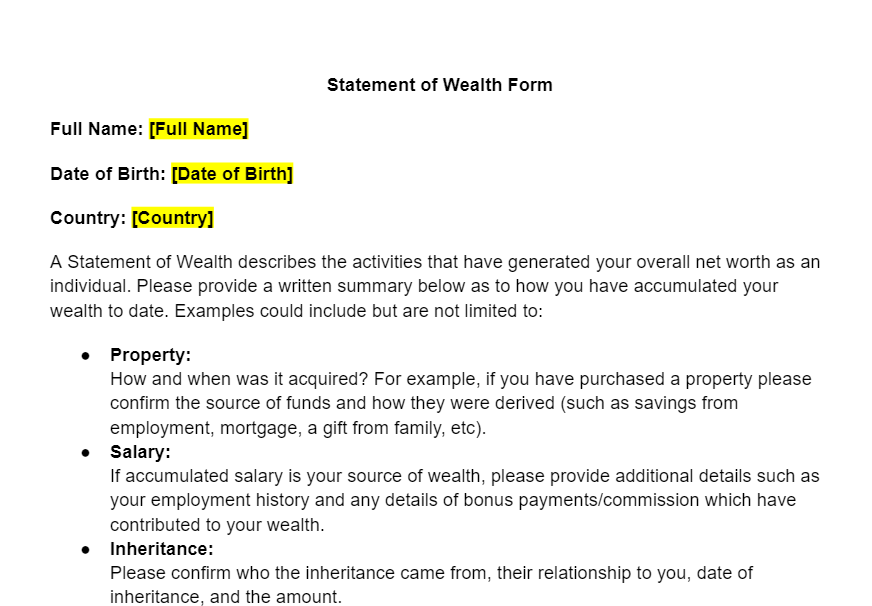

Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds

7 Downloads

Commercial, Corporate, Money and Finances

March 4, 2025

Sayantani Dutta

Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds

A Statement of Wealth (SOW) Form is a structured document used to record, authenticate, and assess an individual’s financial position at a given point in time. It consolidates key details about assets, liabilities, income, and the source of wealth into a clear, verifiable snapshot of net worth and financial health.

Banks, investment firms, and other financial institutions frequently request a Statement of Wealth Form for loan applications, large-value transactions, high-risk client onboarding, and compliance with AML (Anti-Money Laundering) and KYC regulations. It is equally useful in private situations such as estate planning, divorce settlements, and complex financial negotiations.

In essence, completing a properly designed Statement of Wealth template strengthens financial transparency. It explains where your wealth comes from, how it is structured, and where it is held—creating an orderly overview that can be shared confidently with regulators, courts, lenders, and advisors.

What Is the Purpose of a Statement of Wealth Form?

Put simply, a Statement of Wealth Form consolidates multiple financial data points into one standardized declaration of your economic situation. For financial institutions, this document offers insight into both the legitimacy and stability of a client’s financial standing. It can be cross-checked against transaction records, tax filings, and identity documents to detect inconsistencies or potential fraud.

For individuals, the form acts as a powerful self-audit tool. It forces you to list and quantify your assets and liabilities, often revealing:

- High-interest liabilities that may need restructuring or early repayment.

- Underperforming or non-productive assets that could be better deployed elsewhere.

- Concentration risks—such as overexposure to a single asset class or geography.

In other words, a well-prepared wealth statement form is useful not only for external compliance purposes but also for your own financial planning, risk management, and long-term decision-making.

When Do You Need a Statement of Wealth Form?

A Statement of Wealth or Source of Wealth declaration can be required in several scenarios, including but not limited to:

-

Loan and Credit Applications:

Banks and lenders often request a Statement of Wealth Form to assess repayment capacity and overall credit risk, especially for high-value facilities such as mortgages, business loans, and secured lines of credit. -

Estate Planning and Succession:

Estate planners use SOW forms to map assets and liabilities before drafting wills, family settlements, or trust deeds. This ensures that the distribution of wealth is based on accurate, up-to-date information. -

Divorce and Matrimonial Settlements:

During divorce proceedings, a Statement of Wealth becomes a core document for equitable division of assets and liabilities, reducing ambiguity and disputes. -

Regulatory and AML Compliance:

Regulators, tax authorities, and financial institutions may request a Source of Wealth Form to verify that funds used in large or cross-border transactions (e.g., real estate purchases, portfolio transfers) are legitimate and fully declared. -

Cross-Border and High-Value Transactions:

For international property investments, second citizenship or residency-by-investment programs, and high-value investments, a wealth declaration form is often mandatory.

In all these situations, using a standardized Statement of Wealth Form template saves time, reduces back-and-forth with institutions, and gives you a consistent format that can be adapted for different stakeholders.

Key Sections of a Statement of Wealth Form Template

A comprehensive SOW form should cover the following core provisions. Using a template allows you to customize the level of detail while keeping the structure professional and compliant.

1. Personal Information

This section identifies the declarant and links all financial information to a verified individual.

- Full legal name (as per government-issued ID).

- Date of birth.

- Residential address and contact details (phone and email).

- Employer’s name, designation, and business address (if applicable).

To strengthen verification, the Statement of Wealth Form can be accompanied by copies of passports, ID cards, or utility bills. Where the declarant is a business owner, brief details of shareholding and entity registration may also be included.

2. Employment History and Annual Income

This section explains how income is earned and how stable it has been.

- Current and previous employers or business entities.

- Tenure in each role or business.

- Annual income, including salary, bonuses, commissions, and other compensation.

- Supporting documents such as payslips, employment contracts, or business financials.

For self-employed individuals and business owners, attaching tax returns, profit-and-loss statements, or audited accounts helps institutions verify that wealth has accumulated from legitimate, declared sources.

3. Bank Accounts and Savings

This part focuses on liquidity and short-term financial capacity.

- Details of active bank accounts (institution names, account types; account numbers can be partially masked if required).

- Current balances in checking, savings, and money market accounts.

- Whether the accounts are held singly, jointly, or under a business entity.

Recent bank statements or summary certificates are typically attached to verify the figures in the wealth statement form.

4. Real Estate Holdings

Real estate is often the largest component of individual wealth.

- List of properties (residential, commercial, land), with addresses and property types.

- Purchase dates and acquisition costs.

- Current market values and estimated equity (market value minus outstanding mortgage).

- Any rental income generated by these properties.

Including mortgage details, ownership percentages (for jointly held properties), and valuations provides a balanced view of both asset strength and leverage.

5. Financial Investments

Investments show diversification and long-term financial planning.

The Statement of Wealth Form should capture:

- Equity holdings (listed and unlisted shares), mutual funds, ETFs, and bonds.

- Retirement accounts (pension funds, IRAs, provident funds) and their current balances.

- Investment dates, current market values, and any significant unrealized gains or losses.

Portfolio statements, contract notes, and investment certificates are commonly attached to support the declared values.

6. Life Insurance Policies

Life insurance can be both a protection tool and a wealth-building instrument.

- Type of policy (term, whole life, endowment, ULIP, etc.) and coverage amounts.

- Cash value or surrender value, where applicable.

- Named beneficiaries and policy maturity dates.

Listing these policies ensures that all financial resources are visible while also helping in estate planning and risk assessment.

7. Liabilities and Debts

A realistic picture of net worth is incomplete without a transparent view of debts.

- Mortgages, personal loans, vehicle loans, education loans, and credit card balances.

- Outstanding balances, interest rates, EMIs/repayment schedules, and creditor names.

- Any settlement arrangements, restructuring, or disputes in progress.

The Statement of Wealth Form then calculates net worth by deducting total liabilities from total assets, giving institutions and advisors a clear view of the declarant’s true financial position.

8. Personal Property and Valuables

High-value personal property also contributes to net worth.

- Vehicles, jewellery, luxury watches, art collections, antiques, and other valuables.

- Appraised values, purchase dates, and provenance (for rare or collectible items).

Attaching valuation reports, purchase invoices, or insurance schedules adds credibility to this section of the wealth declaration form.

9. Declaration of Source of Wealth

This is a critical section for AML, KYC, and regulatory purposes. It explains how wealth was accumulated, not just where it is currently invested.

- Inheritance details (estates inherited, dates, approximate values, and relationships).

- Sale of businesses or shareholdings, including consideration received.

- Property sales, key transaction dates, and realized gains.

- Any major settlements, compensation, or windfalls.

Supporting evidence—such as sale deeds, share purchase agreements, probate documents, and settlement orders—helps institutions verify that wealth has been built through legitimate, documented channels.

10. Supporting Documentation

Verification is central to any Statement of Wealth. Typically, the following documents accompany the form:

- Recent bank and investment statements.

- Payslips, employment contracts, or business financials.

- Tax returns for relevant years, confirming declared income and compliance.

- Property title deeds, valuation reports, and probate or inheritance papers.

Attaching a checklist or index makes it easier for reviewers to cross-reference the Statement of Wealth Form with the documents provided.

11. Declaration and Signature

Finally, the declarant must sign and date the form, confirming that all information is true, complete, and accurate to the best of their knowledge.

In some cases, the SOW may also require:

- A witness signature.

- Notarization or attestation by a lawyer, notary, or chartered professional.

This step adds legal weight and reinforces the seriousness of the declaration.

Do You Need an Accountant or Lawyer to Help with Your Statement of Wealth Form?

Depending on the complexity of your finances and the purpose of your SOW form, professional guidance can be extremely valuable.

When to Involve an Accountant

An accountant can help when you need:

- Accurate calculation of net worth and reconciliation of multiple accounts.

- Analysis of investment performance, asset allocation, and leverage levels.

- Structured presentation of income sources, particularly for entrepreneurs and investors with diverse revenue streams.

They can organize documentation, identify missing information, and make sure your Statement of Wealth aligns with your tax records and financial reports.

When to Consult a Lawyer

Legal advice becomes essential when the form is being used for:

- Divorce settlements or family disputes over assets.

- Estate planning, inheritance, or cross-border succession issues.

- Regulatory investigations, litigation, or complex international transactions.

A lawyer will help ensure that your wealth declaration form complies with local laws, properly reflects beneficial ownership, and is structured in a way that minimizes disputes and legal risk.

Why Use a Statement of Wealth Form Template?

Preparing a Statement of Wealth Form from scratch can be time-consuming, especially when multiple institutions expect different formats. A professionally drafted template:

- Saves time: You start with a ready-made structure instead of a blank page.

- Improves accuracy: Standard fields reduce the risk of leaving out critical information.

- Supports compliance: Templates are designed to reflect best practices around AML, KYC, and financial disclosure.

- Looks professional: A clean layout makes it easier for banks, regulators, and courts to review and rely on your SOW.

With a robust template, you can focus on getting the numbers right instead of worrying about format, structure, or wording.

Download a Statement of Wealth Form Template with a Free Trial of FreshDox

Prepare your Statement of Wealth confidently with a professionally designed, fully editable template from FreshDox. When you sign up for a free trial of a Basic or Premium account, you get access to our complete library of business and personal finance templates, including:

- Statement of Wealth Form (SOW) template

- Source of Wealth declaration forms

- Loan support documents and financial disclosure templates

Each template is easy to customize and can be downloaded in Word or PDF format, so you can adapt it quickly for banks, lawyers, or regulators.

Sign up for your free trial on FreshDox today, explore our Statement of Wealth Form template, and bring clarity, transparency, and professionalism to every wealth declaration you prepare.

Popular searches:

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds pdf

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds sample

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds download

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds format

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds template

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds word

- Statement of Wealth Form Template: Clearly Present Your Net Worth and Source of Funds free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews