other hand, can rest assured that their contributions are protected under agreed terms. So, avoid the pitfalls of inadequate investment agreements! Sign up for a FreshDox.com account today and streamline your investment process with our expertly crafted Shares Subscription Agreement Template.

Popular searches:

- Shares Subscription Agreement Template pdf

- Shares Subscription Agreement Template sample

- Shares Subscription Agreement Template download

- Shares Subscription Agreement Template format

- Shares Subscription Agreement Template template

- Shares Subscription Agreement Template word

- Shares Subscription Agreement Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews