Uniform Residential Appraisal Report Template

9 Downloads

Real Estate

March 11, 2025

Sayantani Dutta

Ever wonder how a lender determines how much your home is worth? They use a Uniform Residential Appraisal Report—or URAR. It’s a standard appraisal form the appraiser completes to estimate the market value of a single-family home, condominium unit, or PUD (Planned Unit Development).

Lenders use it when borrowers are looking for mortgages. Homeowners also use it when selling, purchasing, or refinancing their homes. The URAR provides a picture of the value and physical status of the property and tells the parties entering into the transaction how much it is currently worth. It plays a critical role in making real estate transactions open and transparent.

What Is a URAR?

Uniform Residential Appraisal Report is a real estate appraisal form deployed by appraisers for evaluating the market price of a property in real estate transactions. It’s a uniform residential appraisal report file reviewed by lenders when borrowers apply for an FHA, HUD, or conventional loan facility. The reason for the form? To disclose the current value of the property, facilitating a smooth transaction for sellers and buyers alike, while providing lenders with a genuine valuation for the loan facility.

Each URAR is linked with a certain property address and is assigned a unique file number. It’s used in single-family home transactions, condominium, and multi-family home sales, providing a uniform format shared by all real estate markets within the United States. The file no provides the lenders with the assurance needed to secure their investment, and appraisers with the ability to give a clear and unbiased opinion on the value of the property being assessed.

Unpacking the URAR—Key Components

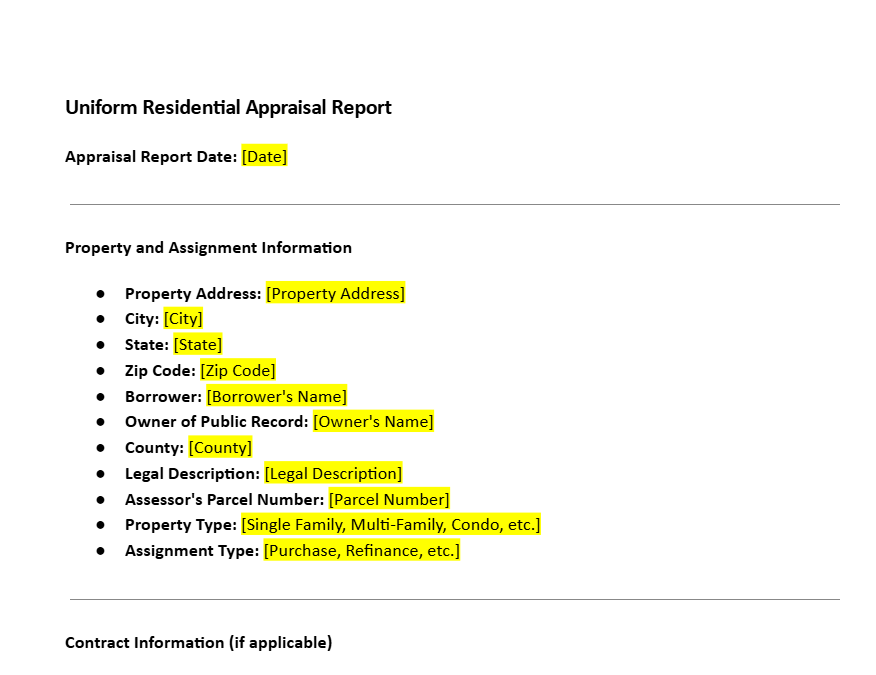

The URAR starts with the basics: the address of the property, the legal description, and the parcel number to determine the exact location of the subject property. You’ll also notice borrowers’ names and the date the assessor performs the appraisal. The physical aspects—like square footage which determines the home’s actual living space are included.

The site value is also covered by the report with respect to the land itself and zoning regulations which dictate how the property can be used. If the property contains an exterior structure, including a carport or attached garage, this is also described within the appraisal. The appraiser also provides a building sketch of the structure—a basic drawing of the layout of the property.

Improvements to the site, such as landscaping or a fireplace, are also listed, creating a better image of what amenities are on the land. During the process of examining the subject property, the appraiser personally assesses everything, taking notes and photographs.

The rest of the information is placed in an addendum or additional comments section, leaving room for personal observations. Lastly, the appraiser’s signature closes the document, certifying they’ve carried out the work earnestly and ethically.

This pairing of cold facts and visual aids makes the URAR a step-by-step guide to understanding the property’s features, allowing lenders and borrowers to get a better view of the deal. It’s a lot of information but all of it is there for a specific reason—to determine the home’s actual value in the market area.

Valuation Methods—How the Appraiser Determines Value

How does the appraiser figure out the appraised value? It’s not like they’re taking a shot in the dark—they employ three methodologies to get an accurate figure. The sales comparison approach takes into account comparable sales, or “comps.” These are similar properties to the subject real estate that have sold recently—in the same neighborhood, with the same lot size, site improvements, or style.

The appraiser confirms each comp’s sale date and sale price and makes adjustments for differences, including extra sq. ft. or gross living area. This method is the favored approach for the majority of single-family residences because it illustrates what buyers are presently paying in the market.

Then there’s the cost approach. Here, the appraiser calculates what it would cost to replace the home from scratch, along with depreciation and the effective age of the building. If the house is old, wear and tear reduces its value.

This approach works best for newer or unique homes for which comps are hard to find, blending construction costs with the site value of the land. It’s not as common for standard single-family homes but still offers a useful viewpoint.

The income approach is used mainly for multi-family or rental properties. The appraiser estimates market rent—what the property would earn if rented—and determines value based on that figure at the date of sale.

For a single-family home, this approach isn’t usually relevant. Having made these calculations, the appraiser weighs the results, usually giving the greatest emphasis to the sales comparison approach for residential assignments.

The last figure—the appraised value—represents the best use of the property, that is, its value in the current real estate marketplace. It’s a delicate process, involving a careful balancing of data and professional opinion to arrive at a reasonable, accurate figure.

Market Conditions and Property Information

Market conditions impact findings substantially. The appraiser takes into account trends like prior sales and rising or falling property values in the area. Are comparable properties selling fast or sitting unsold on the market for months or years? That turnover rate affects the value of the subject property.

They also investigate past sales out of public records, determining what listing in the area sold for to look for pricing trends. Zoning also plays a role—if the property is zoned as residential only, that limits its potential compared to a mixed-use zone.

Other factors also come into consideration during the inspection of the subject property. FEMA flood zones can reduce the value of the property. A home with a fireplace might fetch more than one without, but only if the comps reflect that trend locally. These facts form a broader picture of market conditions for an accurate valuation.

Why the URAR Matters—Practical Applications

For lenders, the appraisal report form is an important means of ensuring the loan amount matches the market value of the property. They don’t want to lend more than the house is worth—that’s a risky move. Borrowers also rely on it, especially when buying or refinancing.

The uniform residential appraisal report file indicates what the home is worth, assisting in negotiations or financial planning. With home transactions, particularly for one-unit residential properties, this report helps keep things fair and square.

If there’s a dispute—such as over property value in an estate settlement or divorce—the URAR provides a brief, professional valuation and opinion of the value of the real estate before it goes up for auction. Homeowners can use it to protect their home’s standing in the market, whether listing it for sale or just to satisfy their curiosity to see what they could get for it if they decided to sell.

The report’s standardized nature, endorsed by Fannie Mae and Freddie Mac, gives the report industry clout. Professionals trust it because it’s consistent and detailed, providing accurate information on everything from the property address to the appraiser’s certification. Think of it as a bridge between buyers, sellers, and lenders.

To a borrower, it might mean the difference between rejection and approval. For the lender, it offers peace of mind. The real strength of URAR is that it brings clarity to complex real estate transactions, making it an indisputable tool for assessing the housing market.

Behind the Scenes—The Appraisal Process

The appraiser is a licensed expert trained to evaluate properties. They start the process with an analysis of the subject property. They walk through the home, taking measurements, checking the layout, and noting amenities like a fireplace or carport.

Photographs follow, documenting the condition of the property and its major features. This personal inspection provides them with a tangible basis to start the valuation. After the visit, the appraiser gets into analyzing the data.

They tap into public records—like past sales or tax assessments—and review data sources like MLS listings. They locate homes that are similar in size, location, and amenities to the subject property and adjust for any dissimilarities.

Market trends show whether values are increasing or decreasing in the area. It’s a mix of fieldwork and research, with the aim of nailing down a specific value. Once the assessor’s parcel analysis is done, the appraiser signs off, certifying the document.

This certification acts as a guarantee that the assessment is completed diligently and impartially. Appraisers act under strict guidelines to keep their reports unbiased, and thus the URAR is a reliable tool in real estate appraisals.

Their knowledge and skillset convert facts and figures into a definitive image of the property’s value. Since property values are continuously shifting, it’s a sound guide to making smart buying and selling decisions.

The Advantage of Using a Prepared Template for the URAR

A template comes pre-loaded with all the necessary sections and appraisers save time by starting with a layout that’s ready to go, allowing them to focus on filling in the details rather than developing the form. There’s no guesswork, just a simple roadmap to follow to an accurate valuation. Aside from efficiency, templates minimize errors and ensure nothing is omitted. For a busy appraiser juggling multiple properties, this structure is a lifesaver, ensuring every report meets industry standards.

Lenders use these forms because they make it easier to review and approve loans. Borrowers also benefit, as the clarity speeds up the mortgage process when using Freddie Mac Form or Fannie Mae Forms for applications. In short, a prepared template turns a complex task into a straightforward process, offering accuracy and peace of mind to all parties involved.

Download a Uniform Residential Appraisal Report Template with a Free Trial of FreshDox

Sign up for a free 7-day trial of FreshDox and get immediate access to our professionally designed URAR. Our templates are designed by industry professionals and comply with lending assessment standards. Customize the template to your residential or commercial assessment needs and download it in Word or PDF format. Sign up with FreshDox today and browse our catalog of real estate templates.

Popular searches:

- Uniform Residential Appraisal Report Template pdf

- Uniform Residential Appraisal Report Template sample

- Uniform Residential Appraisal Report Template download

- Uniform Residential Appraisal Report Template format

- Uniform Residential Appraisal Report Template template

- Uniform Residential Appraisal Report Template word

- Uniform Residential Appraisal Report Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews